Auto insurance policies provide drivers with financial protection against various risks. However, drivers will need comprehensive or all-perils coverage to be covered from certain perils like fire and theft. These kinds of coverage usually cost more than standard auto insurance policies, leading drivers to look for ways to save on premiums. OPCF 40 is an endorsement that can be added to your policy to help reduce monthly premiums.

What does OPCF 40 do? When does it make sense to add OPCF 40 to your policy? How much can this endorsement save you in the long run? Read on to find out what you need to know about OPCF 40 and whether or not you should add it to your policy.

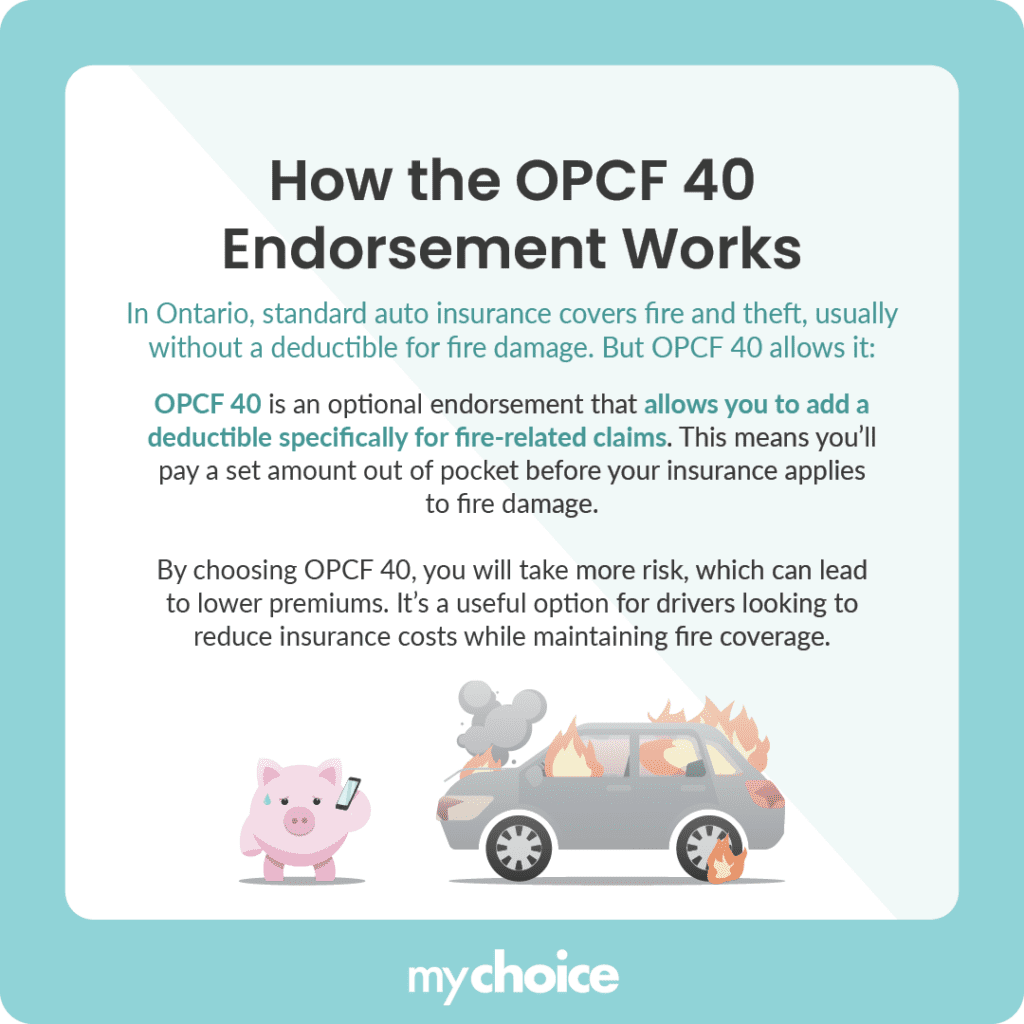

How the OPCF 40 Endorsement Works

Under the standard auto insurance policy offered in Ontario, comprehensive and all-perils coverage includes protection from many perils, such as fire and theft. While a deductible can be added to your policy for many types of damage, fire damage typically doesn’t allow for a deductible.

OPCF 40 allows policyholders to add a deductible specifically for fire-related claims. By opting for this endorsement, policyholders agree to pay a predetermined amount out-of-pocket before their insurance coverage applies to fire damage. This arrangement can lead to reduced insurance premiums, as the policyholder assumes a greater portion of the risk associated with fire losses.

It’s important to note that OPCF 40 is specific to Ontario, but other provinces may have equivalents. In Alberta, a similar endorsement is available called SEF 40 (Standard Endorsement Form 40). This endorsement introduces a deductible for both fire and theft claims, while OPCF 40 only applies to fire-related claims.

Why Would You Want a Fire Deductible?

Many drivers might choose to include a fire deductible as a strategic decision. Here are some key reasons why you might want to add OPCF 40 to your auto insurance policy:

Situations Where Adding OPCF 40 Makes Sense

Before you add IOCF 40 to your policy, you should consider whether or not it would make sense in your specific circumstances. Here are some situations where adding OPCF 40 to save on premiums would be a smart move:

How Much Could You Potentially Save?

The potential savings from adding the OPCF 40 endorsement vary based on several factors, including the value of the vehicle, the amount of the deductible chosen, and the insurer’s specific rate calculations. When you add a fire deductible to your policy, you’re effectively sharing the risk with your insurer. This can lead to noticeable reductions in premium costs. However, it’s important to balance these savings against the potential expenses you would pay out-of-pocket in case of a fire-related claim. The exact amount you might be able to save on premiums heavily depends on your insurer and its own underwriting process. To get a baseline estimation of what your monthly premiums would look like after OPCF 40, you can consult your insurer or use a car insurance calculator.

Key Advice From MyChoice

- Before adding OPCF 40 to your auto insurance policy, assess your financial capabilities and ensure that you can comfortably afford the deductible in case of a fire claim.

- The cost-benefit ratio of adding a fire deductible may be less favourable for older vehicles with lower market values. In such cases, paying a deductible when your car is damaged by fire might not be worth it.

- Regularly review your auto insurance coverage to make sure it aligns with your current financial situation, vehicle value, and risk assessment.