When renting or borrowing a vehicle, you aren’t covered by your primary vehicle insurance but you still need insurance if you want to drive them. Non-owner car insurance is a product that’s designed for drivers who frequently drive cars that they don’t own.

There are a variety of situations where you may need to rent or borrow a car. By taking out a non-owner car insurance policy, you keep yourself protected and compliant when on the road in a vehicle that isn’t yours. What does non-owner car insurance cover? Who is it for? Read on to find out what you need to know about non-owner car insurance.

Can I Insure a Vehicle I Don’t Own?

Yes, you can insure a vehicle you don’t own. In fact, you’re legally required to have an auto insurance policy to be able to drive a car in Canada. Though auto insurance policies are usually tied to the vehicle’s registered owner, it’s possible to take out non-owner car insurance if you have a valid driver’s license and an existing insurance policy.

What Does Non-Owner Car Insurance Cover?

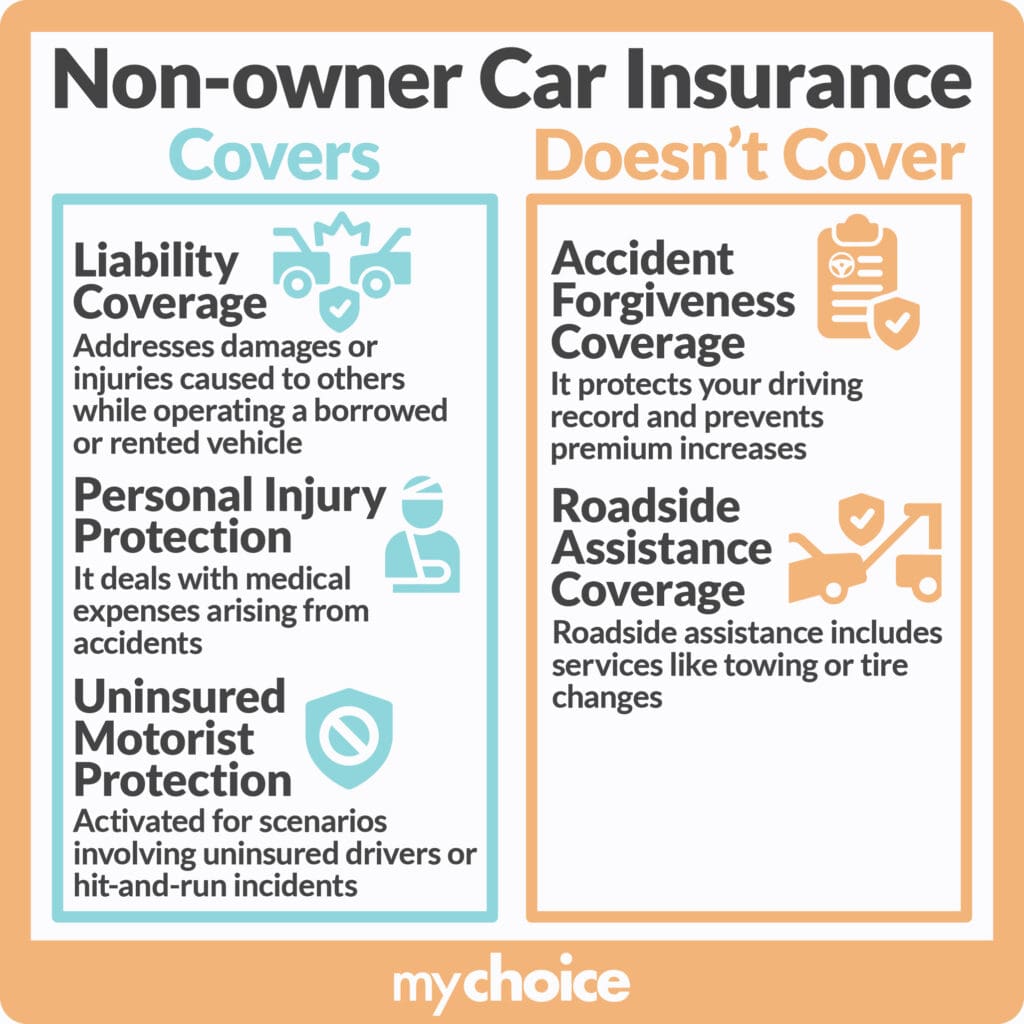

Non-owner insurance typically isn’t as comprehensive as an auto insurance policy connected to a car you own. It’s important to know the coverage and limitations of a non-owner car insurance policy:

When Should You Get Non-Owner Car Insurance?

