A fraction of Canadian homeowners don’t have any flood coverage because it can be prohibitively expensive or even impossible to get in high-risk areas. The National Flood Insurance Program (NFIP) is one of the most significant steps toward bridging this insurance gap.

With extreme weather events becoming more frequent and destructive, civilians and insurers alike have been clamouring for a more proactive approach to managing the financial impact of flooding. Unfortunately, home insurance policies, whether broad or comprehensive, usually exclude flood damage. And while homeowners can purchase additional riders to include it, insurers can (and do) deny coverage to those living in flood-prone areas.

In response to the lack of private flood insurance for high-risk homes, the Canadian government announced its plans to implement the NFIP, a federal low-cost insurance plan, to better protect vulnerable homeowners. Read on to learn about the program and how it could impact your home insurance once it’s rolled out.

Flood Risk in Canada: An Overview

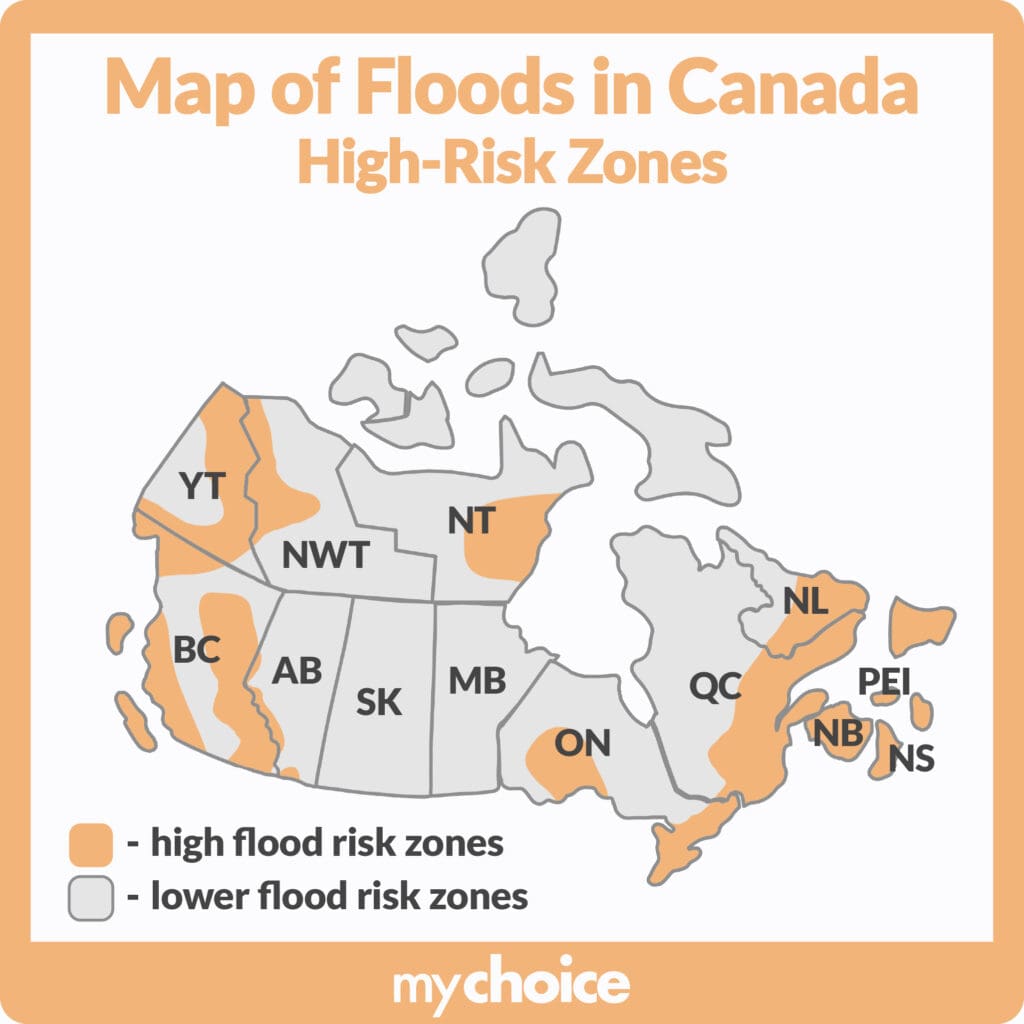

Flooding is the dominant climate threat that Canadians face. Those in high-risk zones — like along the coast, near dams and rivers, and in valleys — are more vulnerable, but most regions are projected to experience more extreme rainfall due to stronger storms, snow melt, and rising sea levels.

