A life insurance policy can be a safety net to ensure your loved ones are financially secure in the event of your passing. But what many Canadians may not know is that it’s also an efficient tool for passing on your wealth to the generation. The rest of your estate will be subjected to fees and taxes like capital gains tax and estate tax, but that’s not the case for a life insurance policy.

With careful planning, a life insurance policy is a valuable component for providing for the next generation. Read on to learn why you should consider getting life insurance coverage as part of your estate, as well as its tax advantages for your beneficiaries.

How Can I Use Life Insurance for Estate Planning?

Life insurance can help with estate planning by addressing financial needs that arise when you pass away. Here are some of the ways that you can use a life insurance policy to maximize the amount that passes down to your heirs and provide for them when you’re gone:

What Are The Tax Advantages of Using Life Insurance for Estate Planning?

When a person passes away, their assets like homes, personal possessions, and investments form their estate. An estate is subject to taxes like capital gains tax and needs to cover outstanding debts before it’s transferred to the heirs, which can be a significant financial burden that may leave them out of pocket.

A life insurance policy can be a valuable component of an estate without the same tax burdens. Here’s a quick breakdown of life insurance’s tax advantages for passing down wealth:

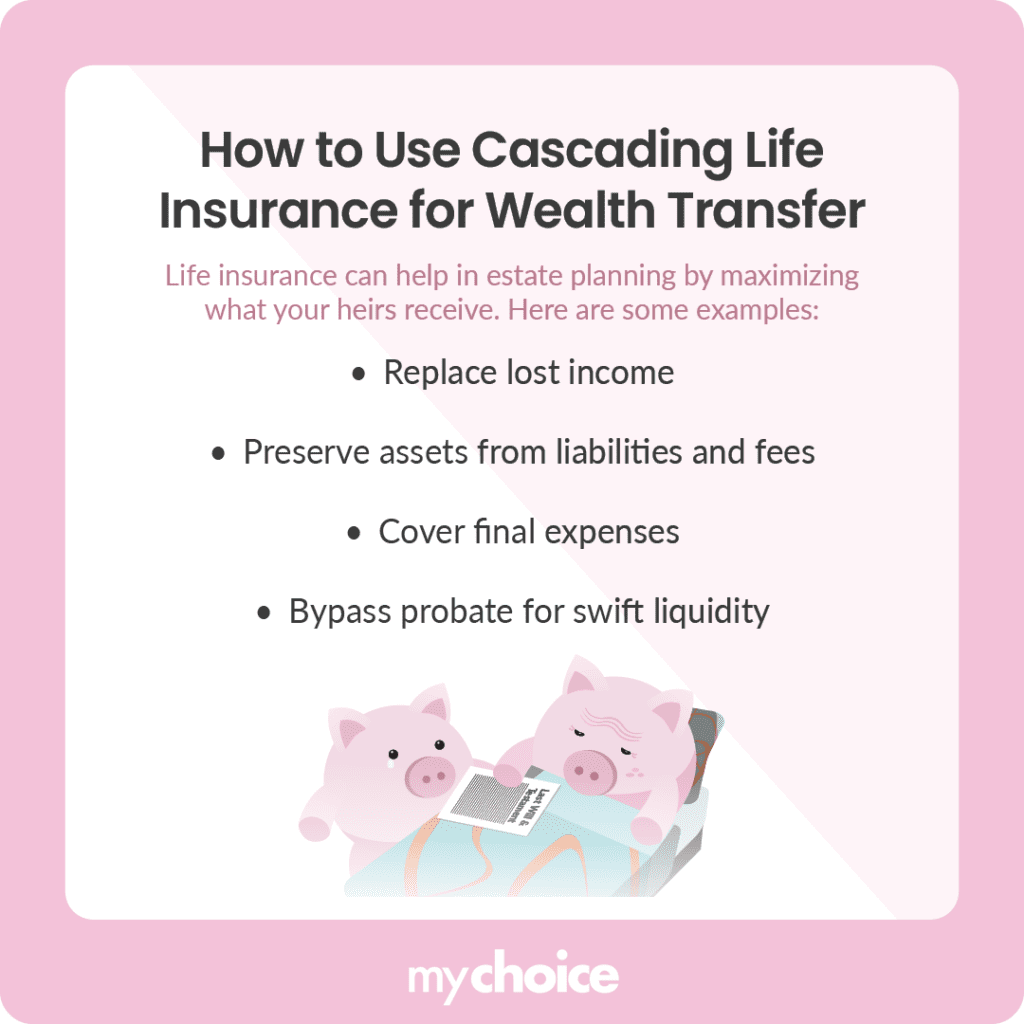

How to Use Cascading Life Insurance for Wealth Transfer

Another tax-efficient way you can use life insurance to transfer wealth is by planning cascading life insurance. Here’s how this strategic approach works:

- Parents or grandparents purchase a permanent life insurance policy on the life of their child or grandchild: Apart from being used for wealth transfer, this locks in life insurance rates for the child or grandchild while they’re still favourable. This ensures that they’ll pay more affordable premiums later on when the policy is transferred to them by the policyholding parent or grandparent.

- The parents or grandparents then fund the life insurance policy with assets that they plan to leave to the child or grandchild as a legacy or for funding specific purposes: This allows parents or grandparents to place these assets into a tax-advantaged life insurance policy.

- The policyowner names the child or grandchild as the contingent policyowner: By naming them, this allows a tax-deferred rollover of the policy when the policyholder dies. Note that this depends on whether the child meets the legal definition and standard of “child” under the Income Tax Act.

Cascading life insurance then allows the child or grandchild to access the policy’s cash value through policy or collateral loans if needed. Its death benefit is also generally passed down to the child’s named beneficiaries tax-free, bypassing that child’s estate probate and providing immediate liquidity.

Key Advice From MyChoice

- Get a life insurance policy in place early for lower premiums. Qualifying for an affordable policy gets harder as you age because your health risks increase, making it riskier for a life insurer to insure you.

- There are different types of permanent life insurance policies you can choose from depending on preferences like flexibility and potential investment. Talk to an estate planning attorney and qualified financial adviser to find the best one for your needs.

- Many people underestimate the value of their estate, which includes not just real estate and investments, but also cars and personal belongings like artwork or unique collectibles. Generally, if you have dependents, you’ll need to plan your estate to determine who receives what and reduce the costs they’ll have to cover.

- If you want to support a charitable cause without burdening your estate or creating a tax liability for the charity, you can simply name the charity as a beneficiary in your life insurance policy