Many professions require training or licensing, and being able a life insurance salesperson is no different. Before you can legally sell life insurance, you need to qualify through the Life Licence Qualification Program or LLQP.

Do you want to take the LLQP and are interested to know more? Read on for our complete guide to the LLQP.

What Is the LLQP?

The LLQP is an entry-level licencing program required for life insurance salespeople. You need to pass the LLQP and earn a certificate to apply for a provincial insurance-selling licence. Think of the LLQP as your first stop in your journey to becoming a licenced and qualified insurance salesperson.

Your LLQP certificate lets you apply for provincial licences anywhere in Canada except for Quebec. Quebec uses a different insurance licencing system, so your journey might be different if you want to sell insurance there. However, some course providers can also help you qualify for an insurance salesperson licence in Quebec.

Types of LLQP Licences

There are two types of LLQP licences:

- Accident & Sickness (A&S) Representative Licence

- Life Insurance Representative Licence

The Life Insurance Representative Licence is often seen as the “full LLQP” since it covers both A&S and life insurance training.

What Careers Can You Get With an LLQP Certificate?

You can start your career as an insurance agent with an LLQP certificate. Passing the LLQP also puts you on track to becoming a financial planner or insurance underwriter.

However, the LLQP is just your first step. You still need to pass a provincial licencing exam to become a full-fledged insurance agent.

LLQP Education Courses and Exams

Your LLQP journey consists of two elements: the course and the exam. You need to attend and complete a four-module LLQP course before you’re eligible to write the certification exam. The exam itself is made up of four parts, each representing the module you learned during the course.

The LLQP Course

The LLQP course is a requirement for taking the LLQP exam. This course is available in English and French from various authorized providers across Canada. Since many different providers administer the course, you might see differences in fees and instruction formats.

However, the main LLQP course curriculum is the same. You’ll study these four modules during the course:

- Accident and Sickness Insurance

- Ethics and Professional Practice

- Life Insurance

- Segregated Funds and Annuities

The average student can complete these four modules in about 100 hours of study. But times may vary depending on the course provider and other factors.

You need to complete all modules to get a Life Insurance Representative Licence. However, you only need modules 1, 2, and 4 to qualify for an A&S Representative Licence.

Once you complete the modules, you’ll get an LLQP course completion certificate. This certificate is only valid for one year, so you have to take and pass your LLQP exam before it expires.

The LLQP Exam

The LLQP exam tests your mastery of the topics covered in the modules you’ve studied. This exam consists of 140 multiple-choice questions across all modules. Participants are given four hours to complete these exams. The national passing grade for the LLQP exam is 60% for all modules, and results are usually available the very next day.

Traditionally, LLQP exams are administered at test centres. But some test centres have recently offered online exams due to COVID.

Is the LLQP Exam Hard?

The LLQP exam is going to be challenging, but whether or not it’s hard depends on how you prepare. The good news is that this exam is multiple-choice and open-book, so you can still consult your notes if you don’t know the answer.

But that doesn’t mean you don’t have to prepare well. Sufficient preparation is the key to succeeding in all tests, the LLQP exam included.

Do LLQP Exams Allow Rewrites?

LLQP exams allow separate rewrites for every module. This means you can still have a shot at passing the LLQP even if you fail the initial exam.

However, there are some conditions to the rewrites:

- You need to wait three months for your next rewrite if you fail the same module three times.

- You need to wait an extra three months if you fail the same module for the fourth time.

- You need to wait an additional six months if you fail for the fifth time.

Remember that your LLQP course certificate is only valid for one year. Too many failures usually mean you need to retake the course.

