Life insurance plays a natural role in planning for the future, especially for recently married couples or those entering a common-law relationship. However, life insurance can also factor into a prenuptial agreement, especially in separation, divorce, or death.

By understanding the dos and don’ts of navigating life insurance in prenups, you and your spouse can secure your financial future. Here’s what you should consider when working a life insurance policy into your prenuptial agreement.

The Intersection of Prenups and Life Insurance

In 2024, more Canadians signed prenups than ever – precisely 47% of surveyed newlyweds. While prenups typically address asset division during a divorce, they also influence your life insurance policy. In a prenup agreement, couples can specify how to allocate life insurance resources in various circumstances like divorce, death, or the birth of children.

While couples can change policy beneficiaries, Canadian law considers life insurance a “non-divisible” asset that doesn’t fall under the rules for dividing property during a divorce. However, a prenup agreement can help shorten and settle complex legal disputes in the event of a divorce.

With the proper clauses and proactive financial planning, couples can avoid potential pitfalls and ensure that life insurance proceeds are distributed according to a reasonable agreement.

What You Should Do

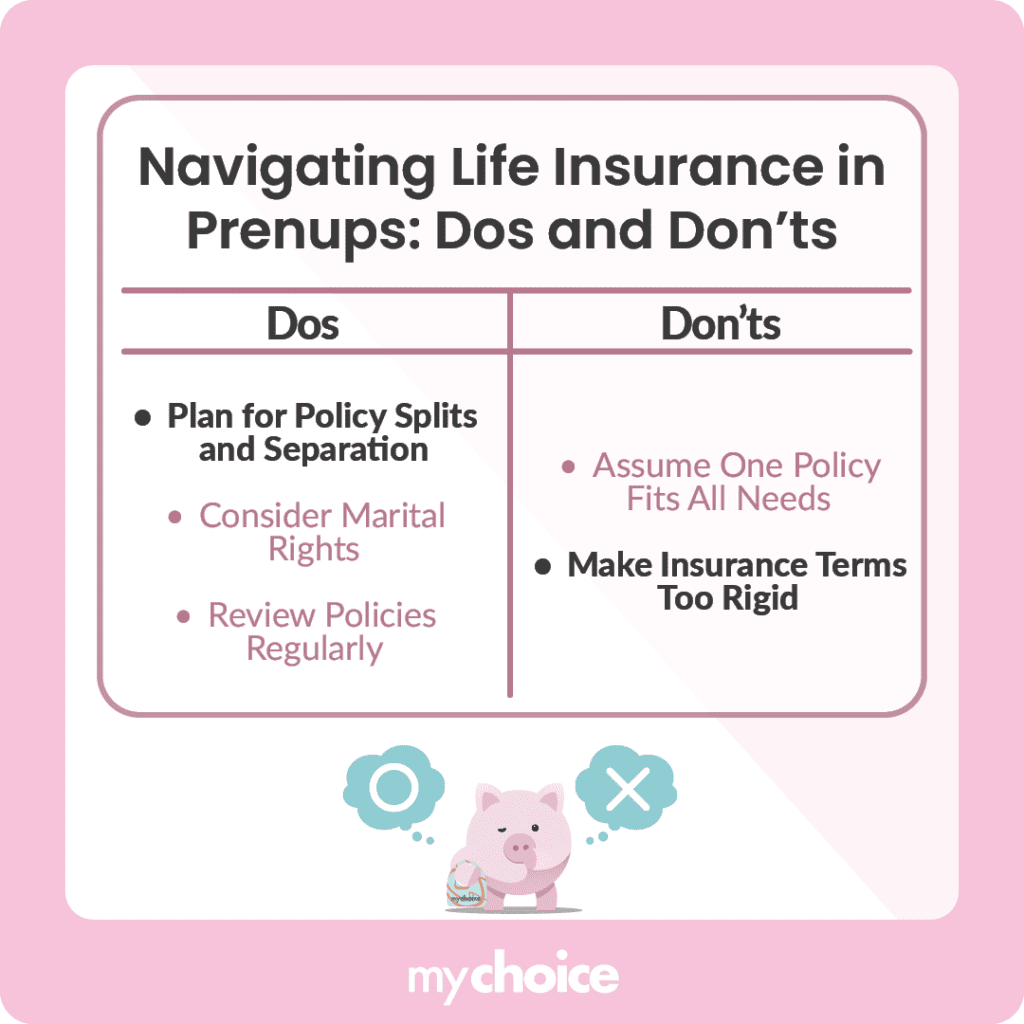

You want to include a life insurance policy in your prenup, but that’s just the first step toward protecting your financial interests. Here are some good habits to follow.

What You Shouldn’t Do

Missteps in combining a life insurance policy and prenup can lead to confusion, unintended consequences, and long legal battles in the future. Knowing what to avoid can keep this from happening.

Tax Implications: What You Need to Know

When you include a life insurance policy in your prenup agreement, there are tax implications for when you surrender the policy, convert it, or get a divorce.

Suppose you surrender a permanent life insurance policy with a cash value component. Any amount exceeding the premiums paid might be considered taxable income. If the prenup agreement dictates the surrender of the policy in case of a separation or divorce, then both parties are subject to this tax liability.

On the other hand, if you and your spouse have a term life insurance policy and plan to convert it into a permanent policy to benefit a spouse, Canadian law typically cosniders this a tax-free event. However, the new sole policyholder may be subject to higher premiums.

If you and your spouse agree to split the policy in case of a divorce, the cash value component of your policy may trigger tax consequences. Transferring ownership can also create tax liabilities.

Key Advice From MyChoice

- Avoid having a single life insurance policy for both spouses. Beacuse each person may have different coverage needs, having separate life insurance policies makes more legal and financial sense.

- Review your life insurance policies regularly and consider changes for significant life events like having a child or getting a divorce.

- Consult legal and financial experts to ensure your life insurance policies align with your prenup agreement and comply with applicable laws.

- Understand the tax implications of converting or surrendering your life insurance policy.