Loss assessment coverage is a necessity for all condo owners to protect against unintended spending – but let’s zoom out a little bit to get a picture of how it all fits together.

Condo ownership usually comes with many benefits: pools, gyms, function rooms, community events, and sometimes even luxury amenities like theatre rooms. However, each one of these benefits needs to be funded somehow. While these costs are usually already rolled into your association dues, there are special circumstances where condo owners may be asked to pay a little bit more on top of that. This is when loss assessment coverage for condos comes into play. If your condo association requires you to pay a couple of thousand dollars out of pocket to cover a roof leak or something similar, you don’t want to be caught in a bad situation. Let’s dive in deeper.

Why Do I Need Loss Assessment Coverage?

Most, if not all, condominium developments usually have a master policy that covers all considerable building-related expenses to a point. After all, even large insurance plans covering an entire building have limits to their coverage. But what happens if repair costs overshadow the amount covered by the master policy? This is where condo owners may need to shell out some cash.

In these unfortunate cases, the HOA or condo association will usually conduct a condo special assessment to figure out exactly how much each unit owner will have to pay to cover these new expenses. Sometimes, expenses are split evenly across the board if all the units are the same size. Other times, folks who own larger slices of the property will have to pay more.

As a condo owner, your responsibility goes further than just the walls of your unit. That’s because owners are closer to “shareholders” in a condo corporation than mere tenants when they purchase a bit of space – so it follows that they’re also accountable for when things need repair.

Now most boilerplate condo unit insurance plans don’t usually cover things outside of the actual unit, specifically because these master plans should cover everything. However, master policies often have significant deductibles, or sometimes repair costs are in the hundreds of thousands of dollars – so having that little bit of extra coverage for loss assessments can save you a lot of trouble in the long run.

In short, loss assessment coverage acts as a bridge between your personal condo insurance and the building’s coverage.

How Loss Assessment Coverage Works: A Concrete Example

Sometimes it can be difficult to visualize exactly how loss assessment coverage works, especially because it’s quite unique in nature. Here’s an example scenario to help you understand:

Let’s say you have a condo insurance plan with a loss assessment coverage add-on. Firstly, good on you for being so proactive. Now let’s say that a big fire damaged a significant part of the building’s lobby in a freak accident, and repairs will cost $250,000. Unfortunately, the condo’s master plan only covers up to $150,000. In this case, the condo association would conduct an assessment to figure out how much everyone needs to pay.

If, in this instance, you live in a condo complex with 50 equal-sized units, then the remaining uncovered $100,000 would have to be split between all condo owners. If every single unit is occupied in this scenario, then you (and every other unit owner) would have to shell out $2000 to help with repair costs – which can be a hassle for some, and devastating for others.However, since you already had loss assessment coverage, your insurance company will pay the $2000 instead of you, leaving your monthly expenses stable and uninterrupted.

More on Loss Assessment Coverage

There are two specific situations when loss assessment coverage can be helpful. The first is, like we mentioned earlier, when the condo association needs a bit more funding to cover expenses beyond the policy’s limits. The second is when the master plan has a large deductible that needs to be paid upfront.

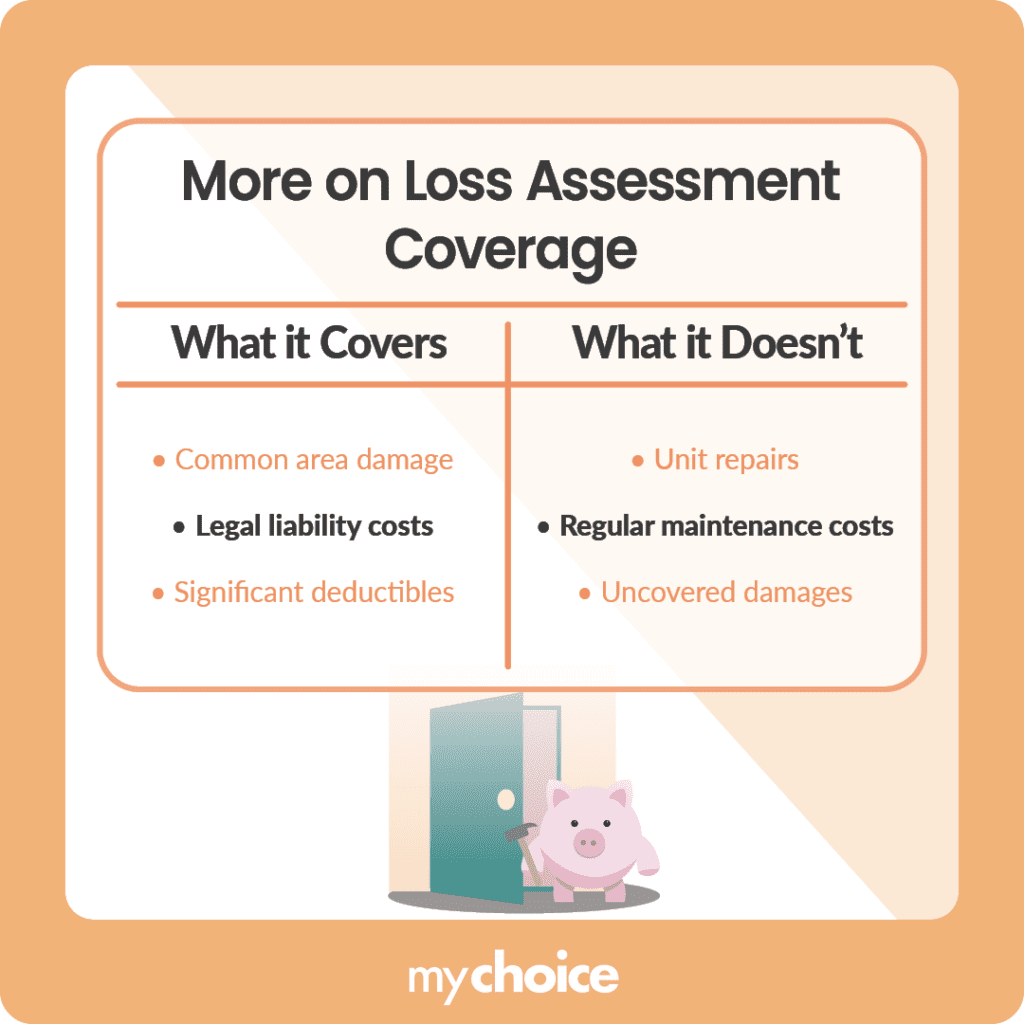

Given the flexibility of the situation, you may be wondering when loss assessment coverage helps, and when it doesn’t. Here’s a quick breakdown of what loss assessment policies cover, and what they don’t.

Tips for Condo Owners

Given everything we’ve mentioned before, there are a few ways to ensure you’re never left without coverage, no matter the situation. Here are a few of our recommendations:

Key Advice from MyChoice

- Keeping an eye on the condo association’s finances can help you assess your personal risk

- Condo association dues are different from loss assessment charges

- Consulting with your insurance provider can help you bridge any potential gaps