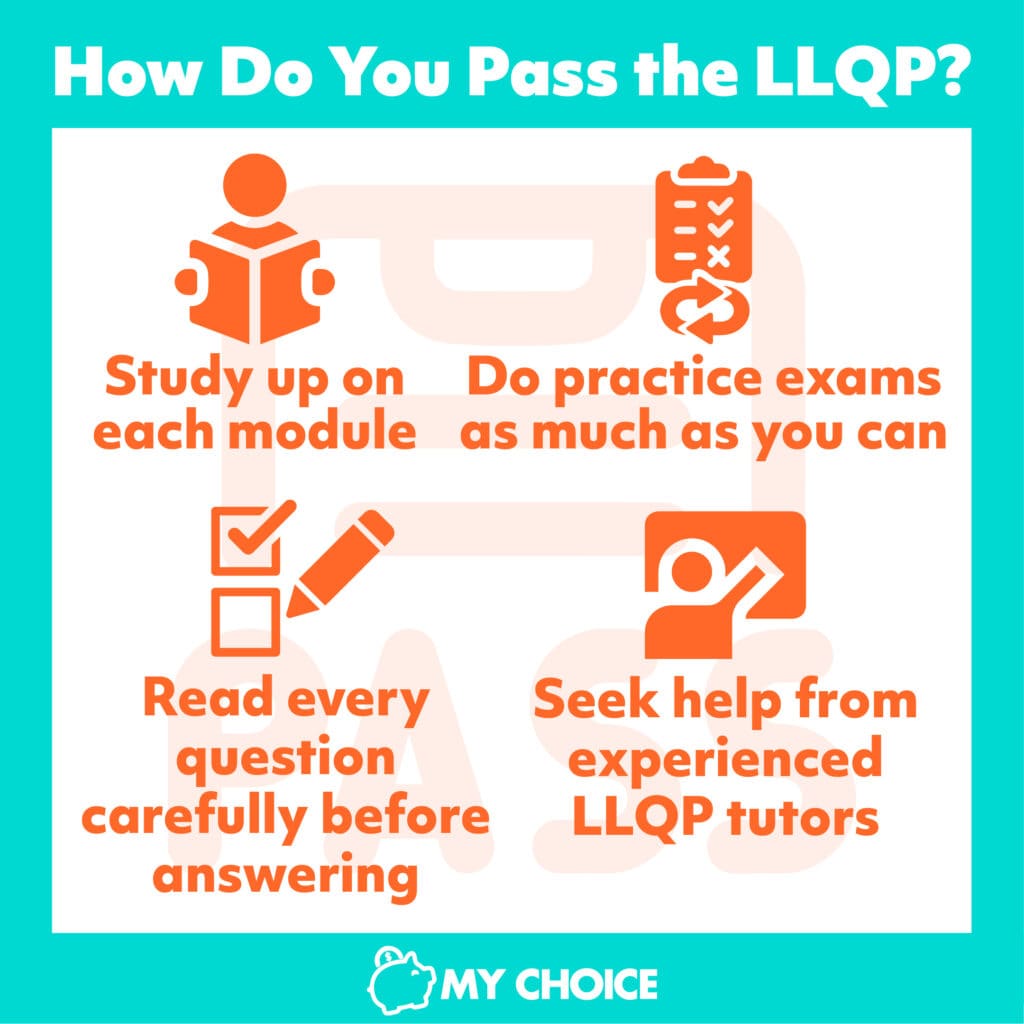

How Do You Pass the LLQP?

Like any other exam, you pass the LLQP by studying hard and preparing yourself well. Here are some tips to try when preparing for the LLQP:

- Study up on each module.

- Read every question carefully before answering.

- Do practice exams as much as you can.

- Seek help from experienced LLQP tutors if you can’t do it yourself.

How Much Does an LLQP Cost?

Training materials, exam reg, certification. Varies depending provider and province

The cost of LLQP exams and preparation differs depending on the course provider and your location. In Ontario, the LLQP exam itself costs $264 for a single attempt at the four modules. You need to pay extra to get a rewrite on each module.

Here’s a quick look at LLQP exam fees in other provinces:

| Province | First attempt |

|---|---|

| British Columbia | $145 |

| Alberta | $100 |

| Manitoba | $110 |

| Saskatchewan | $100 |

| New Brunswick | $66 |

| Nova Scotia | $66 |

| Prince Edward Island | $66 |

Check with your province’s LLQP test administrator for more information on rewrite fees.

In addition to the exam itself, you need to pay for the course. Again, different course providers offer different prices. For example, here’s the cost breakdown for an LLQP course from IFSE, one of the authorized providers:

- Course price: $350

- Optional textbook: $120

- Optional study guide: $100

- Optional video study materials: $99

Assuming you’re taking the LLQP in Ontario and skipping the optional materials, it would cost around $614 for an LLQP certification.

