Are you looking for the best rates for a new insurance policy? Now that car insurance rates in Ontario have risen by 12%, having a letter of experience can be crucial for obtaining a better car insurance quote.

Our quick guide will explain what a claims experience letter is, whether you need it, and how to request one from your insurance provider.

What is a Claims Experience Letter For?

A claims experience letter (also known as a letter of experience or claims history) shows your insurance claims history with a particular provider. It serves two purposes:

- To help insurance providers verify the information you provide about your past coverage and claims

- To qualify you for potential discounts on a new insurance policy by demonstrating a responsible insurance past

- To get the best rates from new companies when you relocate to a new city or region

Claims Experience Letter vs. Driver’s History Report

A claims experience letter and driver’s history report may be similar in that they contain information regarding a driver’s history. However, a driver’s history report primarily outlines information on your driving record, such as the type of driver’s licence you have and any demerit points or driving convictions.

What is Included in a Claims Experience Letter?

A claims experience letter typically outlines the following information:

- The name and residential address of the policyholder

- The policy number

- The policy’s expiration date

- All claims made (if any) during the policy period

- The names of secondary drivers or other individuals included in the policy

- Reasons for insurance cancellations

Is a Letter of Experience Required for Insurance?

A letter of experience is not strictly required when applying for insurance. However, it can qualify you for potential discounts, verify your insurance history, and expedite the application process. It’s best to get a claims experience letter if:

- You’re moving to another region or country

- You haven’t had insurance in the last few years

- You have not been the primary person insured (common for underage applicants, college students, or divorced individuals who used to be on a spouse’s plan)

However, a claims experience letter may not help if:

- You’re an occasional driver

- You don’t have a claims history

- You’re a new or young driver and have a short insurance history

- You already have direct access to your claims history

How to Get a Claims Experience Letter

Obtaining a claims experience letter is relatively straightforward – just follow these steps:

- Contact your insurance provider and clearly state your request for a claims experience letter.

- Provide any necessary information, such as your full name, policy number, and the specific period you want the letter to cover.

- Allow for processing time, as it takes a few days to several weeks for an insurance company to process your request and send the letter.

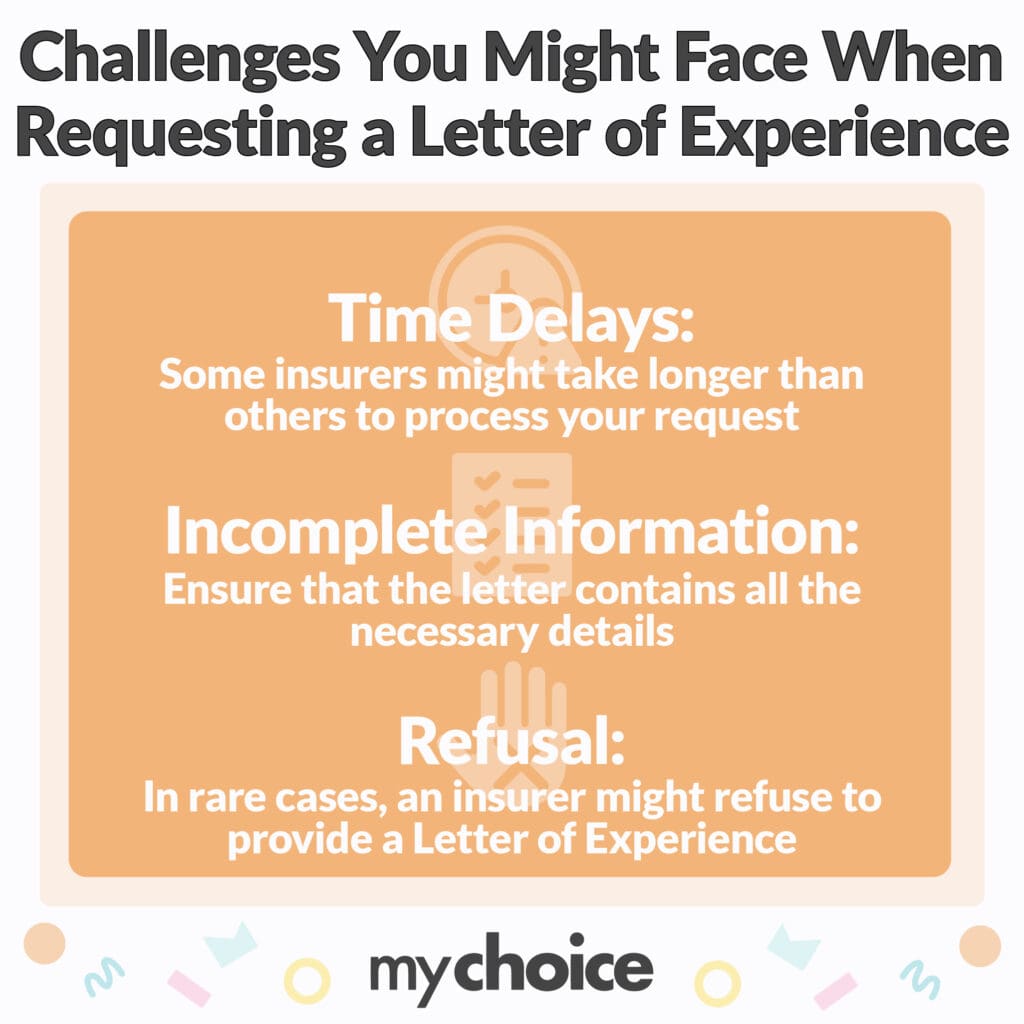

Account for potential delays and ensure you review the information included in the final letter.

Example of a Claims Experience Letter

Here’s what a car insurance letter of experience from your provider might look like.

[Insurance Company Letterhead]

[Date]

[Policyholder Name] [Policyholder Address]

Dear [Policyholder Name],

This letter confirms your insurance history with [Insurance Company] for the following policy:

- Policy Number: [Policy Number]

- Policy Effective Date: [Start Date]

- Policy Expiration Date: [End Date]

During the policy period, you filed the following claims:

[List of claims with the date and type of loss, claim amount paid, and claim status]

Please note that this letter summarizes your claims history and only constitutes a partial record. For a detailed claims history, please contact our claims department.

Sincerely,

[Authorized Representative] [Insurance Company Name] [Contact Information]

Following Up and Troubleshooting a Claims Experience Letter

Sometimes, you’ll find inaccuracies in your claims experience letter and may need to address an insurance dispute. If you believe your claims experience letter is inaccurate, here’s what you can do:

Key Advice from MyChoice

- Indicate the start and end dates for the claims history you need. Explain why you need the letter and provide as many details as possible.

- Consider digital options to expedite your request. Some insurance companies offer online portals where you can request your letter. Alternatively, you can send your request via email.