Life insurance can provide your loved ones financial security when you pass away, so they can cover costs like living expenses while they regain their footing. But if you want more control over how your life insurance payout is distributed to your loved ones and when, consider getting a life insurance trust.

Below, we explain why you should use a life insurance trust and compare it to other estate planning tools to help you prepare for the future.

What Is a Life Insurance Trust?

A life insurance trust lets the owner of a life insurance policy plan when and how their policy’s proceeds are distributed. When you establish a life insurance trust, the trust becomes the owner of the policy and the policy’s proceeds will be given out according to the terms of your trust agreement.

There are three parties in a life insurance trust:

- The beneficiaries: These are the people who will receive the proceeds of a life insurance policy under the terms of a trust.

- The grantor: This person holds the life insurance policy and is using it to fund the trust. The grantor names the trustee and dictates when and how life insurance policy proceeds will be distributed to their beneficiaries.

- The trustee: A life insurance trustee manages a trust’s assets (such as your policy) according to the terms of the trust before distributing them to beneficiaries.

Irrevocable vs Revocable Trusts

There are two kinds of trusts you can set up: irrevocable and revocable trusts. In both types, your assets are placed within it for distribution upon your death.

However, these types have distinct differences. Here’s how they work:

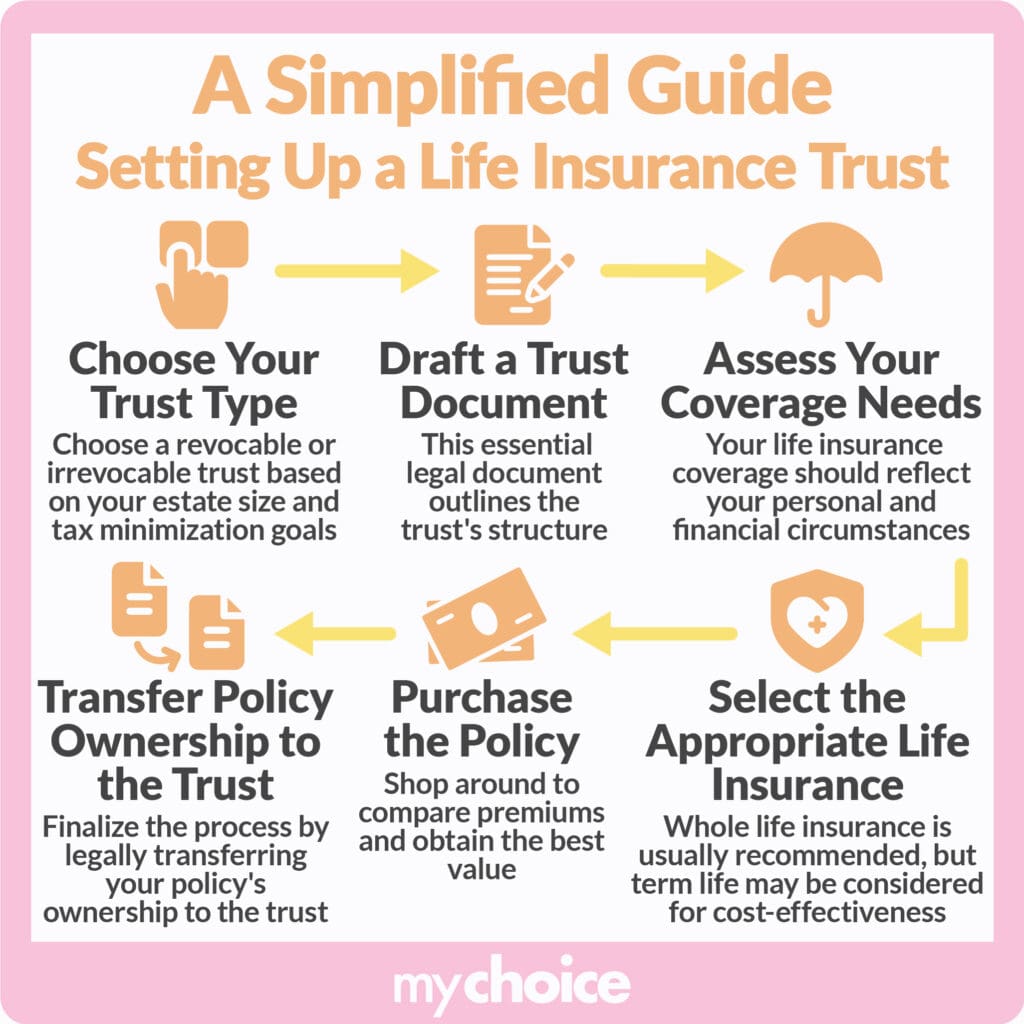

How Do I Set Up a Life Insurance Trust in Canada?

Follow this step-by-step guide to establishing a life insurance trust in Canada:

- Choose what type of trust to set up: Choose between a revocable or irrevocable trust. Generally, you should choose an irrevocable trust to reduce estate taxes if you have a large estate.

- Create your trust document: A trust document is legally binding and sets out the structure of your trust, including the grantor, trustee/s, beneficiaries, and instructions for distribution.

- Think about how much coverage you’ll need and what type: Deciding between whole vs. term life insurance? Whole life insurance is typically best because it doesn’t expire and has guaranteed benefits. If you have a lot of financial responsibilities and a limited budget, term life insurance may be more cost-effective.

