Any homeowner knows that sometimes things just happen – from small nuisances like leaky faucets to large, near-catastrophic accidents like a roof collapse. In some of these cases, a quick call to the local handyman should suffice, but when the bills start to rack up, contacting an insurer to make claims on a homeowner’s policy is the better choice.

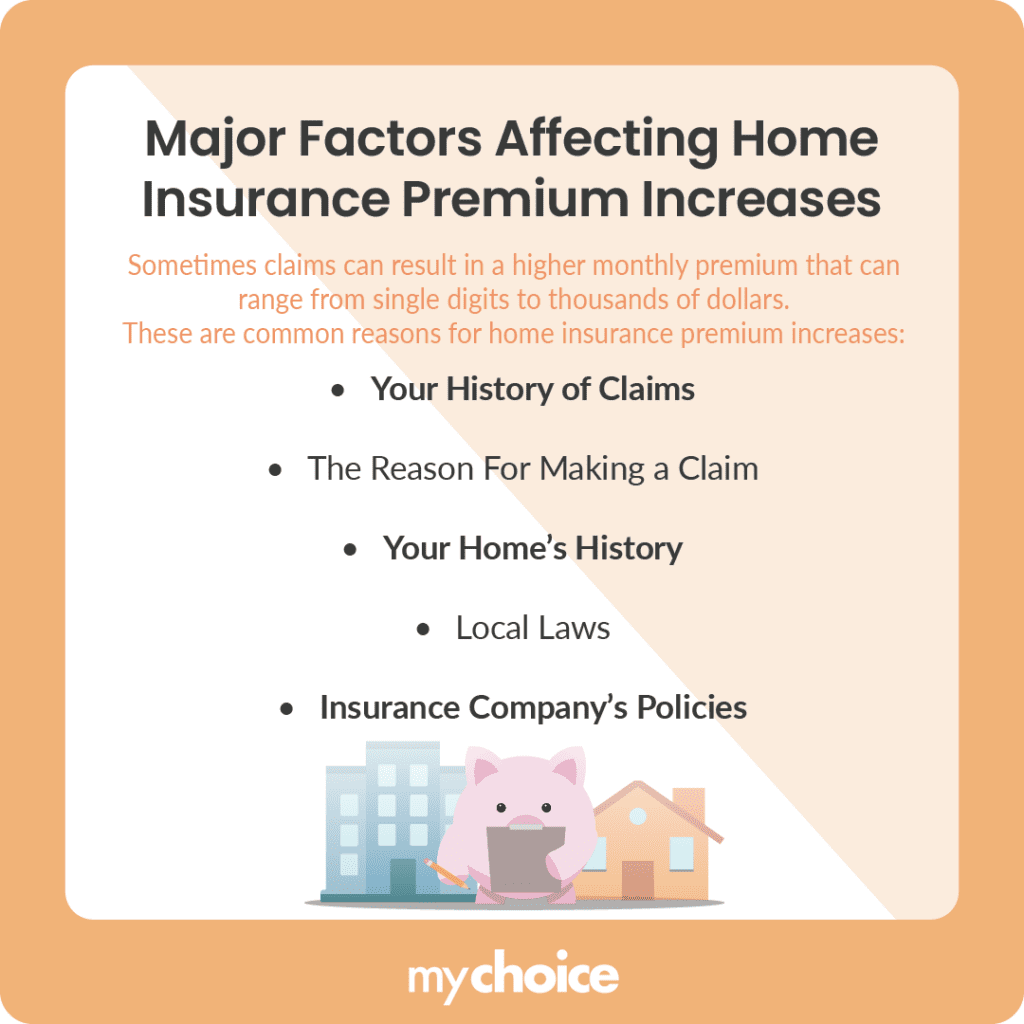

However, sometimes these claims can result in a higher monthly premium that can range from single digits to thousands of dollars – it really is extremely case to case, but important to know as rates continue to climb in Canada.

That said, there are some things that you can take into consideration to get a rough idea of any potential increases.

How Much Does My Home Insurance Go Up After a Claim in Canada?

The bottom line about home insurance premium calculations is that it varies widely from person-to-person, but most homeowners can expect a 5-7% increase on a big claim. Here’s a run-down of a few scenarios and how they would play out.

How Are Home Insurance Premium Increases Calculated?

What is Claim Forgiveness?

Claim forgiveness is a feature that some insurance companies offer as a way to protect you from premium increases after your first claim. Essentially, it’s a way for the insurer to “forgive” a single claim, so your premiums don’t automatically go up after you file it. However, this is usually an optional add-on to your policy, and while it can be a great safeguard, it’s worth checking how much extra you’ll be paying for this feature.

Think of it as a buffer—especially if you’re worried about needing to file a claim for something unexpected like storm damage or an accident. It won’t prevent your premium from increasing if you file multiple claims, but it can provide a little peace of mind.

How To Avoid Future Home Insurance Claims

Consider Your Deductible

Your deductible is the amount you pay out of pocket before your home insurance kicks in. It’s crucial to weigh the cost of the deductible against the amount of the claim. A general rule of thumb is that if the cost of the claim is only slightly more than twice your deductible, it might not be worth filing the claim.

For example, if your deductible is $1,000 and the total damage is only $2,500, filing that claim could result in premium increases that outweigh the payout you receive. It’s important to run the numbers before making a decision.

Only File If You Really Need To

Insurance is there for the big, unexpected events—think major storms, fires, or significant liability issues. For smaller, manageable repairs, it might be better to pay out of pocket to avoid premium increases. For instance, if you have minor water damage or a small roof repair that you can afford, handling it yourself may save you more in the long run.

By only filing claims for truly catastrophic events, you’ll avoid unnecessary hits to your insurance record, keeping your premiums as low as possible over time.

Key Advice from MyChoice

- If your premiums rise a large amount after making a claim, you can shop around for a new policy.

- Pay attention to how your neighbors make claims on their home insurance policies, too.

- Denied claims and policy inquiries will not result in home insurance premium increases.