Inflation is a pressing concern for many Canadians in today’s economic landscape. As the cost of living continues to rise, the purchasing power of money diminishes, affecting everything from groceries to housing. This inflationary trend also extends to life insurance, making it crucial for policyholders to assess whether their coverage remains adequate.Will your life insurance policy resist inflation? How much coverage do you need when considering inflation? Read on to learn about how inflation affects life insurance and how to prevent its negative effects.

Life insurance doesn’t just provide a financial cushion in case of your death – it can also make for an intelligent investment move. If you’re looking for a policy that offers peace of mind and helps grow your wealth, a variable life insurance policy may be for you. Learn how it works and what you need to consider before getting one.

How Inflation Affects the Life Insurance Industry

Canada’s life insurance industry is affected by inflation in a number of ways. According to recent reports, the Canadian life and health insurance sector paid out a record $128 billion in benefits in 2023 – a 13% increase from the previous year. This surge in payouts demonstrates that the demand for life insurance is steadily growing amidst economic uncertainty.

Unfortunately, as inflation rises, the value of money decreases. For example, a death benefit of $500,000 today will not hold the same value in five years due to inflation. This decline in purchasing power can leave beneficiaries with less financial support than intended.

While existing policyholders typically do not see immediate changes in their premiums, new policyholders may face higher rates due to increased operational costs for insurers. Insurers often adjust premiums based on overall economic conditions and inflation trends.

Higher interest rates associated with inflation can also lead to better returns on investments linked to whole or universal life policies. This can positively affect the cash value component of these policies.

Do Insurance Companies Adjust Life Insurance Policies for Inflation?

Insurance companies do not automatically adjust existing life insurance policies for inflation. Once a policy is issued, the terms – including premium amounts and death benefits – remain fixed unless specific riders or adjustments are made at renewal or through additional coverage options.

However, insurers may offer options like inflation riders that allow policyholders to increase their coverage periodically without undergoing medical underwriting again. This can help mitigate the effects of inflation on death benefits but may come with additional costs.

Which types of Policies Does Inflation Affect the Most?

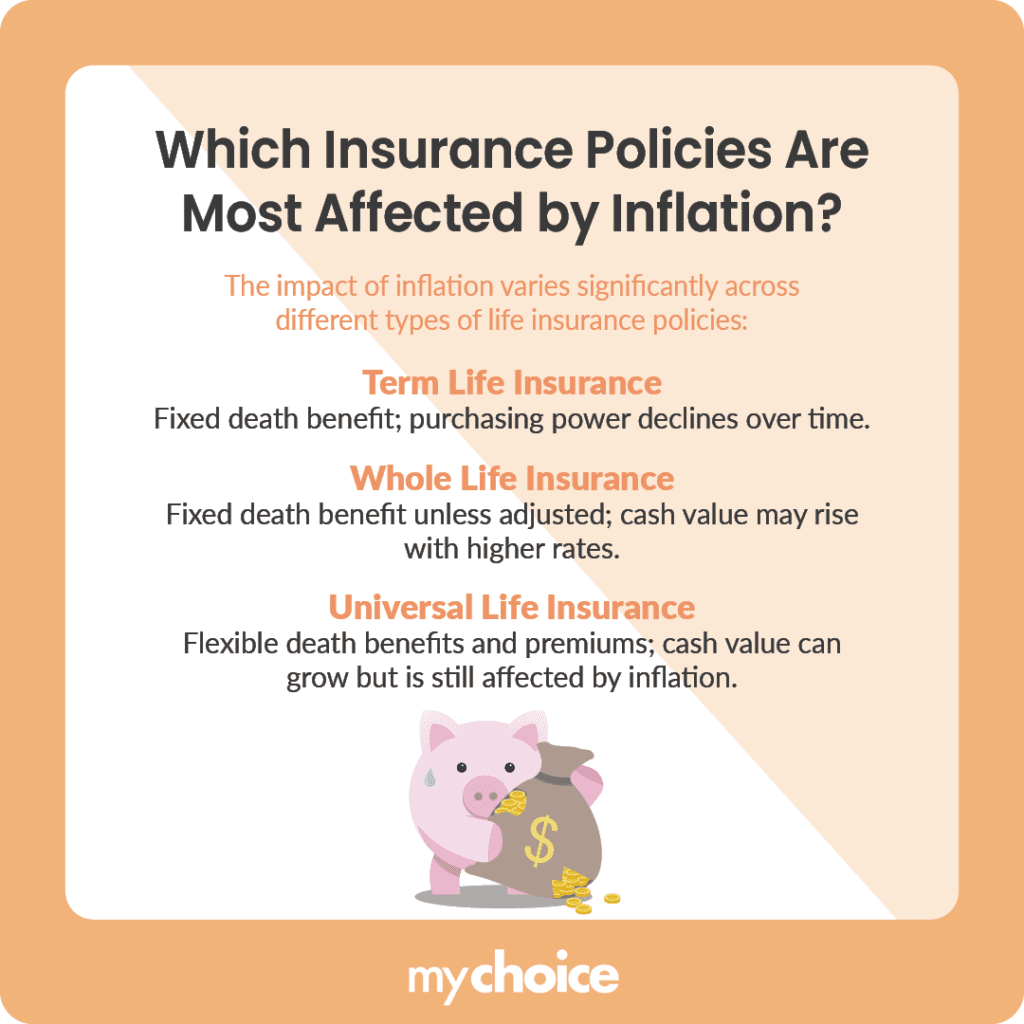

The impact of inflation varies significantly across different types of life insurance policies:

Term life insurance is particularly vulnerable to inflation since its death benefit does not change over time. Conversely, whole and universal life policies may provide some protection against inflation through cash value growth, but they still face challenges regarding fixed death benefits.

How to Calculate the Inflation-Adjusted Coverage Amount

To make sure that your life insurance policy is adequate over time, you need to calculate the coverage amount adjusted for inflation. Here’s a detailed step-by-step guide on how to calculate this value properly.

- Start by noting the amount of life insurance coverage you currently have. For example, let’s say it’s $500,000.

- Look at historical inflation rates to find a reasonable estimate. In Canada, inflation has averaged around 3% in recent years, but it can fluctuate. For this example, we’ll use 3%.

- Decide how many years you want to project into the future. For instance, if you’re planning for 20 years, that will be your timeframe.

- Use the Future Value Formula to calculate your needed coverage. This formula is as follows: FV = PV×(1+r)n

- FV = future value (the amount needed in the future)

- PV = present value (your current coverage)

- r = annual inflation rate in decimal form

- n = number of years until payout

- Plug your numbers into the Future Value Formula. Using the values in our example, here’s what it would look like:

- Current Coverage (PV): $500,000

- Inflation Rate (r): 0.03 (3%)

- Time Frame (n): 20 years

- Calculation: FV = 500000×(1+0.03)20

- Perform the calculation. Using the numbers above, it would look like this:

- FV = 500000×(1.8061) = 903050

Based on our example, after 20 years, you would need approximately $903,050 in coverage to maintain the same purchasing power as your original $500,000.

How to Select a Policy that Accounts for Inflation

When selecting a life insurance policy that accounts for inflation, keep these tips in mind:

There is no such thing as an inflation-proof life insurance policy, but by making smart decisions and reviewing your policy regularly, you can minimize the impact that inflation has on your death benefit.

Key Advice from MyChoice

- Regularly review your current coverage, taking potential future needs into account. Adjust your coverage when needed.

- Understand how different types of life insurance policies react to inflation and choose your policy accordingly.

- Utilize available riders or options that allow adjustments to your policy over time.