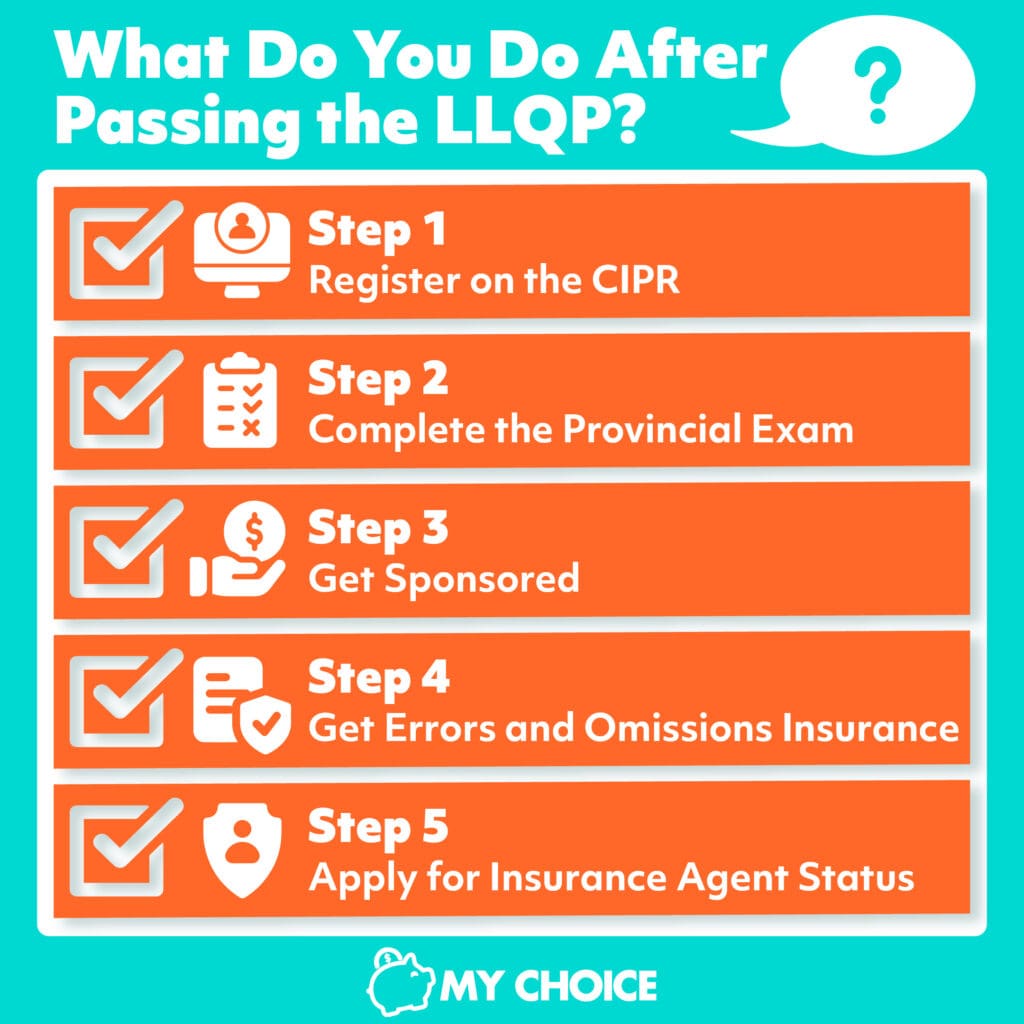

What Do You Do After Passing the LLQP?

You still need to do more work after passing the LLQP to be a full-fledged insurance agent. Here’s a step-by-step guide to what to do after the LLQP:

Step 1: Register on the CIPR

Once you pass the LLQP, your course provider will update your certification status on your Canadian Insurance Participant Registry (CIPR) account. You usually make this account as part of your LLQP course enrolment.

Step 2: Complete the Provincial Exam

But that isn’t the end of your journey. You then need to register and complete a provincial licencing exam through your chosen province’s insurance regulator. For instance, the regulator in Ontario is the Financial Services Commission Of Ontario or FSCO.

Does that mean you have to redo the exam every time you move provinces? Fortunately not. Once you qualify for one province, your licence is valid everywhere except Quebec.

Step 3: Get Sponsored

With the provincial exams behind you, now’s the time to search for a sponsor. Your sponsor is an insurance company that assists in your licence application. It’s your sponsor’s responsibility to determine whether you’re eligible to get an insurance agent licence. They also monitor your activities to ensure you can follow the industry’s rules and regulations.

Step 4: Acquire Errors and Omissions Insurance

You need to have errors & omissions (E&O) insurance before applying for a licence. It’s a professional liability policy designed to protect you from clients making claims on unintentional mistakes. In most cases, your sponsor company will help you find an E&O policy provider.

Step 5: Apply for Insurance Agent Status

Your insurance agent application process involves submitting a form, paying a licence fee, and passing background checks. If your provincial regulator says you’ve met all the criteria, then congratulations! You’re officially an insurance agent.

What’s the difference between an insurance broker and an insurance agent? Check our article about what sets insurance brokers and agents apart to learn more.

Do Licenced Insurance Agents Need to Continue Their Education?

Licenced insurance agents still need to continue their education. Many provinces require agents to keep up with insurance industry developments to maintain their licences. You’ll likely be required to obtain certain continuing education hours through courses and seminars.

Essential Skills for Insurance Agents

Naturally, you need more than insurance knowledge to succeed as an insurance agent. Here are some must-have skills for insurance salespeople:

- Communication and negotiation: Sometimes, the customer might take some convincing before they’re open to your offers. Good communication and negotiation skills mean you can make them see why life insurance is important and why it’s a good investment.

- Product knowledge: Knowing what your insurance company offers means you can serve the customers better. If you know the difference between universal and whole life policies or which one is better between term and whole life insurance, you can tailor your solutions based on what the customer needs.

- Attention to detail: Insurance policies often have lots of information, and sometimes people will make mistakes. Good attention to detail lets you spot errors and correct them before they become big issues later on.

The Bottom Line

Becoming an insurance agent or broker in Canada is a long journey. The first step in your journey is passing the LLQP, a course and exam covering the basics of life insurance for would-be salespeople.

The LLQP is a challenging exam, so make sure you study hard and prepare yourself if you want to qualify and go to the next step in your journey to becoming an insurance agent.