Staying claims-free on your auto insurance policy promotes safer driving habits and signals to your insurer that you’re a lower-risk driver. But does this lower risk mean lower premiums as well – and can just one year of being claims-free make your car insurance more affordable?

Being claims-free is just one factor that car insurers take into account when calculating your auto insurance rates. Learn more about how no-claims bonuses work, what considerations affect your premiums, and strategies for lowering your auto insurance rates.

What Is a No-Claims Bonus?

A no-claims bonus (NCB) is a discount on your car insurance premium that you earn for each year you drive without making a claim. The longer you go without filing a claim, the larger your discount becomes. This system is designed to reward safe driving and reduce the overall risk for insurance companies.

How no-claims bonuses are calculated can vary between insurers. Canadian insurers generally follow a similar structure to this:

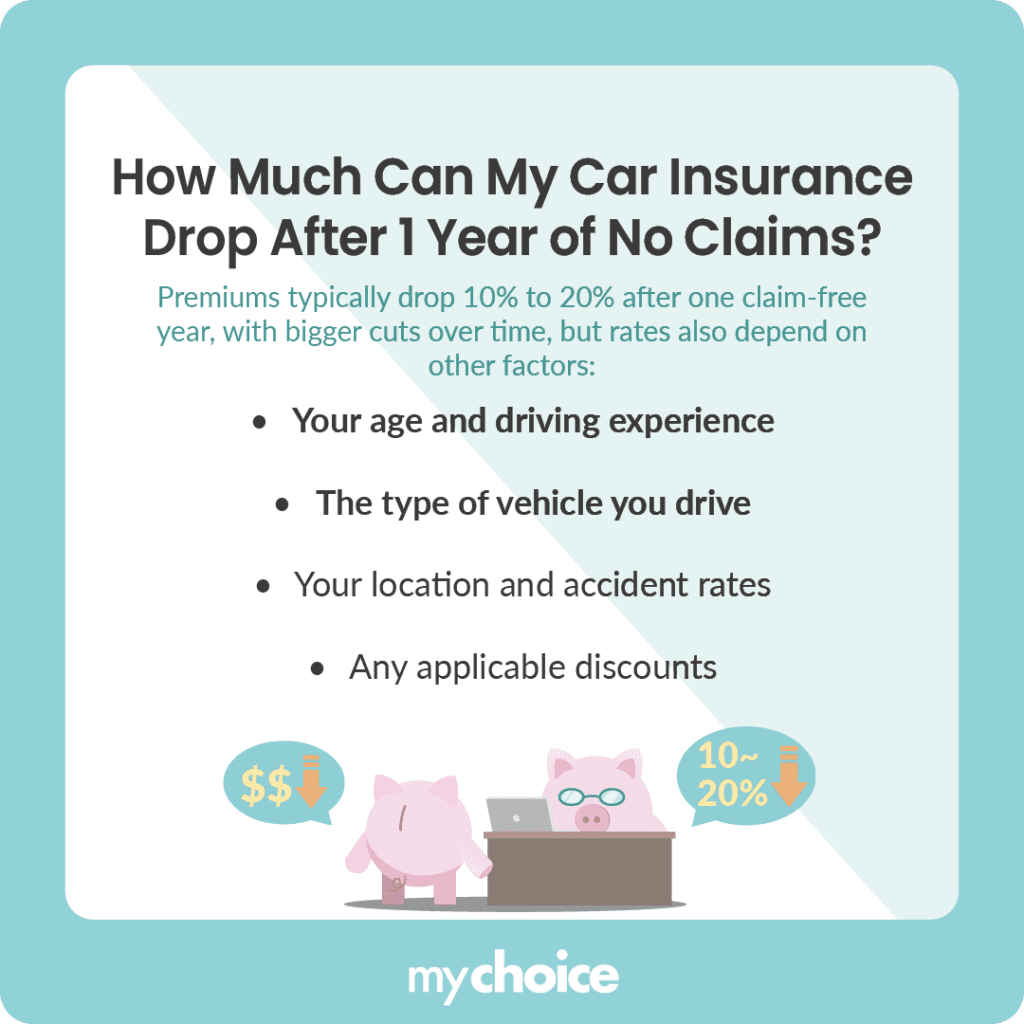

How Much Can My Car Insurance Go Down After 1 Year of No Claims?

On average, drivers may see their premiums decrease by 10% to 20% after one year of no claims. Some insurers may offer even more significant reductions if you maintain a longer streak of claim-free driving. However, your car insurance may still be higher or lower when you renew because of other factors that can affect your premiums such as:

Check with your insurer if they offer specific reductions based on a certain number of claim-free years.

Will My Car Insurance Premiums Go Down Every Year?

It’s normal for younger, less experienced drivers to suddenly see a drop in their premiums as they get older. Still, car insurance premiums don’t automatically drop every year, and they may even increase because of these reasons:

While maintaining a clean driving record typically leads to lower rates over time, this alone doesn’t guarantee that you’ll have cheaper car insurance when it’s time to renew.

What Can I Do to Lower My Car Insurance Premiums?

Avoiding claims on your car insurance policy is one way to eventually lower your rates. If you’re trying to keep your car insurance premiums affordable, here are other effective tips you can try:

Key Advice from MyChoice

- Review your car insurance coverage and premium rates at least once a year. As your circumstances change – say a new job or a new car – your insurance needs may change as well.

- Communicate with your auto insurer. Don’t hesitate to ask questions or seek clarification about how premiums are calculated and what discounts might be available to you.

- Car insurance regulations can change at both provincial and federal levels. Staying informed helps you understand how these changes might affect your coverage and costs.