Car insurance is a legal requirement in Canada for a reason. It provides financial protection against accidents, theft, and liability. It also ensures that drivers can cover damages and medical expenses resulting from car-related incidents. But sometimes life gets in the way and you forget to make a car insurance payment on time. How does this impact your protection?

Missing a car insurance payment doesn’t just affect your present coverage – it affects your future rates and your credit score. Learn more about what to do if you miss a car insurance payment, how long non-payment stays on your record, and how to get new coverage if your policy is cancelled.

Consequences of Missing a Car Insurance Payment in Canada

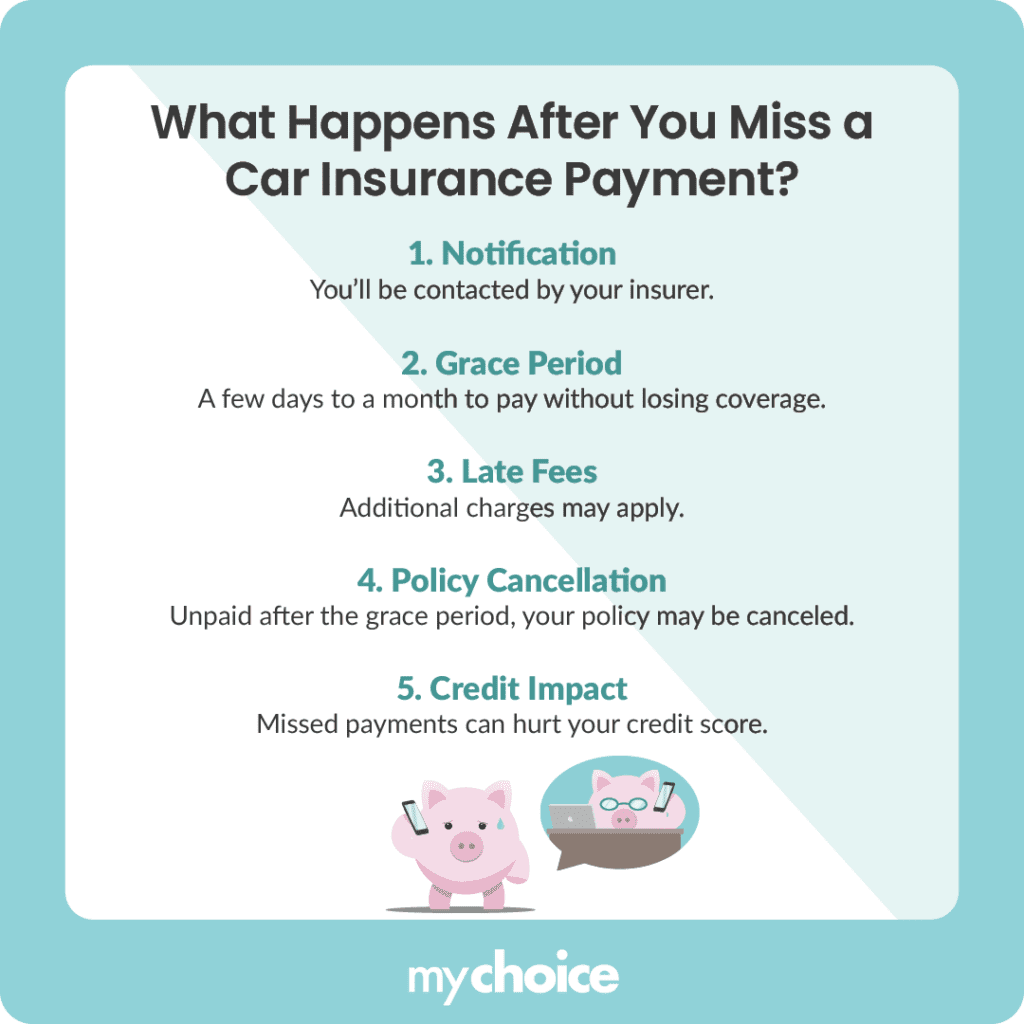

When you miss a car insurance payment in Canada, the consequences can vary depending on your policy’s terms and conditions. Here are some of the effects that it can have on your finances and future insurance coverage.

Resolving the Issue Step-By-Step

Sometimes, your insurance premium payment slips your mind or it doesn’t go through with your credit card or bank account. If you realize you’ve missed a car insurance payment, here’s what you can do:

Most insurers are willing to work with clients to help them find solutions that avoid policy cancellation, so stay in touch and relay your concerns to your car insurer as soon as they arise.

It’s also important to take care of late payments immediately to prevent fees, coverage interruption, and legal penalties for driving without car insurance. For example, Albert’s Traffic Safety Act expressly fines offenders a minimum of $2,500 for the first violation, with escalating fines and even imprisonment for subsequent offences – and other provinces have similar laws.

What Steps Should I Take to Get Auto Insurance After My Policy Was Cancelled?

Securing a new auto insurance policy after having the previous one cancelled for non-payment poses some challenges. But fret not – you can still get coverage by being upfront about your policy history, shopping around, and looking at high-risk insurance options. Learn more about what you can do to get new car insurance – read our guide on how to get car insurance after cancellation in Ontario.

How to Make Sure I Don’t Accidentally Miss a Payment in the Future

Life happens, and it’s all too easy to overlook your car insurance payments. Here are a few simple tricks to make sure you never miss another payment and your policy stays in force:

Key Advice from MyChoice

- When seeking new car insurance after a cancellation, be honest about your history and explore all available options.

- Communicate with your insurer as soon as you realize you’ve missed a payment. They may offer options such as extending the grace period or setting up a new payment plan.

- Review your car insurance coverage regularly to ensure that it still meets your needs within your budget. You may find that making adjustments like having a higher deductible or removing endorsements you don’t need can help you save money without compromising coverage.