When owning a car in Canada, getting auto insurance is mandatory.

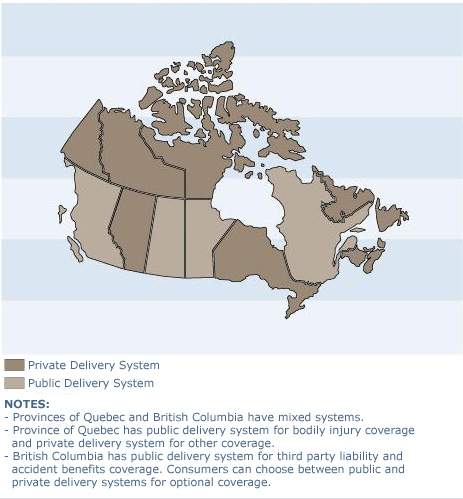

Depending on which province you live in, you will have to decide between Public and Private Insurance – yes, in some provinces of Canada, you can actually get access to public insurance. This applies to those who live in Manitoba, British Columbia, and Saskatchewan.

However, provinces like Ontario and Alberta require car owners to purchase private insurance. Here is a close examination of the two types of insurance.

Why does Public Insurance exist in Canada?

As everyone cannot afford to purchase insurance, certain provinces offer basic coverage to those who reside there via established public bodies.

Why You Should Consider Public Insurance

Here are a few reasons why you should consider public insurance for your vehicle. While not all provinces provide it, the greatest benefit of living in one with public insurance is that you will always be able to afford minimal insurance. The cost is usually low, but the coverage is also quite limited.

In most cases, the insurance is usually a one size fits all.

That means the prices, coverage, and services you can get are fixed. In most cases, only the basic minimum of these services will be offered. However, if you live in Manitoba, this is a bit different.

The Manitoba Public Insurance offers a wide array of options that include Optional Autopac, Basic Autopac, and the Special Risk Extension package. If you live in the province, you will need to have at least Basic Autopac. With this option, you are protected in case of personal injury, third-party liability claims, and all perils. You can choose to step up this coverage with the Optional Autopac package.

What is the Cost of Public Insurance?

Establishing public insurance costs provinces hundreds of millions of Canadian dollars. This is because the insurance also requires taxpayer subsidies to ensure that it is affordable.

Another cost of public insurance is that it leads to reduced investment by the private sector. Insurers usually prefer to invest in provinces where there is more business. These direct investments include bonds, shares, and real estate.

The downside to Public Insurance

Besides discouraging investment by private insurers, government insurance does not offer competitive services. Thus, you can only expect to get the bare minimum since they are not very worried about the bottom line and customer satisfaction.

The other downside is that there is limited choice for customers in these provinces (for instance, there are no multiple vehicle discounts or variable deductibles). Since private insurance companies are competing with each other, they strive to offer the lowest options and various options to their customers. They also work hard to offer the best possible customer service to their customers.

Another downside to public insurance is that there is a lack of innovation. Since they already have a large market share, they do not feel obliged to develop better services. However, private insurers have to be innovative if they want to keep their customers. Thus, they have come up with interesting packages such as replacement cost coverage, roadside assistance, and forgiveness for first accidents.

The Benefits of Private insurance in Canada

With private insurance, you will benefit from free-market pricing. This is because companies will compete with each other for your business and will have to offer the best service possible at the lowest prices. When shopping for private insurance, take time and shop around. Once you get a low quote from one company, ask another company about it. They may agree to lower their prices for you to get your business. You can also use this free tool to calculate your best quote on car insurance depending on your specific profile.

Private insurance takes into account various factors when determining your premiums. This will include your credit history, driving record, and the type of car that you own. Besides that, your age and gender will come into play. If you are an awesome driver with a great credit history, this will get you a low rate. This is usually the main determinant factor when choosing private insurance over public insurance.

Since there is competition in the private insurance sector, they strive to offer more value and choice to their customers. In Canada, most people believe in the free market for almost any product they purchase. In fact, some of the provinces of Canada have deregulated their public monopolies. The result has been more choice and value for those who need car insurance.

Endnote

Because of the healthy competition between private insurers, their premiums reflect the true cost.

For instance, a private insurer will base its premiums on factors that affect the cost of the claims and the frequency of the claims. These companies are guided by the cost of the claim when setting premiums.

Another advantage of private insurers is that they create jobs and boost the local economy.

Today, the private insurance sector in Canada employs about 118,600 people, employed directly by the companies or through a broker workforce. When the competition increases because of an enabling environment, it leads to even more jobs and investment.