- Buy the life insurance policy: Rates vary wildly between different companies. Shop and compare premiums between different providers using MyChoice.ca to find the best deal.

- Transfer ownership of the policy: Consult an estate attorney to transfer policy ownership and ensure that your trust fulfills all legal requirements. After the transfer, the trust will be responsible for managing your policy, paying premiums, and distributing proceeds.

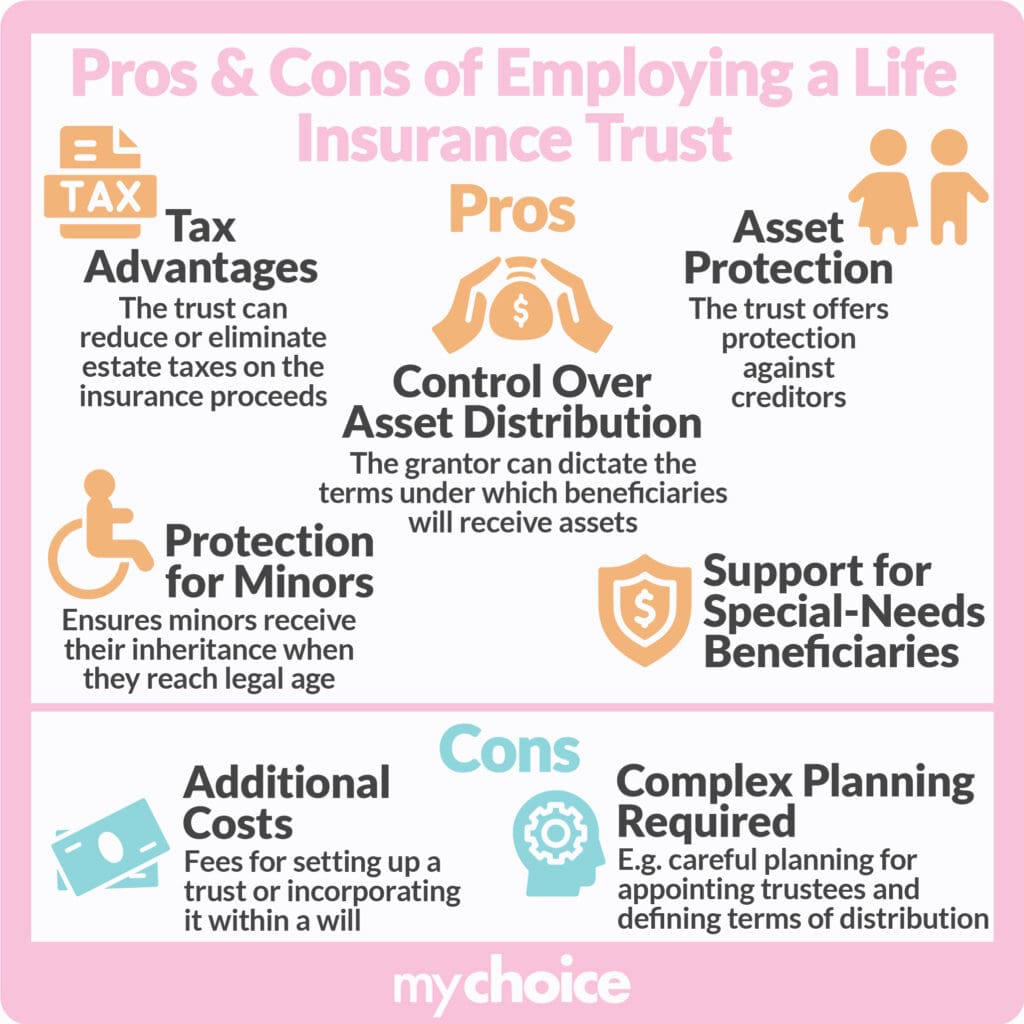

Why Should I Use Life Insurance Trusts?

Many people use life insurance trusts to protect their dependents’ financial security and control how they receive benefits. Here’s why you should use a life insurance trust:

What Are the Cons of Life Insurance Trusts?

The cons of life insurance trusts are that they can be costly to set up and administer, and they require careful planning. Here’s a brief explanation of these drawbacks:

Additional Costs

If you’re creating a life insurance trust agreement, prepare for additional legal and administrative costs. Whether you’re planning to set up a life insurance trust within a will or a separate trust, you’ll have to spend for legal assistance.

Complex Planning

A life insurance trust needs methodical planning for distribution. These are just some of the factors you’ll need to take into consideration:

- When and how proceeds will be distributed

- Who will be the beneficiaries

- Who to appoint as a trustee

Life Insurance Trusts vs Other Estate Planning Tools

There are other ways you can plan your estate and the distribution of your policy proceeds and other assets. Some of the most common estate planning tools are:

How to Set Up a Life Insurance Trust

The below infographic should guide you and be a useful point of reference should you chose to set up a life insurance trust.

Key Advice from MyChoice

Now that we’ve gone through what life insurance trusts are and compared them to other estate planning tools, here are some top tips from MyChoice:

- A life insurance trust gives you control over how and when the proceeds of your policy will be distributed.

- Setting up a life insurance trust can protect your policy’s proceeds from creditors and estate tax.

- If you want to name a minor as a beneficiary, set up a life insurance trust.

- A life insurance trust has additional costs and needs careful planning. It may not be worth it if the expenses are too big and you only have a few beneficiaries. Learn more about life insurance and trusts by reading our full articles on MyChoice.ca.