When Canadians think of taxes, many focus on income tax or sales tax. However, capital gains tax can also carry a significant financial burden. This tax is applied to profits from selling or transferring assets like real estate, stocks, or businesses. This tax burden becomes especially pressing at death, when the government treats most assets as if they were sold at fair market value, potentially leaving heirs with a sizeable bill known as a “deemed disposition” tax.

In response to this growing pressure, more Canadians are looking for strategies to soften the blow of capital gains taxes. One approach that has gained considerable traction is using life insurance as a kind of safety net, providing tax-free proceeds that can be used to cover or offset capital gains tax. How can one use life insurance as a wealth transfer tool? How does a life insurance policy help with capital gains tax while you’re still alive? Read on to find out what you need to know about using life insurance as a relief for capital gains tax.

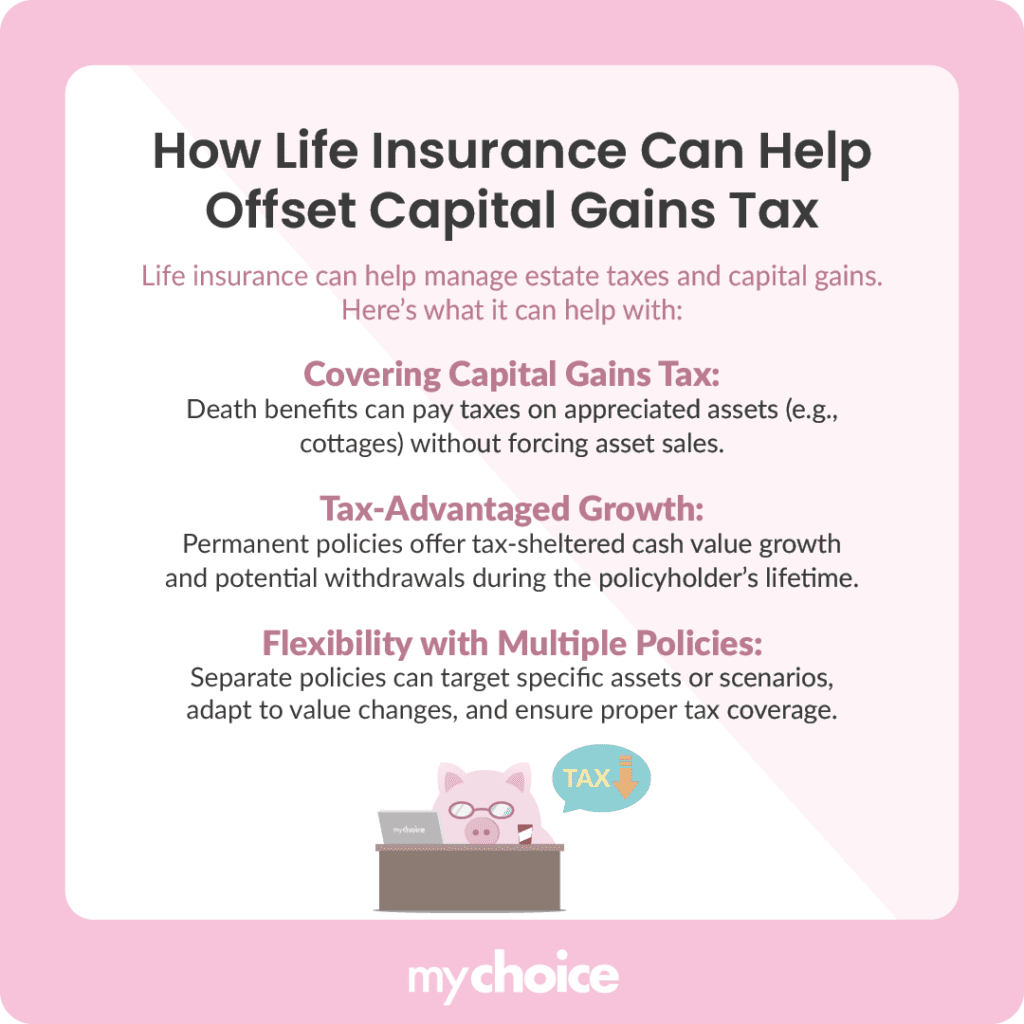

How Life Insurance Can Help Offset Capital Gains Tax

While life insurance is generally perceived as a safety net for loved ones in case of untimely death, it can also be used as a valuable estate planning tool. Permanent life insurance policies (such as whole life or universal life) offer a death benefit that is usually paid out tax-free to beneficiaries. This payout can be used to cover funeral costs, estate taxes, and other expenses, including capital gains tax. Here are a few ways that life insurance can help offset the tax from capital gains:

Examples and Case Studies

Key Advice from MyChoice

- If you have a real estate asset, stock portfolio, or business that may be subject to capital gains tax upon your death, make sure to take out a life insurance policy with a sufficient death benefit to cover the tax.

- Regularly review and update your life insurance policy as changes in your life occur. For example, you may want to raise the death benefit to account for a newly acquired property or business venture.

- If you have a complex estate with many assets, taking out multiple life insurance policies may be a good idea to easily offset the capital gains tax on each asset.