With the sheer volume of cross-provincial travel every year, the intersection of auto liability and provincial caps has become increasingly relevant for Canadian drivers. If you reside in one province and have an auto insurance policy there, then get into an accident in another province, which provincial cap applies to your car accident claim?

Why was the minor injury cap of Nova Scotia applied when the driver was from Newfoundland? Learn more about the legal reasoning behind the Hillyer ruling, how this affects a cross-provincial claim in case of an accident, and what to consider for your auto insurance coverage if you frequently cross provincial borders.

Why Nova Scotia’s Minor Injury Cap Applies in Newfoundland Cases

In Hillyer v Tilley, the Court of Appeal of Newfoundland and Labrador ruled that Nova Scotia’s minor injury cap is a matter of substantive law rather than procedural law. This is a key distinction because it determines which laws apply to claims arising from accidents that occur in one province, but involve residents from another province.

The plaintiffs argued in this case that they shouldn’t be subject to the cap in Nova Scotia because they were residents of Newfoundland and Labrador, where no such cap exists. However, the court found that Nova Scotia’s cap was actually essential in determining non-pecuniary damages (a.k.a. damages in tort claims), which makes it substantive law.

This decision underscores a crucial legal principle: when an accident occurs in one province, the laws governing damages from that accident should apply uniformly, regardless of where the plaintiffs reside. As a result, Newfoundland drivers involved in car accidents in Nova Scotia may find their compensation limited by this cap.

Understanding Substantive vs. Procedural Law in Auto Insurance Claims

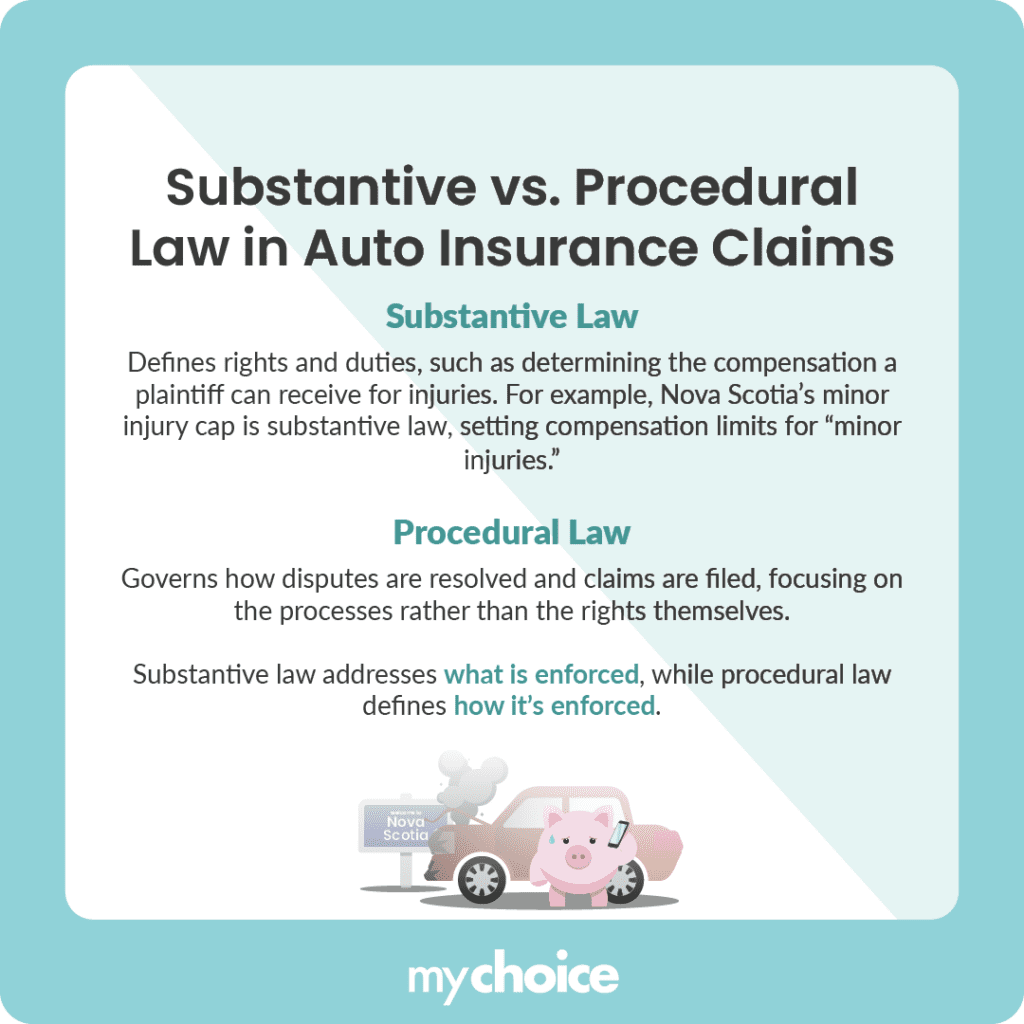

The distinction between substantive and procedural law is key in deciding cross-provincial legal matters – in this case, cross-provincial auto insurance claims. Here’s a quick breakdown of how the two differ:

Think of substantive law as the “what” that is enforced, while procedural law is the “how” that is enforced. In Hillyer, the court clarified that determining damages isn’t just a procedural issue, but it has substantive considerations such as what makes an injury “minor” under the provincial law. This distinction is crucial for drivers involved in accidents across provinces, as it dictates which province’s laws will apply to their claims.

Implications for Drivers Traveling Between Provinces

The application of Nova Scotia’s minor injury cap means that drivers could face limitations on their compensation if they’re injured in an accident while travelling through or visiting another province. Depending on provincial caps, a driver from one province may have their injury claim capped at a lower amount despite being able to claim higher compensation under the law of the province they live in.

So for example, if a a driver from Newfoundland is involved in an accident in Nova Scotia and sustains what is classified as a minor injury, their claim could be capped at approximately $10,000 (the Nova Scotian cap) despite Newfoundland law having a higher cap.

Drivers should review their auto insurance policies to understand how coverage applies when travelling out of their home province. Some policies may not fully account for interprovincial differences in liability caps or coverage limits.

What This Means for Your Auto Insurance Coverage

Review your auto insurance policy to understand how interprovincial accidents might be handled and whether your coverage is adequate in light of differing provincial laws. Here’s what you can do:

Key Advice from MyChoice

- Always verify how your insurance policy addresses out-of-province accidents and whether it aligns with your typical travel patterns.

- Be proactive about understanding the implications of provincial caps on damages if you travel frequently between regions.

- One thing to remember about what to do after a car accident is how different provinces handle accident reporting, which can be critical. For instance, some provinces may require specific documentation or forms to be filled out immediately after an accident occurs, while others may have different protocols.