Ontario Policy Change Form 5 (OPCF 5) is an endorsement added to your auto insurance policy when you lease a vehicle. This endorsement is usually a requirement stated on lease agreements, giving the leasing company protection in case anything happens to your leased vehicle.

How does OPCF 5 work? Can I skip adding it to my policy? How does it differ from OPCF 23A? Read on to find out when you need OPCF 5 and what can happen if your leased vehicle suffers damage or loss without this endorsement.

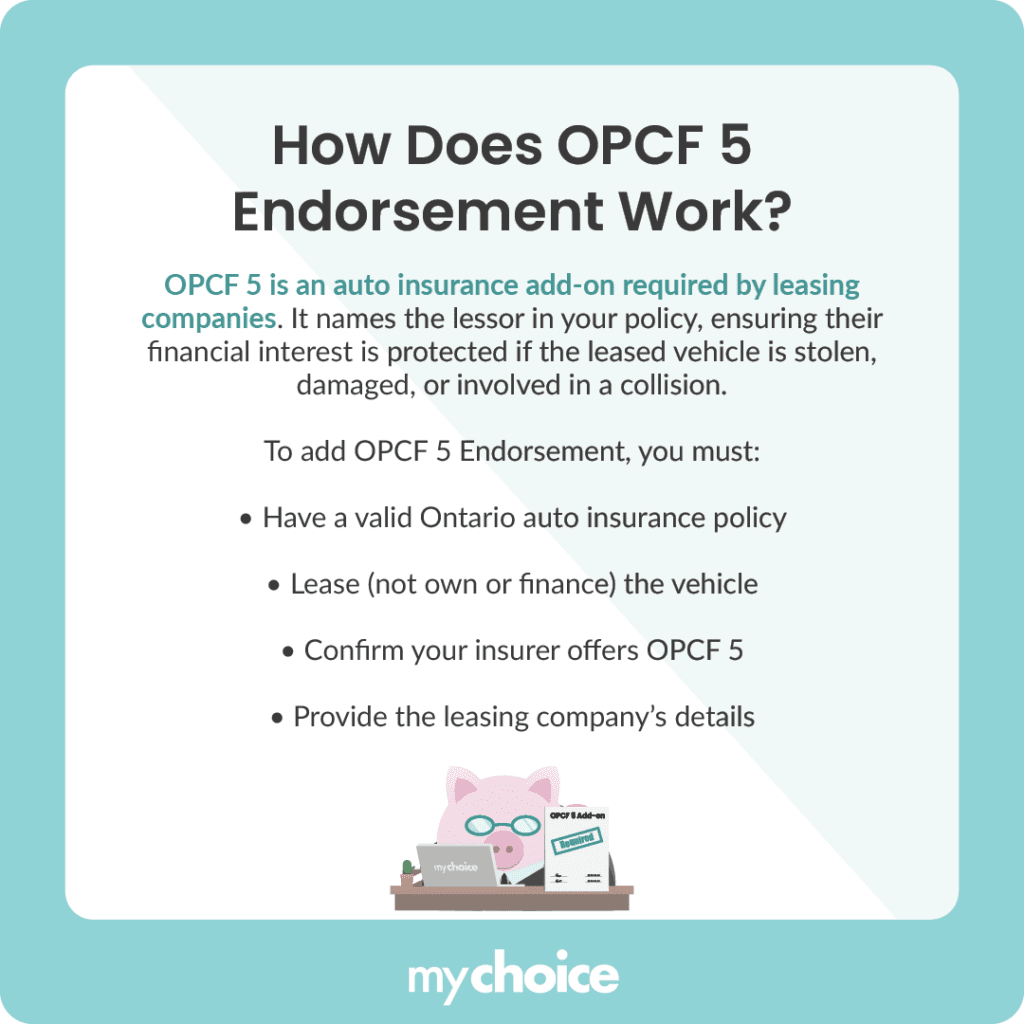

How OPCF 5 Endorsement Works

OPCF 5 is an endorsement you add to your auto insurance policy when you lease a vehicle. This endorsement names the lessor in your car insurance policy, which means that your insurer recognizes the leasing company’s interest in your vehicle.

While the government doesn’t mandate OPCF 5 for every insured driver, it’s usually required by leasing companies as part of the lease agreement. Having this endorsement on your insurance policy protects the leasing company’s financial interests in case the leased vehicle is stolen, involved in a collision, or otherwise damaged.

What are the Requirements for OPCF 5?

To add an OPCF 5 endorsement, you must:

- Have a valid Ontario car insurance policy already in place.

- Be leasing the vehicle rather than financing or owning it outright.

- Verify that your insurance company offers the OPCF 5 endorsement.

- Provide the leasing company’s details so that the company can be listed on your insurance.

OPCF 23A vs. OPCF 5

Many drivers may confuse OPCF 5 with OPCF 23A. These endorsements perform similar functions: OPCF 5 protects the leasing company when you lease a vehicle, and OPCF 23A protects the financing company when you finance a vehicle. However, since you can’t finance and lease a vehicle at the same time, you can only hold one or the other, depending on whether you’re leasing or financing your vehicle.

Can I Avoid Adding OPCF 5 to My Policy?

No, you can’t avoid adding OPCF 5 to your policy if you intend to lease a vehicle in Ontario. Ontario leasing companies will typically not allow you to lease a vehicle without the OPCF 5 endorsement on your auto insurance policy. An insurance broker will advise you to add this endorsement to your policy when they know your vehicle is leased.

However, it’s always best to check your policy details in case of a miscommunication with a broker or a leasing company. Don’t assume that your standard auto insurance policy automatically covers every situation.

The Consequences of Not Having OPCF 5

Leasing a vehicle without adding OPCF 5 to your auto insurance policy can result in serious repercussions. Some of the typical consequences of ignoring OPCF 5 include:

The potential financial repercussions of not having OPCF 5 can be far greater than any monthly insurance premium. If your leased vehicle is declared a total loss, such as after theft or a major collision, the leasing company may still require you to cover any remaining outstanding payments. This could mean tens of thousands of dollars in debt if you don’t have OPCF 5 covering you.

Key Advice from MyChoice

- Before leasing a vehicle, check your lease agreement to see if OPCF 5 is required.

- If you’re already leasing a vehicle, review your auto insurance policy to ensure that OPCF 5 is added as an endorsement.

- If you realize that your insurance policy is missing OPCF 5, contact your insurer immediately to have it reviewed and this vital endorsement added.