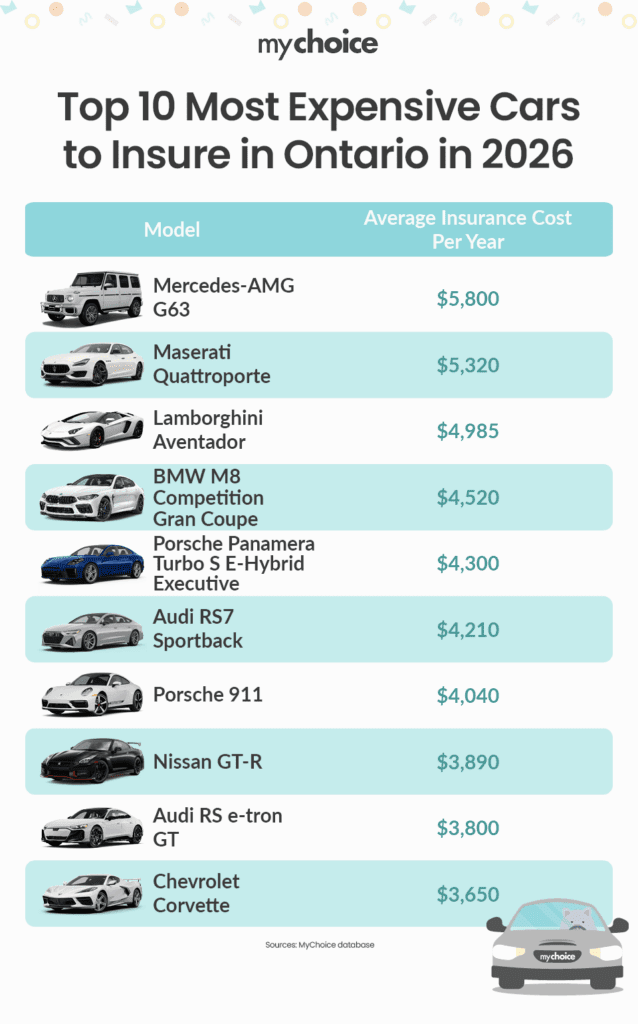

If you prefer newer upscale rides, expect a higher insurance premium. After all, you’re paying for aesthetics, comfort, and potential risks. Below are the top 10 most expensive cars to insure in Ontario in 2026.

If you’re on a budget and want to go the opposite way, you may want to visit our list of the cheapest cars to insure in Ontario.

Top 10 Most Expensive Cars to Insure in Ontario in 2026

| Car Model | Average Annual Car Insurance Premium | Average Monthly Car Insurance Premium |

|---|---|---|

| Mercedes-AMG G63 | $5,800 | $483 |

| Maserati Quattroporte | $5,320 | $444 |

| Lamborghini Aventador | $4,985 | $415 |

| BMW M8 Competition Gran Coupe | $4,520 | $377 |

| Porsche Panamera Turbo S E-Hybrid Executive | $4,300 | $358 |

| Audi RS7 Sportback | $4,210 | $351 |

| Porsche 911 | $4,040 | $337 |

| Nissan GT-R | $3,890 | $324 |

| Audi RS e-tron GT | $3,800 | $317 |

| Chevrolet Corvette | $3,650 | $304 |

The insurance premiums in the table above and the infographic below are based on the thousands of quotes we collected through our platform in 2025.

Our Methodology for Choosing the Most Expensive Cars to Insure in Ontario

To create this updated 2026 list, we analyzed more than 60,000 auto insurance quotes generated through our website in 2025. These quotes represent actual Ontario drivers shopping for insurance coverage, giving us a clear picture of what people are really paying, not just what insurers advertise.

Here’s how we did it:

- We grouped the quotes by vehicle make, model, and year, calculating each car’s average annual premium and average monthly premium.

- The quotes were then ranked from highest to lowest to identify which vehicles consistently appeared at the top of the cost spectrum.

- To ensure a fair and consistent comparison, we focused on a standard driver profile across all vehicles: a 35-year-old married driver (male or female), fully licensed, with a clean driving record.

Insurance costs can vary between drivers depending on personal factors like driving record, location, age, and claims history.

1. Mercedes‑AMG G63

Average insurance cost per year: $5,800

This hulking luxury SUV packs serious presence on Ontario roads. With its high price tag, powerful engine, and premium parts, it makes sense that insurers treat it as a higher risk in terms of cost.

2. Maserati Quattroporte

Average insurance cost per year: $5,320

The Quattroporte is a luxury sedan with high-performance credentials and Italian styling. Its ownership involves higher repair and parts costs. Combined with the brand prestige, the added expense of owning and maintaining this is reflected in its usual insurance rates.

3. Lamborghini Aventador

Average insurance cost per year: $4,985

This is a true luxury car that boasts low production numbers, enormous performance, and an eye-catching design. All of that drives up the cost to insure because of theft risk, repair cost, and specialist work, which is reflected here.

4. BMW M8 Competition Gran Coupe

Average insurance cost per year: $4,520

This BMW combines sports-car performance with a four-door layout. While more “usable” than some exotics, it still commands a high premium for insurance because of performance and repair and parts cost.

5. Porsche Panamera Turbo S E‑Hybrid Executive

Average insurance cost per year: $4,300

This is a high-end hybrid performance sedan from Porsche that’s on the pricier end to insure. The hybrid tech, the premium materials, and the Porsche badge all contribute to higher premiums compared to a “normal” car.

6. Audi RS7 Sportback

Average insurance cost per year: $4,210

The RS7 gives you a fast, stylish hatch/sedan hybrid with luxury finishes. As a performance model under a luxury brand, it steps up into the higher insurance bracket.

7. Porsche 911

Average insurance cost per year: $4,040

A storied sports car, the 911 is popular, powerful, and often driven hard. The higher risk of accidents and theft, increased cost of parts and maintenance, and its high performance all contribute to its higher insurance premiums.

8. Nissan GT‑R

Average insurance cost per year: $3,890

This Japanese performance icon is a bit more “accessible” than other ultra-luxury foreign cars, but still very much in the high-risk premium bracket because of its performance credentials and appeal to enthusiast drivers.

9. Audi RS e‑tron GT

Average insurance cost per year: $3,800

An electric-performance luxury car from Audi. While electric vehicles sometimes benefit from lower repair costs due to factors like less engine wear, this model’s premium parts, performance and brand premium still push insurance costs higher.

10. Chevrolet Corvette

Average insurance cost per year: $3,650

The Corvette is the “entry-point” performer in this list. While it costs less to insure than some ultra-luxury models, it still sits significantly above average for Ontario car insurance because of its performance nature.

What Factors Affect Insurance Rates For Luxury Cars?

When you’re insuring a high-end vehicle in Ontario, several factors tend to push the cost upward. Here are the main ones, along with an explanation of how they apply particularly to luxury or performance vehicles.