Higher interest rates can benefit you by making life insurance more desirable, especially if you have policies that build value over time. But how exactly do these increased rates impact your policy and its benefits? Let’s dig deeper into the effects of higher interest rates on your life insurance policy.

The Impact of Rising Interest Rates on Life Insurance

Surging interest rates are generally a good thing regarding life insurance. Experts expect life insurance companies in the biggest markets worldwide to earn more money over the next few years due to rising interest rates, as investment incomes will also rise. Let’s take a deeper look at how rising interest rates impact life insurance products:

Revival of Life Savings and Annuity Products

Rising government bond yields and interest rates make life savings and annuity products more attractive because they can build more value than they could previously. For the insurer, that means they can sell more life savings and annuities. For the customer, that means they can receive better investment growth for the money they’ve put into their policies.

Let’s examine the reasons why life savings and annuity products have been on the rise:

Closing the Retirement Savings Gap

In 2022, the retirement savings gap for the world’s largest economies sat at around US$ 106 trillion. The retirement savings gap represents the divide between the assets people have saved and the assets people need for a comfortable retirement. With a big gulf between the two, many people don’t have enough saved to afford a retirement free of financial worries.

But with rising interest rates and the increased popularity of life savings and annuities products, there’s a good chance that the gap can begin to be bridged. By purchasing these insurance products earlier, people can begin saving up for their retirement and let value build up in their policies to increase the likelihood of having no financial issues once they exit the workforce.

While higher life insurance premiums may sound undesirable, they can help bridge the retirement savings gap better. Your premiums are divided into portions in policies featuring a cash value component. One portion covers your death benefit, the second covers your insurance costs, and the third goes to your cash value. By paying higher premiums, you can grow your cash value faster, saving more money toward retirement.

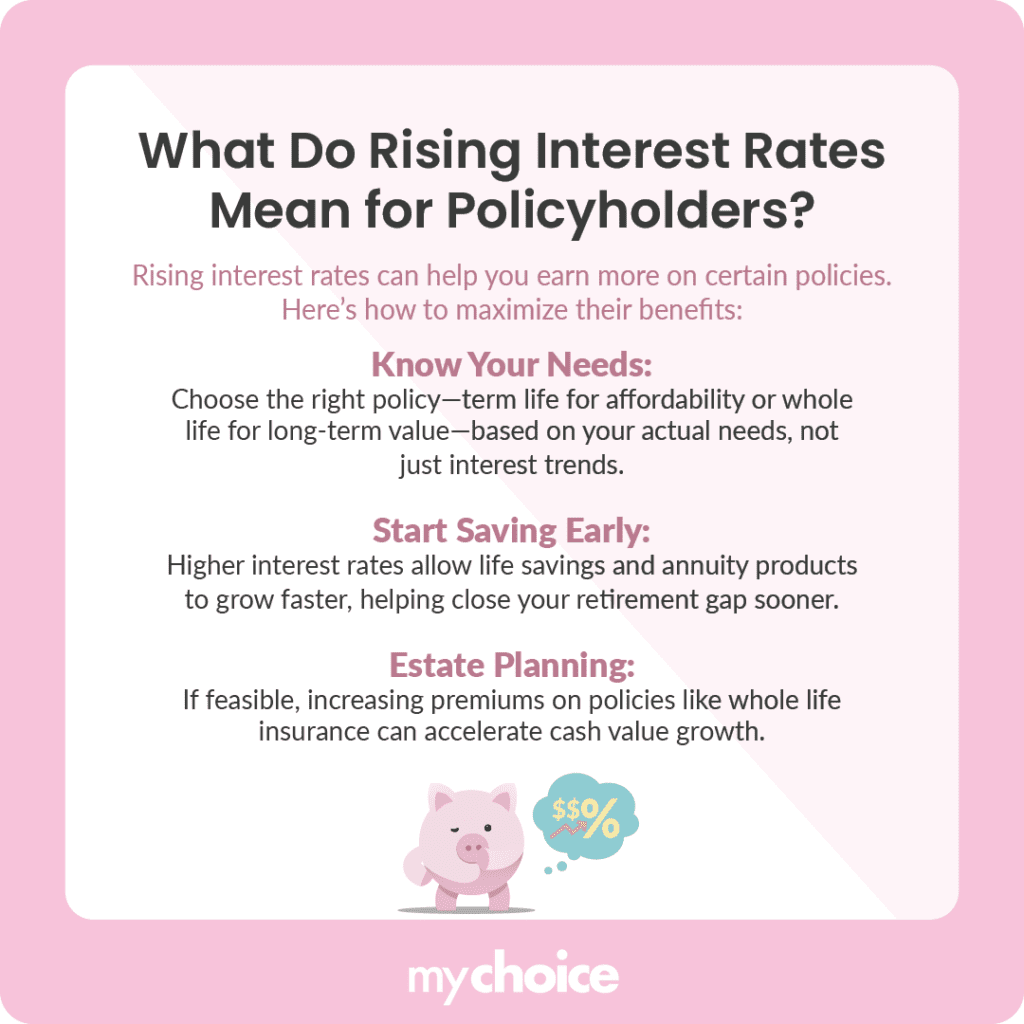

What Do Rising Interest Rates Mean for Policyholders?

For policyholders, rising interest rates mean you can potentially earn more money on your policies. Here are some tips you can follow to find the best life insurance product for your needs amid interest rate surges:

Key Advice from MyChoice

- Take advantage of higher interest rates by seeking insurance products that benefit from the rate hikes. A good example is a whole life insurance policy that relies on long-term asset yields.

- Consider saving up for retirement by purchasing annuities early. Higher interest rates mean you can earn more money on your annuity, building up your retirement nest egg faster.

- Think about paying higher premiums on your life insurance policy. By paying higher premiums, your cash value grows faster, so you can save it for your eventual retirement.