Going through life in a new country comes with many challenges, and one of these challenges is setting up a financial plan. One important aspect of financial planning is life insurance, which can help keep loved ones safe from financial burdens in case of an untimely death.

Can newcomers get life insurance in Canada? Is it worth it to get life insurance if you’re a temporary resident? Read on to learn about why newcomers should get life insurance in Canada.

Understanding Life Insurance for Newcomers to Canada

Life insurance is a contract between an individual and an insurance provider that guarantees a death benefit to the policyholder’s beneficiaries upon their death. This financial safety net can cover various expenses, such as funeral costs and outstanding debts, and provide ongoing support for dependents.

While purchasing a life insurance policy may seem like a big expense, it’s important for newcomers to secure their loved ones’ financial future in case of their passing. As a newcomer to Canada, a life insurance policy will give you peace of mind, knowing that your family will be taken care of if something happens to you.

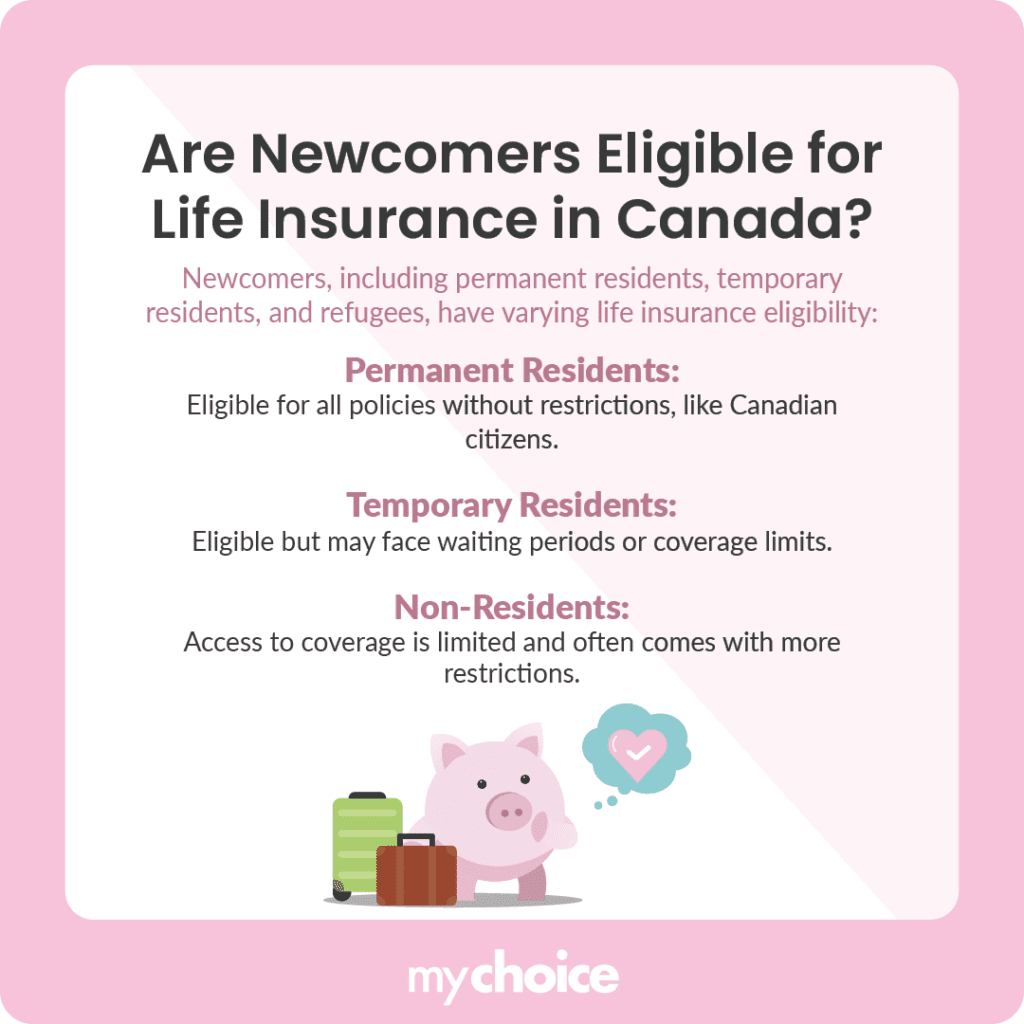

Are Newcomers Eligible for Life Insurance in Canada?

In Canada, a newcomer typically refers to anyone who has arrived in the country within the last five years. This includes permanent residents, temporary residents (such as foreign workers and international students), and refugees. Each category has different eligibility criteria for life insurance:

Types of Life Insurance Available for Newcomers

There are two primary types of insurance in Canada: term life insurance and whole life insurance. Term life insurance provides coverage for a specific period – typically between 10 and 30 years. It is typically more affordable and does not accumulate cash value. On the other hand, whole life insurance offers lifelong coverage and includes an investment component that builds cash value over time. Premiums for whole life policies are generally higher than term policies.

Coverage Amounts and Eligibility for Newcomers

Each category of newcomer has a specific amount of life insurance coverage that can be purchased. Some categories also have restrictions on what kind of policies are available to them.

Financial Considerations

Taking out life insurance means paying for a monthly or yearly premium. This insurance rate is determined by a few factors:

On average, newcomers can expect to pay between $10 to $70 per month for life insurance coverage. However, these costs can vary widely based on individual circumstances and insurer policies. For example, a healthy young adult might pay approximately $10 per month for a term policy providing $100,000 in coverage over ten years. On the other hand, an elderly person with a whole life policy of $1,000,000 will pay significantly more due to the risk calculated by the insurance company.

Key Advice from MyChoice

- Newcomers to Canada who are not permanent residents can only take out term life insurance policies with specific coverage limits. Permanent residents face no restrictions on what kind of policy they can purchase.

- If you’re unsure of how much coverage you need, use a life insurance coverage calculator to determine the right amount of coverage for your situation.

- Make sure to have any relevant documents ready when applying for a life insurance policy to minimize delays.