Term life insurance is often the most affordable life insurance product you can get. However, it has a limited protection period, which may be an issue if you find out you need more insurance protection. If you think you might need extra protection after your term life insurance expires, you can consider renewing or converting your policy.

Renewable and Convertible Life Insurance: What Makes Them Different?

The main difference between renewable and convertible life insurance is what happens after the term expires. In renewable life insurance, you add another term of coverage, extending your protection. In convertible life insurance, you turn your term policy into a whole life policy.

Generally, you don’t have to buy renewable or convertible life insurance immediately since many term life insurance products today are renewable or convertible. Some policies are even both convertible and renewable. You can check with your insurance broker or agent if you’re unsure.

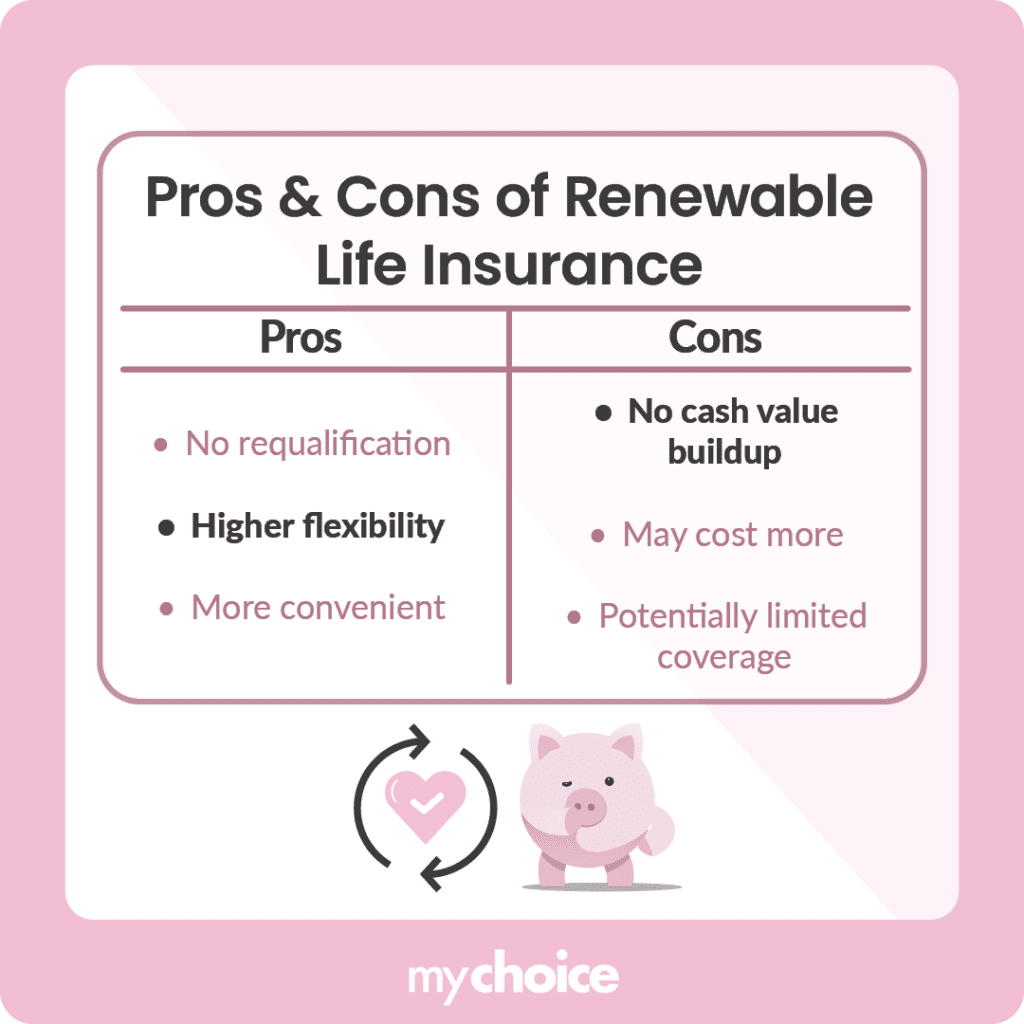

Pros and Cons of Renewable Life Insurance

Renewing your policy means adding extra coverage to your current life insurance term. That means you get extra flexibility if you need extra protection after your current term ends.

