When financing a vehicle, drivers may be required by the financing institution to add an OPCF 23A or OPCF 23B to their auto insurance policy. While these Ontario Policy Change Forms might seem like minor add-ons to your car insurance in Ontario, they play an important role in protecting both you and the financing company in case of a claim. Without these key endorsements, drivers financing vehicles may be underinsured or face other financial consequences.

What does OPCF23A/23B do? Are these endorsements required when financing a vehicle? What are the penalties for skipping OPCF 23A/23B? Read on to learn about the specifics of OPCF 23A/23B and why it matters when financing your vehicle.

Why Lienholder Protection Matters

When you take the option to finance a vehicle, the financial institution providing the loan – also known as the lienholder – legally owns your car until the loan is repaid. This means that the lienholder has a significant financial interest in your vehicle, and any damage to the car directly affects their stake. OPCF 23A and 23B are endorsements designed to guarantee lienholders are compensated for losses, regardless of an insured driver’s compliance with policy conditions.

Without adequate protection, lienholders risk significant financial exposure if the insured fails to maintain proper insurance, misrepresents information, or defaults on premiums. OPCF 23A/23B mitigate these risks, ensuring stability for financial institutions and helping maintain healthy lending environments that benefit consumers through more accessible financing terms.

OPCF 23A: More Than Just a Finance Requirement

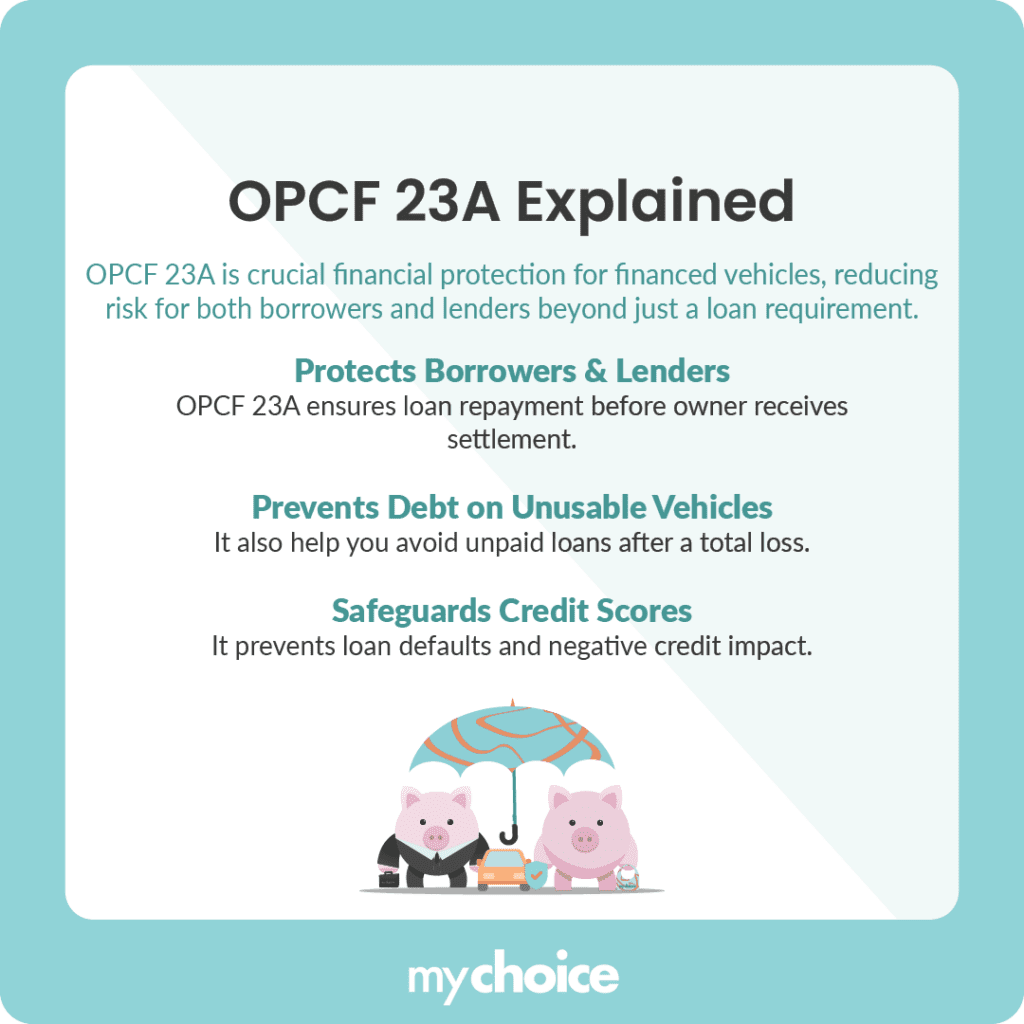

OPCF 23A serves as essential financial protection for individuals who have financed vehicles. Many vehicle owners misunderstand OPCF 23A as just another checkbox lenders require on the loan agreement. However, it’s more than just a simple requirement before you can take a loan; it significantly minimizes financial risk for both borrower and lender.

When a financed vehicle is significantly damaged or destroyed, OPCF 23A mandates insurers to first allocate the settlement funds toward repaying the outstanding loan. After the lender receives the settlement, any remaining funds are distributed to the vehicle owner. This sequence protects borrowers from becoming responsible for an outstanding loan on a car that is no longer usable or repairable.

Additionally, OPCF 23A helps borrowers maintain good credit scores. Without this protection, a vehicle loss could result in missed loan payments, potentially leading to defaulting on your car loan and negatively affecting your credit ratings.

What Happens When You Skip OPCF 23A?

Not including OPCF 23A in your insurance policy could be a costly mistake in the long run. If your financed vehicle suffers significant damage and you’re without OPCF 23A, any insurance settlement paid directly to you might not necessarily go towards vehicle repair or loan repayment. This can lead to the lienholder implementing strict terms, higher interest rates, or even avoiding financing altogether.