Weather-related losses are the main reason for property insurance claims and are only expected to increase as climate change worsens. Annual insured damages have surged in recent years, with 2023 being the fourth-worst year for losses. In the last decade alone, there have been 35 catastrophic floods in the country, with losses exceeding $30 million per flood.

The Task Force on Flood Insurance and Relocation estimates that the average annual cost of residential flooding in Canada is $2.97 billion per year. 90% of the risk is borne by the top 10% of high-risk households that, even if they could afford it, likely aren’t eligible for flood insurance because potential payouts would far exceed their premiums. That translates to roughly 1.5 million households without adequate protection in the event of a flood.

The 2024 Federal Budget Announcement

In its budget for 2024, the federal government reiterated its commitment to the low-cost flood insurance program with more details on its funding and implementation, with a target up-and-running date of 1 April 2025.

The government plans to offer both a flood reinsurance scheme and an insurance subsidy for high-risk households, pledging $15 million to facilitate the rollout. This is in addition to the initial seed funding of $31.7 million over three years, as earmarked in the 2023 federal budget.

The NFIP is a private-public partnership in collaboration with the Insurance Bureau of Canada, Finance Canada, Public Safety Canada, Canada Mortgage and Housing Corporation, and property and casualty (P&C) insurers across the country.

What the NFIP Means for Canadians

The goal of the NFIP is to prevent Canadian homeowners, especially those in flood-prone zones, from taking on the financial burden of ever-increasing flood risks. While some of the details are expected to change, here’s what we know so far about the NFIP:

- Once implemented, all Canadian homeowners can access flood insurance, including those previously not eligible for coverage due to their higher risk.

- Coverage will be offered through existing home insurance policies and channels (e.g., brokers, agents). This means that homeowners will still need to purchase overland flooding and/or sewer backup coverage.

- The government will subsidize premiums for high-risk and low-income households above a certain cap, which is yet to be determined. A task force estimates the cost of flood insurance to be $3,000/year for up to $300,000 of coverage.

Impact on Homeowners Insurance in Canada

The biggest change the NFIP introduces to the industry is that previously uninsurable homeowners will now be eligible for flood protection. Those who already have flood insurance may benefit as well.

While its financial impact remains to be seen, the NFIP could potentially lower insurance rates, or at least reduce what policyholders pay out of pocket, as the federal government shoulders some of the cost burden. This could also mitigate any premium increases due to flood-related claims. However, insurance prices will likely continue to rise regardless, due to inflation, higher repair costs, and more frequent and severe weather events caused by climate change.

That said, the NFIP is a sign that the government is shifting away from reactive disaster assistance to proactively making insurance more accessible to more people. If reception is positive, other natural disasters that are typically excluded (e.g., earthquakes) may be covered in the future.

Key Advice From My Choice

- Even if you don’t live in a flood-prone area, ask your broker or agent about your flood insurance options. Given the increasing frequency of floods and the rising cost of repairs, you’ll want to stay protected in case the worst happens.

- Watch for early signs of water damage, and address any necessary repairs as soon as possible. Insurers may still deny claims if the damage is due to or worsened by negligence.

- To prevent costly repairs, keep window wells, gutters, roofs, and drains free of snow, ice, and other debris. If you’re going to be away for an extended period of time, have someone check in on your property for you.

- Home renovations can make your home more flood-proof. Consider installing a sump pump, making flood shields/barriers, raising essential appliances above flood levels, and improving lot grading.