Ontario’s auto insurance ecosystem is set to undergo significant changes with the introduction of new no-fault insurance reforms, scheduled to take effect on July 1, 2026. Under the current system, drivers in Ontario benefit from a no-fault insurance model that covers medical expenses and income replacement regardless of who is at fault in an accident. However, the proposed changes will make most benefits optional, making only essential medical rehabilitation and attendant care benefits mandatory.

How will this impact drivers buying auto insurance in Ontario for the first time? Will opting out of benefits reduce your premiums? Is opting out worth it in the long run? Read on to find out all you need to know about Ontario’s no-fault insurance reforms.

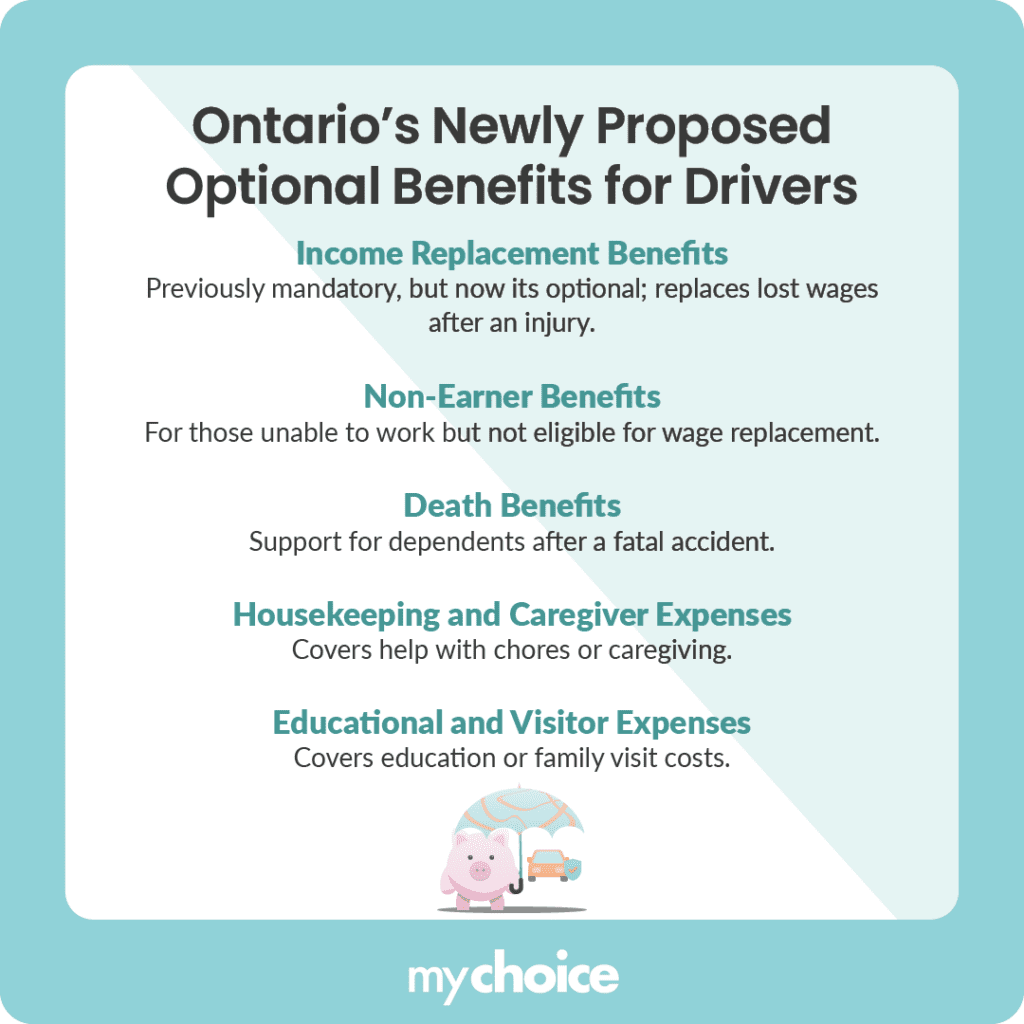

Understanding the New Optional Benefits

The proposed reforms introduce a range of benefits that will become optional for drivers. These include the following:

Drivers will need to carefully consider which optional benefits align with their individual needs and financial circumstances. Opting in typically involves higher premiums, but it can provide critical financial support in the event of an accident. If you want to opt in for specific benefits, you’ll need to tell your insurance agent which ones you want to have applied to your current policy.

Why Brokers Are Raising Concerns

The potential for consumers to inadvertently leave themselves underinsured is a pressing concern among brokers. Many drivers may not fully understand the importance of certain coverages, especially when they’re faced with numerous optional choices.

With increased consumer choice comes increased responsibility for brokers. Brokers fear that consumers may opt out of essential coverages in pursuit of lower premiums, leaving them financially vulnerable if they are involved in an accident. Insurance companies and agents must ensure that clients are well informed about what they are opting into or out of, which requires thorough communication and guidance.

This puts the onus on brokers to ensure that optional coverage is explained thoroughly to potential clients. If clients do not grasp the significance of certain coverages, they may find themselves wanting to claim insurance benefits that they actually don’t have access to. This could potentially result in drivers filing lawsuits against insurance companies when their claims are ultimately denied.

The Risks of Opting Out

Declining certain optional benefits could expose drivers to significant financial risks following an accident. Here are some real-life scenarios that could arise should a driver opt out of certain coverages:

When choosing which optional coverage options to opt into, drivers must work with their insurers to understand which options cater to their specific needs and budget. Drivers also need to consider the risks associated with opting out of optional insurance coverage to avoid making an uninformed decision.

Making Informed Decisions About Your Coverage

As Ontario transitions to this new auto insurance framework, it becomes increasingly important for drivers to evaluate their insurance needs carefully. Here are practical steps for making informed decisions:

Key Advice From MyChoice

- Consult your insurance agent or broker before choosing to opt in or out of certain benefits. Make sure to understand every risk and consider your personal circumstances to make an informed decision.

- Lowering your premiums may save you money in the short term, but losing access to certain benefits can lead to huge financial burdens if an accident does happen.