There are several situations where you should purchase non-owner car insurance. Here are a few examples:

- If you frequently drive a family member’s or friend’s car, then non-owner car insurance can protect both of you in the event of an accident. Supplementing the car owner’s primary insurance ensures that you’re covering all bases if you’re not listed on the auto insurance plan.

- People who rent cars regularly or avail of car-sharing services can benefit greatly from taking out non-owner car insurance. While it’s possible to get rental car insurance every time you rent a car, this option can get expensive over time. Non-owner car insurance can save you more money in the long run while ensuring that you’re covered every time you rent or share a car.

- If you’re between owning vehicles, taking out a non-owner car insurance policy can help keep your insurance coverage uninterrupted and avoid any gaps in your insurance history. Maintaining a continuous line of insurance coverage will help you out when applying for another insurance policy, as insurance companies can consider any interruptions in your coverage as red flags and result in higher premiums.

Non-Car Owner Insurance in Ontario

In Ontario, non-owner car insurance isn’t available as a standalone policy. You need to have an existing auto insurance policy before you can take out non-owner car insurance. This is done by adding OPCF27 as an endorsement to your current policy. This form, also known as legal liability for damage to non-owned vehicles, allows your primary auto insurance policy to extend to borrowed or rented vehicles in Ontario.

What Do I Do When I Get into an Accident in a Vehicle I Don’t Own?

While driving a borrowed or rented car, getting into an accident can cause some financial and legal implications when it comes to making an insurance claim. To know whose insurance policy covers what, you need to understand a few things: exactly what your non-owner car insurance policy covers, what the vehicle owner’s car insurance policy covers, and how fault is determined by insurance companies. Here are a few tips for if you get in an accident:

- Read your non-owner car insurance policy closely and determine how extensive your coverage is.

- If you get into an accident, report it immediately to your insurance company and notify the owner of the vehicle so they can let their insurance company know as well.

- Don’t admit fault at the scene of the accident – let the insurance companies sort that out.

- Take note of all the details you need to properly file a claim with your insurance company.

- Don’t agree to a settlement with another driver at the scene of the accident.

- Go to a hospital to get medically checked, even for small injuries. Medical professionals can better assess you after an accident, and you’ll cover your bases for future insurance claims for medical expenses.

- If the insurance company of another driver involved in the accident calls, you may need to talk to an insurance investigator. Make sure to keep details about the accident consistent and accurate. If your insurance company finds out you lied about your involvement in an accident, they may raise your insurance premiums or even cancel your policy altogether.

- Contact an insurance lawyer if an insurance company – whether yours or another driver’s – wants to dispute your claim and you believe that you’re in the right.

How Does Non-Owner Car Insurance Impact Your Auto Insurance Rates?

Taking out a non-owner car insurance policy can impact your auto insurance rates. The biggest factor that this will affect is your insurance track record. If your insurance coverage history has a gap or interruption, that can be seen by insurance companies as a red flag, giving them a reason to raise your insurance premiums.

If you buy non-owner car insurance when driving a rented or borrowed car, insurance companies will see that as a sign of you being a responsible driver. By doing this, you signal to insurers that you are a low-risk driver and they’ll be more comfortable giving you lower auto insurance rates.

Key Advice From MyChoice

- Non-owner car insurance can keep you covered when driving someone else’s vehicle.

- You can take out a non-owner car insurance policy if you don’t currently own a vehicle but are planning to buy one soon. This keeps your insurance record continuous and prevents a gap in your record that can be seen as a red flag.

- A non-owner car insurance policy can save you money in the long run as opposed to taking out rental car insurance every time you rent out a car.

- Non-owner car insurance typically doesn’t cover vehicles driven as part of a business.