All drivers are legally required to have a car insurance policy in Ontario. But what happens if you’re in a traffic collision and the at-fault driver’s coverage can’t fully compensate you or your passengers for losses? This coverage gap is precisely where the OPCF 44 & 44R endorsements can step in. Below, we’ll explore how these endorsements work, who might benefit from them, and how to decide if they’re right for your family.

Understanding their functionality can help you make informed decisions about your coverage. Let’s dive into how OPCF 44 and 44R work and what you should expect if you ever find yourself in a situation where they take effect.

How Does OPCF 44 & 44R Work?

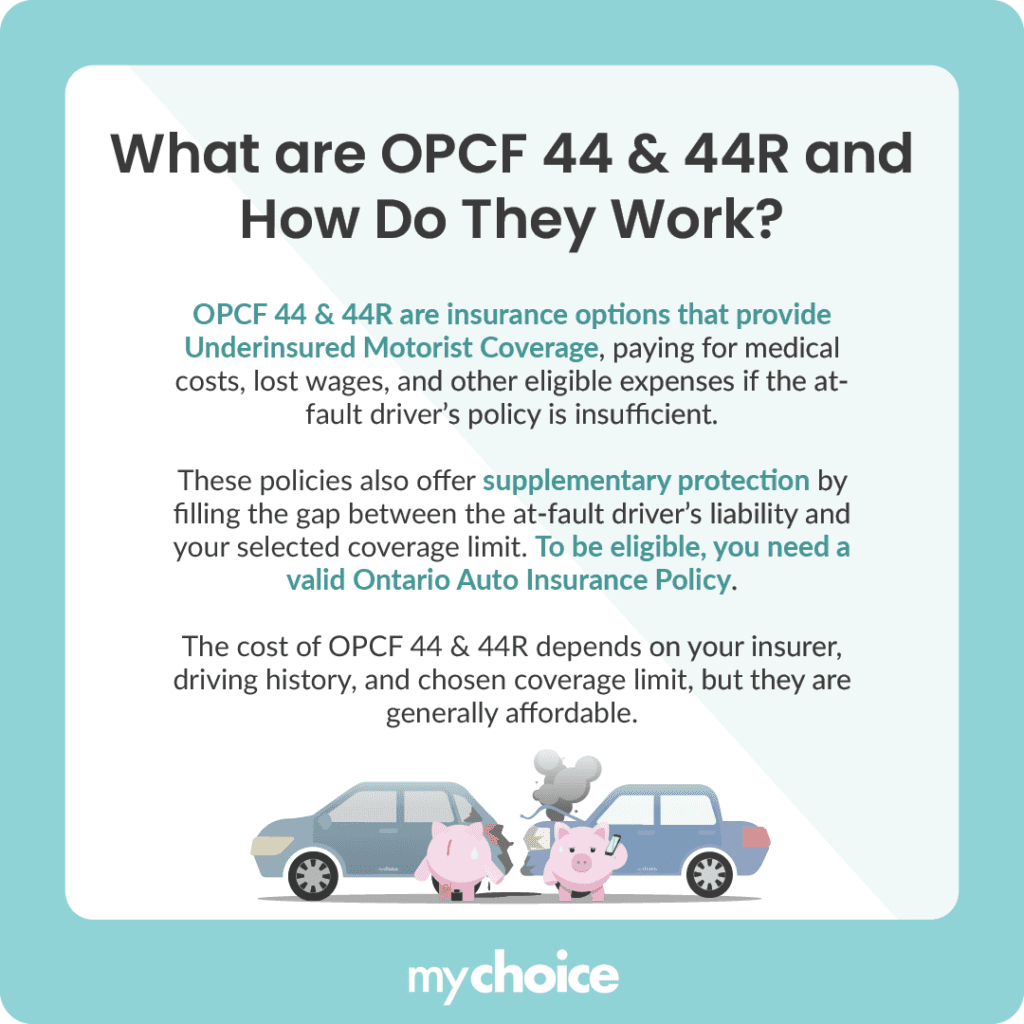

OPCF 44 and 44R are insurance endorsements intended to protect you if you’re involved in an accident with a driver who doesn’t have enough insurance to cover your losses. You may not like dealing with these situations, but it happens, especially considering that there are too many uninsured drivers in Canada.

You might as well be geared up for what’s ahead, so here’s what you need to know about how the insurance endorsements work:

Who Can Benefit From the OPCF 44R Endorsement?

While any driver can potentially benefit from extra coverage – in some cases and for certain people, this endorsement can be incredibly useful:

Alternative Coverage Choices

Although there’s no exact replacement for the protection OPCF 44R provides, below is a list of other optional endorsements that can help strengthen your auto insurance coverage:

Is It Worth Getting OPCF 44R for Your Family?

This question will cause you a dilemma because of the idea of pulling out more ‘cash’ to fortify your policy. This is why you need to determine whether OPCF 44R is a worthwhile addition based on these factors:

Key Advice from MyChoice

- Look at how often you drive, your family situation, and your financial vulnerability if you’re left with major expenses due to another driver’s insufficient coverage.

- Spend some time comparing the costs of other OPCF policies to see which option offers the best value for your family.

- Check with your insurer about exact coverage limits, deductibles, and any exclusions. Knowing how these apply to your situation can help you decide if OPCF 44R is needed.

- Life changes like new vehicles or additional drivers in the household may require a policy review. Stay proactive to ensure you’re adequately protected.

- If you’re unsure, don’t hesitate to talk with a licensed insurance broker or agent. They can clarify the benefits of OPCF 44R and help tailor a policy that fits your requirements.