Life insurance is crucial for providing for your loved ones’ financial future, giving you peace of mind during your working years. Despite these benefits, younger Canadians may be reluctant to spend on life insurance because they feel it’s too expensive or they don’t need it until later in life. However, getting life insurance while young can be better than waiting when you’re older.

Why should you get life insurance at a young age? Read on to learn how its advantages can help you plan systematic savings and how to navigate coverage costs without breaking the bank.

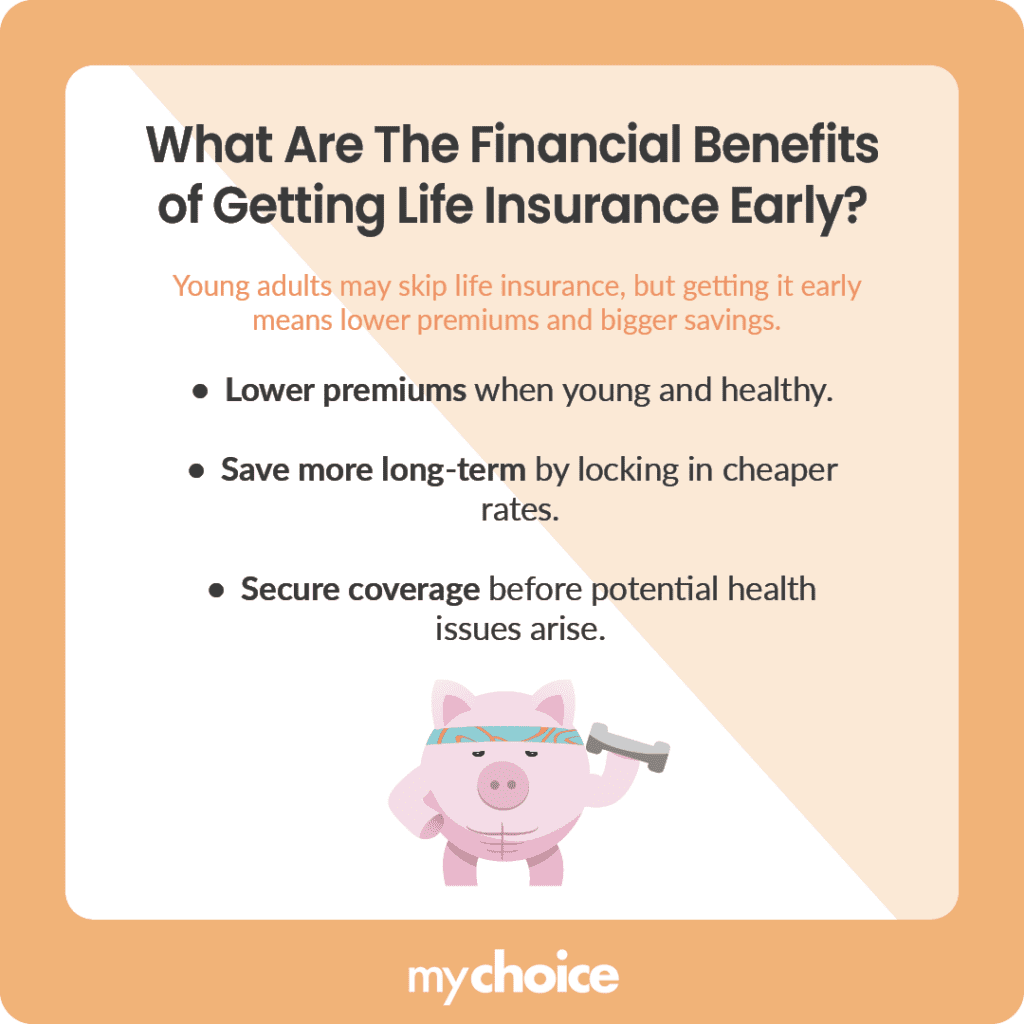

What Are The Financial Benefits of Getting Life Insurance Early?

Young adults who are still starting their careers may not consider getting life insurance. As many are still in entry-level jobs at this stage of their lives, they may be on a tight budget and have other priorities. But here’s why you should get life insurance in your 20s or early 30s instead of later:

Incorporating Life Insurance in Financial Planning

As you navigate your young adult years and financial responsibilities, life insurance can be a key component of a comprehensive financial strategy. Here’s how you can make a policy part of your plan to provide for your loved ones and improve your financial well-being.

Long-Term Implications of Different Policy Types

The type of life insurance policy you choose can have significant implications for your financial future in the long term. Understanding each type’s drawbacks and advantages will help you align your coverage with your life goals. Here’s a quick breakdown of some of the most common types of life insurance:

Key Advice from MyChoice

- Don’t settle for the first quote you get. Different life insurance providers have different underwriting processes and weigh the same criteria differently. Comparing quotes from different providers will help you find the best rates for your preferred coverage.

- Some insurers offer discounts for maintaining a healthy lifestyle or bundling your life insurance with other policies. Be sure to ask about any available discounts when getting quotes for life insurance for young adults.

- Depending on the type of life insurance policy you get, you can also invest its accrued cash value in different financial instruments. Talk to your life insurance provider to learn more about your options for increasing returns over time through investments.