Keeping your car insured will save you from a certain amount of financial loss in case your vehicle is totalled in an accident or stolen. However, sometimes your car’s value can depreciate, which can make the insurance payout much less than the value of your car. OPCF 19/19A can help keep your car insurance payout from decreasing by locking the payout amount to an agreed-upon value. What are the differences between OPCF 19 and 19A? Which one is better for your vehicle? Read on to learn what you need to know about OPCF 19 and 19A.

OPCF 19 Explained

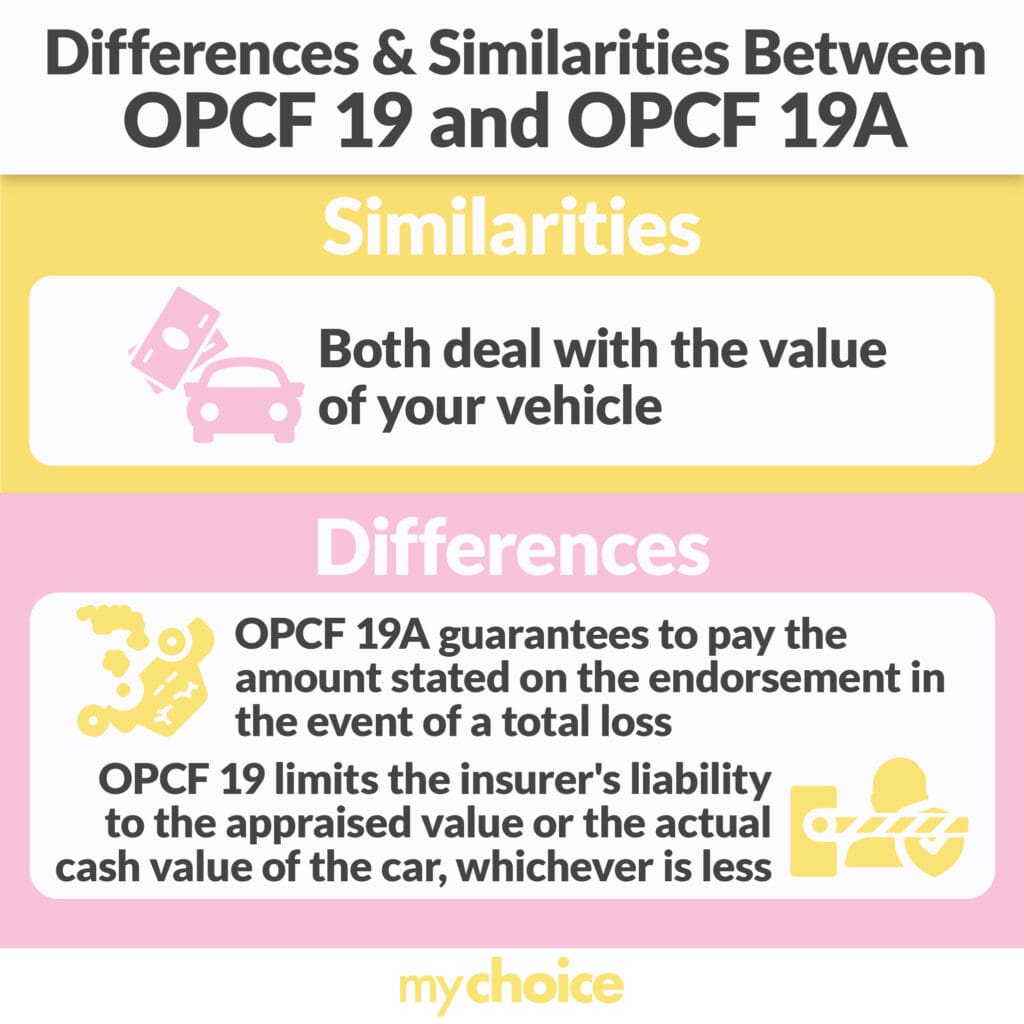

Ontario Policy Change Form (OPCF) 19 is an endorsement that’s known as the “Limiting the Amount Paid for Loss or Damage Coverages”. When you file a claim due to the total loss of your vehicle, the insurance company can choose the lower of two values between the actual cash value (ACV) or the value limit set on your OPCF 19 form.

OPCF 19A Explained

OPCF 19A is a similar endorsement to OPCF 19, known as the “Agreed Value of Automobile(s) Endorsement”. This endorsement sets one value on the form that the insurance company will payout in case of a total loss of your vehicle. The amount stated on your OPCF 19A form is set based on an appraisal of your vehicle. The insurance company will have their own appraiser, but you can hire your own appraiser to evaluate your vehicle, at which point the appraisers will agree to a certain value to put on the OPCF 19A form.

What’s the Difference Between OPCF 19 and 19A?

While OPCF 19 and 19A are similar in name, they have some key differences that can affect your decision on which endorsement to add to your auto insurance policy. Here’s how they differ:

OPCF 19 or 19A For Collector Vehicles?

If you have a car that was manufactured over 20 years ago, then it’s considered a classic or antique vehicle. This will usually allow you to take a special “classic or special interest” auto insurance policy, which comes with OPCF 19A by default. If you do choose to get a regular auto insurance policy for your collector car, make sure that you’re getting OPCF 19A with it. Some policies will offer full coverage but fail to include OPCF 19A, so you will need to specify with the insurance agent or broker that you want OPCF 19A with your policy.

OPCF 19 is a more restrictive endorsement that allows insurance companies to pay out a lower value between the appraised value of the vehicle and the actual cash value at the time of loss. If you take out OPCF 19 for your classic vehicle, you might be paid out a much lower amount than your car is worth in case of a total loss. This is because the insurance company is the one to decide the cash value of it at the time of loss, and can choose to name a low value for the claim.

Overall, OPCF 19A is the better option for your classic or collector vehicle, since it protects much more of the value of your car than OPCF 19. Make sure to get a regular appraisal for your car to keep its value updated as it appreciates. It’s ideal to get your classic car appraised every couple of years to help keep its maximum value in case of a total loss.

Should I Choose OPCF 19/19A or OPCF 43?

Much like OPCF 19 and 19A, OPCF 43 (Waiver of Depreciation and Replacement Value) is an endorsement that you can add to your auto insurance policy that preserves the value of your vehicle in case of a total loss claim. However, OPCF 43 only protects against depreciation, meaning that your insurance claim may pay out less than the actual value of your car if it happens to appreciate over time. Additionally, you can only add OPCF 43 if you’re buying your car brand new, so you can’t use it if you’re buying a used or classic car.

As a rule of thumb, it’s much better to add OPCF19/19A to your car insurance policy if you’re buying a luxury or classic car, as that will preserve more of its value compared to OPFC 43. However, if you’re getting a more common model of car for your daily driver, OPCF 43 might be better, since it protects against value depreciation that newer vehicles are more susceptible to.

Key Advice from MyChoice

- Get your car appraised regularly, at least every two years, to help maintain its maximum value if you need to file a claim.

- OPCF 19A is the better choice when insuring an antique or collector vehicle since the claim payout is locked to the amount set on the form.

- OPCF 19 will usually add less to your annual premiums than OPCF 19A.