Your home is more than just four walls; it’s a haven that protects your family and valuables. That’s why finding the right home insurance coverage is one of the most important financial decisions you’ll make. While many homeowners focus on finding the cheapest premiums, a truly valuable policy strikes a balance between affordability and proper protection.

What are the most common mistakes to avoid when buying home insurance? What’s the best way to get the most value and coverage from your insurance policy? In this article, we’ll discuss the seven mistakes people often make when shopping for home insurance, along with how to avoid them.

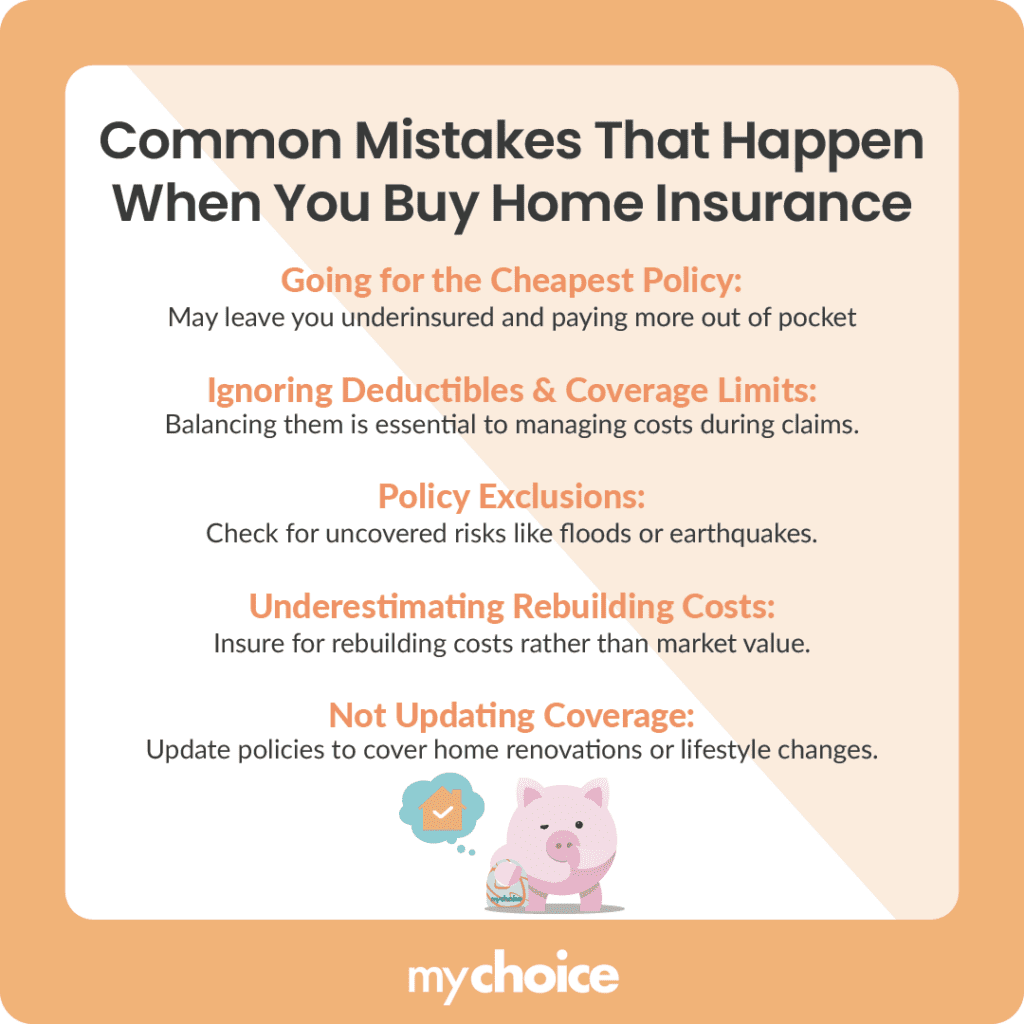

1. Focusing Solely on Price

One of the most frequent mistakes homeowners make is shopping for insurance based on the lowest price available. However, opting for the cheapest policy can backfire if it doesn’t offer sufficient coverage. A policy that seems like a bargain could leave you with serious out-of-pocket expenses when disaster strikes.

2. Failing to Consider Deductibles and Coverage Limits

When evaluating a home insurance policy, homeowners often overlook the combined impact of deductibles and coverage limits. A higher deductible typically results in lower premiums, while a lower deductible means you’ll pay higher premiums but less out of pocket in the event of a claim.

Meanwhile, coverage limits determine the maximum amount your insurer will pay toward a covered loss. If your coverage limit is too low, you could be left footing a significant portion of repair or replacement costs. Balancing the deductible with your coverage limits can drastically affect your insurance premiums.

3. Overlooking Important Policy Exclusions

Many homeowners assume that home insurance covers everything, but misunderstanding your policy coverage can be very costly. Standard home insurance policies typically exclude damages from floods, earthquakes, wildfires, and lack of routine maintenance. You may need additional coverage if your home is in an area prone to such natural disasters.

4. Underestimating Your Home’s Rebuilding Cost

Many homeowners make the mistake of insuring their home for its real estate or market value rather than the cost to rebuild or replace it. The market value of a home factors in land costs and local property values, which don’t necessarily reflect the actual amount required to reconstruct the property after a total loss. Underestimating these rebuilding costs can leave you underinsured if your home sustains severe damage.

5. Failing to Update Coverage as Needs Change

Many homeowners purchase a home insurance policy and then keep that same policy for years, forgetting to update it as their home and lifestyle evolve. Home renovations, valuable possessions, or changes in personal circumstances can alter your insurance needs. If you don’t update your policy regularly, you might be underinsured or lack coverage for valuable items.

6. Missing Out on Potential Discounts

When shopping around for home insurance, many homeowners see the listed premium and assume that that’s what they have to pay. It’s easy to miss potential discounts on your insurance rate when you’re not familiar with them.

One way to save money on insurance is bundling your home policy with other policies, such as auto or life insurance, under one insurer. This can entice your insurer to offer a percentage discount on the whole bundle.

7. Not Utilizing Insurance Comparison Websites like MyChoice

Insurance companies differ in their offerings, discounts, and customer service reputations. One big mistake is settling for the first quote you get or sticking with your current insurer simply due to familiarity. Instead, use widely available online insurance comparison websites like MyChoice. These websites help you find the best deals for your insurance needs by comparing offerings between dozens of the top insurance providers in your area. Utilize this resource to get the best-value home insurance policy available to you.

Key Advice From MyChoice

- Compare policies based on coverage limits, deductibles, and exclusions, not just premiums.

- Read your policy’s fine print carefully. Identify what is excluded and what is covered, and discuss potential coverage gaps with your insurance agent or broker.

- Use a website like MyChoice to easily compare the best home insurance plans between all available providers.