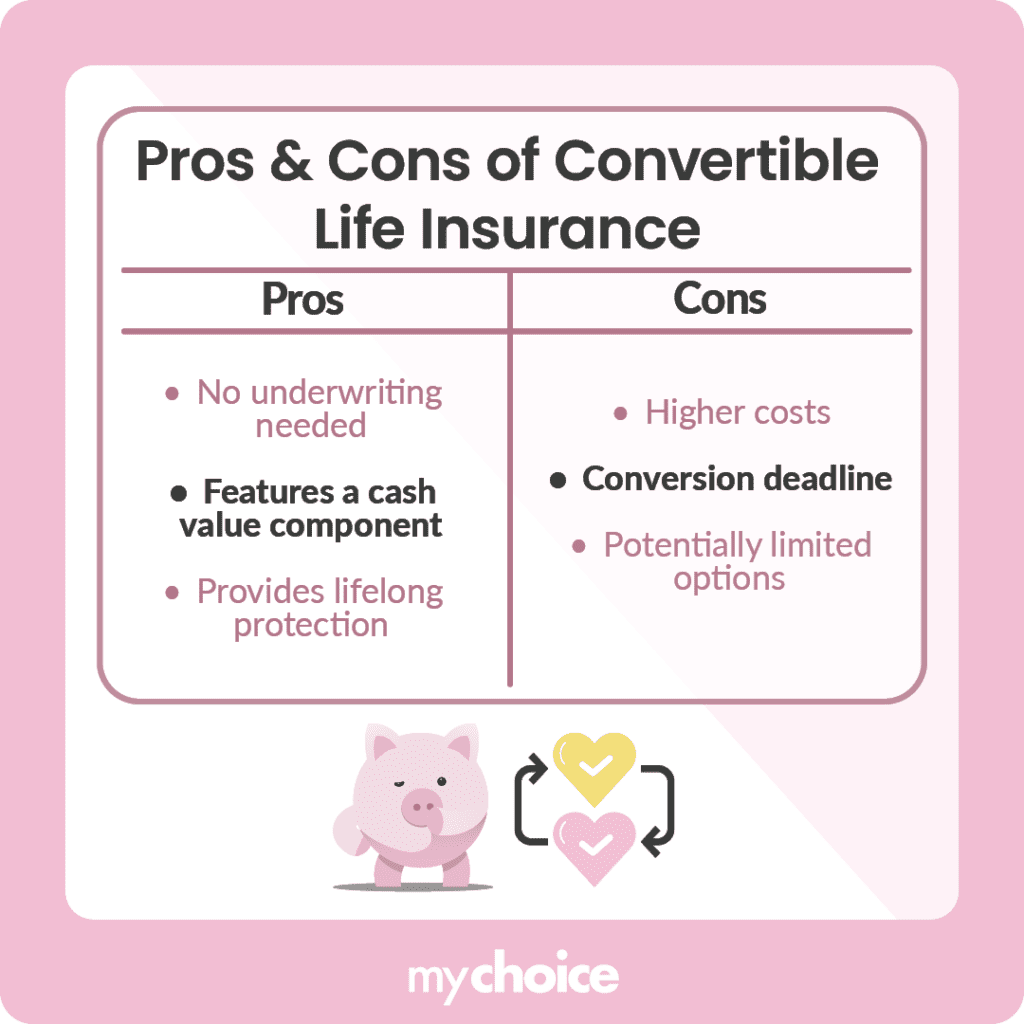

Pros and Cons of Convertible Life Insurance

Converting term into whole life insurance means you get lifelong protection. However, it has its own set of benefits and drawbacks.

Converting Vs Renewing My Life Insurance: Which Should I Do?

Whether converting or renewing your life insurance is best for you depends heavily on your insurance protection and financial needs.

If you only need life insurance protection for a limited time, like until your children graduate college or you pay off your mortgage, renewing your policy may be the most economical option. Because your insurance needs have a “deadline” and you don’t need insurance beyond that point, it’s better on your finances to stop insurance coverage once it’s not needed.

Conversely, you may benefit more from converting your policy if you need lifelong protection. While it may be more expensive, it also lets you receive investment income, meaning you can earn money on your policy to use on various needs.

Key Advice from MyChoice

- Renewing a term policy is generally more affordable and is a good idea for people with limited insurance needs.

- Converting a term policy may be more expensive, but it provides lifelong coverage and a cash value component that you can earn money from. You can also borrow money against this cash value if needed.

- Before deciding to convert or renew your policy, it’s a good idea to understand both your present and future financial obligations, then set your budget to ensure you don’t overpay for insurance protection.