Whether mortgage insurance or life insurance is better depends on your protection needs. That means the right choice for you may not be right for others and vice versa.

Learning more about life insurance and mortgage insurance is a great way to make an informed decision. Keep reading because we’ll dive deeper into how both insurance types can help you.

How Life Insurance Helps Your Home Loan

How life insurance helps your home loan is pretty straightforward: If you pass away while under coverage, your loved ones can use the life insurance payout to pay your mortgage. Naturally, your life insurance payout can be used by your beneficiaries for other purposes like school tuition and income replacement.

With a life insurance policy, there’s no obligation to use the payout to repay the mortgage. Therefore, your beneficiaries have more freedom regarding how the money is used.

Which Type of Life Insurance Is Best for My Mortgage?

The type of life insurance that’s best for your mortgage depends on your protection needs. If you just want to get coverage until you pay your mortgage in full, you can get term life insurance that covers you until the mortgage period is over. But if you want to get insurance protection beyond your mortgage term, you can opt for permanent or whole life insurance.

Remember that permanent life insurance is typically more expensive than a term policy. So, choosing the policy that suits your overall protection needs, not just your mortgage requirements is best.

How Mortgage Insurance Helps Your Home Loan

Before we delve deeper into mortgage insurance, you should know there are two types of insurance products called “mortgage insurance.” So, what is mortgage insurance really? Let’s clear that up first by taking a look at both products:

- Mortgage loan insurance: Also known as mortgage default insurance, this is insurance that you must buy if you pay less than 20% down on your home. This insurance product protects the mortgage lender in case you can’t repay your mortgage. Generally, mortgage loan insurance premiums are between 0.6% and 4.5% of your total mortgage value. The larger your down payment, the lower your mortgage loan insurance premiums.

- Mortgage life insurance: Mortgage life insurance works similarly to a life insurance policy, where the insurer pays out if you pass away during the policy’s term. However, mortgage life insurance is exclusively used to repay the mortgage, meaning your beneficiaries won’t be able to use the money for other purposes.

Mortgage life insurance is a more direct way of repaying or paying down your mortgage if you pass away. You may be wondering if both life insurance and mortgage life insurance can repay a mortgage loan; why not choose life insurance for its flexibility?

One of the advantages of mortgage life insurance on this front is that it’s often easier to qualify for, meaning you don’t have to pass through as many hoops as life insurance.

Comparing Both Options

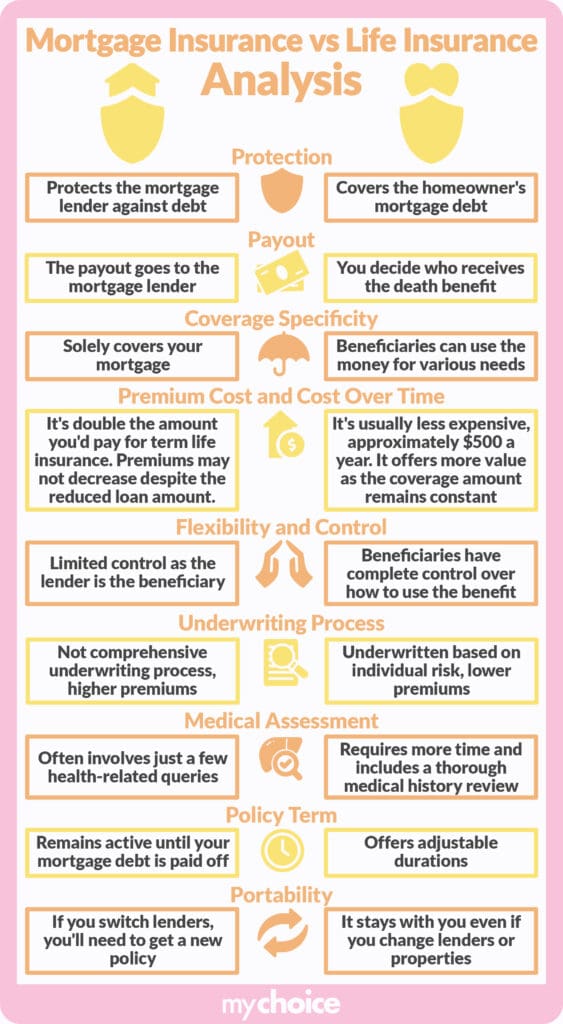

If you’re still on the fence whether to get a life insurance policy or mortgage life insurance, we’re here to help. Here’s a table that compares key elements of each insurance product side-by-side:

| Features | Life Insurance | Mortgage Life Insurance |

|---|---|---|

| Available types | Term life insurance and permanent life insurance, among others. | One type of mortgage life insurance. |

| Cost | Can be affordable or more expensive, depending on whether you choose term or permanent coverage. | Typically cheaper because insurance coverage ends when your house is fully repaid. |

| Consistency of premiums | Generally constant for term and permanent insurance policies. | May decrease as your cover amount reduces over time. |

| Ease of qualification | May be stricter, especially if you’re a higher-risk individual due to age, lifestyle, and medical history. | Usually easier because the requirements are more relaxed. |

| Where your insurance payout goes | Beneficiaries can use your death benefit to pay the mortgage and other purposes like schooling and income replacement. | Directly to repay your mortgage. |

| Protection scope | The entirety of your family’s finances. | Your mortgage. |

Which One Is Right for You?

There’s no definitive answer for whether life insurance or mortgage life insurance is right for you. Each type of insurance has its own use cases depending on your financial condition and protection needs. If you’re still on the fence, let’s take a look at the strengths and weaknesses of each type:

Life Insurance

The strengths of life insurance include:

- Your beneficiaries are in control of your death benefit. They can decide what to do with the money, whether it’s putting it all towards the mortgage or using it to cover other expenses.

- Protection can span beyond the term of your mortgage. You can buy term life insurance that’s longer than your mortgage or get permanent life insurance for lifelong coverage.

- Constant coverage amount because it’s not linked to the mortgage balance.

Meanwhile, its weaknesses include:

- Generally, stricter qualification requirements. Most life insurance policies require you to pass a health exam.

- Depending on your chosen policy, life insurance premiums can be more expensive.

- Your premiums generally won’t decrease unless you choose to reduce your coverage.

Mortgage Life Insurance

The strengths of mortgage life insurance are:

- Typically cheaper than traditional life insurance.

- Premium payments can decrease as your mortgage gets repaid.

- Relatively easier qualification requirements.

Its weaknesses include:

- The death benefit payout can only be used to repay your mortgage.

- The coverage period lasts until the end of your mortgage.

- If you’re working with a different lender, you may not be able to port your policy to another home.

Key Advice From MyChoice

Now that we’ve learned about the differences between mortgage life insurance and life insurance, here are some top tips you can follow:

- There’s no definitive “best” answer between whether life insurance or mortgage life insurance is right for you. Both products have pros and cons, so you should choose the one that best fits your needs.

- You can choose life insurance for a home loan if you want more flexibility and have protection needs beyond your mortgage.

- Mortgage life insurance is better if you just want to ensure your mortgage gets paid and don’t have other protection needs.

- If needed, you can take both types of policies simultaneously to complement each other.