Life insurance is the best way to provide your family with a financial cushion and peace of mind in the event of your passing. However, for many Canadians, the stakes are high – balancing a mortgage, family obligations, and long-term financial goals. So, some might consider having more than one life insurance policy. But is it worth it?

Explore why having multiple life insurance policies might be worth considering while understanding its implications.

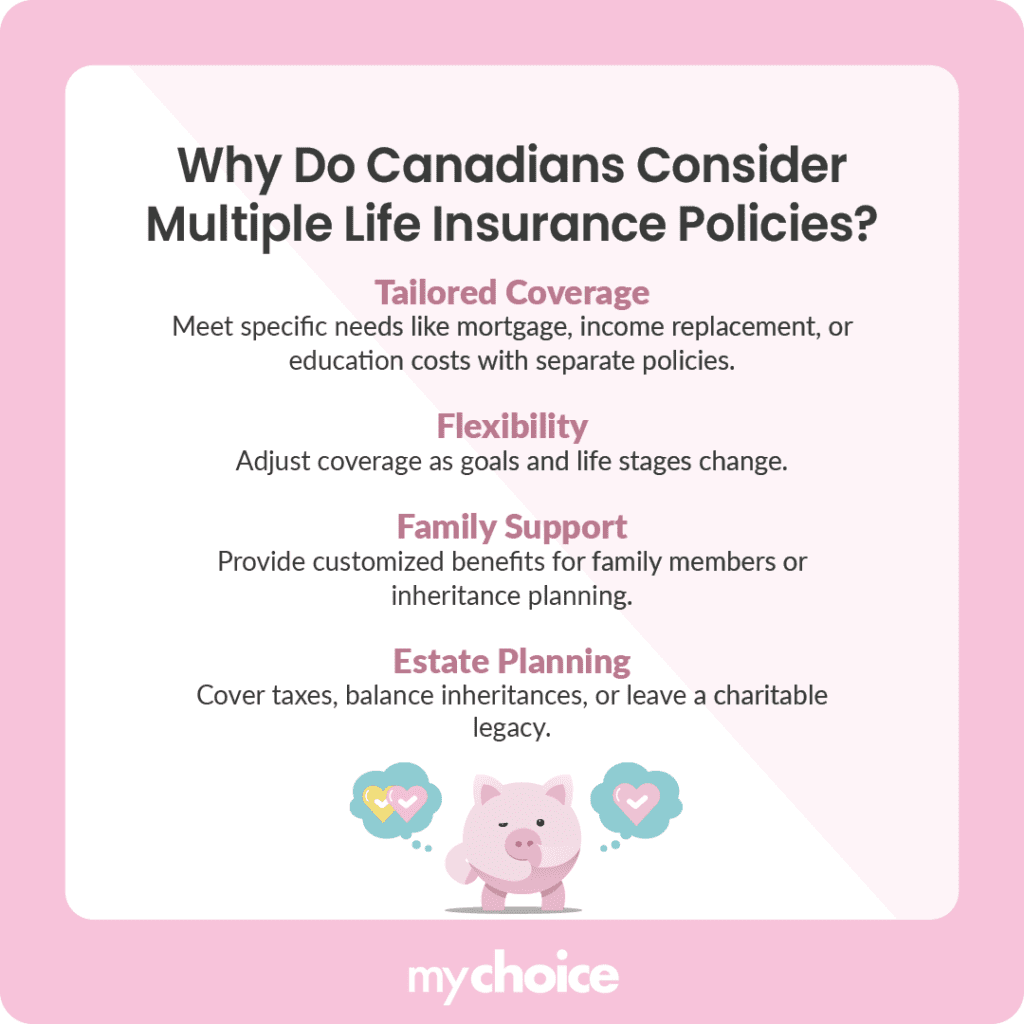

Why Consider Having More Than One Life Insurance Policy?

Whether to safeguard your mortgage or enhance your family’s financial safety net, you might consider multiple life insurance policies for many reasons. Here’s a breakdown of the most important considerations:

Challenges and Considerations for Multiple Life Insurance Policies

While having multiple life insurance policies can offer flexibility and comprehensive coverage, managing them can be complex and lead to the following challenges.

Alternatives to Multiple Life Insurance Policies

Multiple life insurance policies can pose undeniable benefits, but weighing your options before deciding is best. Here are some reasonable alternatives to consider.

Key Advice from MyChoice

- Consider why you want to get multiple life insurance policies and determine whether it’s easier to adjust your existing life insurance policy instead.

- Match coverage to specific goals. Consider short- and long-term goals, such as paying off a mortgage or leaving an inheritance.

- Evaluate the flexibility of a single policy and consider customizing it with riders or increasing your coverage to meet specific financial needs.

- Consult an insurance advisor to help you determine whether multiple policies are necessary. They can help you identify cost-effective solutions and prevent overlaps in coverage.