This situation damages your relationship with your lender and seriously impacts your credit rating. If legal actions escalate, additional legal fees and penalties can stack on top of the initial debt, increasing your financial burden. Since the lienholder technically owns your car, skipping OPCF 23A could also result in vehicle repossession, further risking your financial stability.

OPCF 23B vs. OPCF 23A: Key Differences

While OPCF 23A focuses on financial recovery after a loss, OPCF 23B focuses on protecting the lienholder in case your policy lapses. OPCF 23B ensures that losses are directly payable to the lienholder if the vehicle is not repaired or replaced up to the extent of their financial interest. OPCF 23B also protects the lienholder’s interest against invalidation due to breaches of statutory conditions, exclusions, misrepresentations, or even fraud by the insured.

Additionally, under OPCF 23B, the lienholder agrees to certain obligations. These include paying outstanding premiums if the insured fails to pay, along with notifying the insurer of significant changes or breaches of policy conditions within fifteen days.

In contrast, OPCF 23A specifically addresses the financial distribution following vehicle loss or damage. This endorsement specifies that insurance payments directly satisfy any outstanding debt owed to your lender without involving these additional protective provisions outlined in OPCF 23B. Depending on the specifics of the financing agreement, you may be required to add either OPCF 23A or OPCF 23B to your auto insurance policy.

How OPCF 23A Interacts with Other Coverages

OPCF 23A works seamlessly alongside standard vehicle insurance coverages like comprehensive and collision policies. The endorsement modifies the terms of your primary coverage, allowing insurers to issue joint payments and mandating lienholder notifications about policy changes. OPCF 23A enhances your existing coverage by ensuring that the financial interests of your lender are prioritized during the settlement process.

Additionally, OPCF 23A effectively complements gap insurance coverage. Gap insurance covers the difference between the outstanding loan amount and the vehicle’s depreciated market value. Together with OPCF 23A, gap insurance gives you comprehensive financial protection, limiting your exposure to unexpected debt after an insured damage or loss.

Key Advice from MyChoice

- When financing a vehicle, review your loan agreement to see whether OPCF 23A or OPCF 23B is a requirement. Make sure that your insurance policy has the endorsement added before you start driving a financed vehicle.

- Avoid missing insurance payments or letting your policy lapse if you have OPCF 23A/23B. This can lead to heavy financial consequences or even legal action from your lienholder.

- OPCF 5 is a similar endorsement to OPCF 23A/23B but for leased vehicles. Since you can’t lease and finance your vehicle at the same time, you can only have either OPCF 5 or OPCF 23A/23B on your insurance policy, but not both.