Over the last two weeks, Los Angeles suffered a devastating series of wildfires, with multiple blazes erupting in areas spanning the outskirts of Malibu, the hills of Pasadena, and parts of the San Fernando Valley. These fires destroyed residential neighbourhoods and natural habitats, leaving LA residents and authorities wrestling with how best to respond to the immediate and long-term threats.

A significant part of the recovery process depends on insurance coverage. Many homeowners who lost their properties in the fires are scrambling to check policy details, contact their insurance providers, and determine how much of their losses will be covered. Will insurance companies cover these losses? Who, if anyone, can be held accountable for this damage? Read on to learn about MyChoice’s perspective on the situation, how the US insurers have responded, and how this may affect Canadian homeowners in the future.

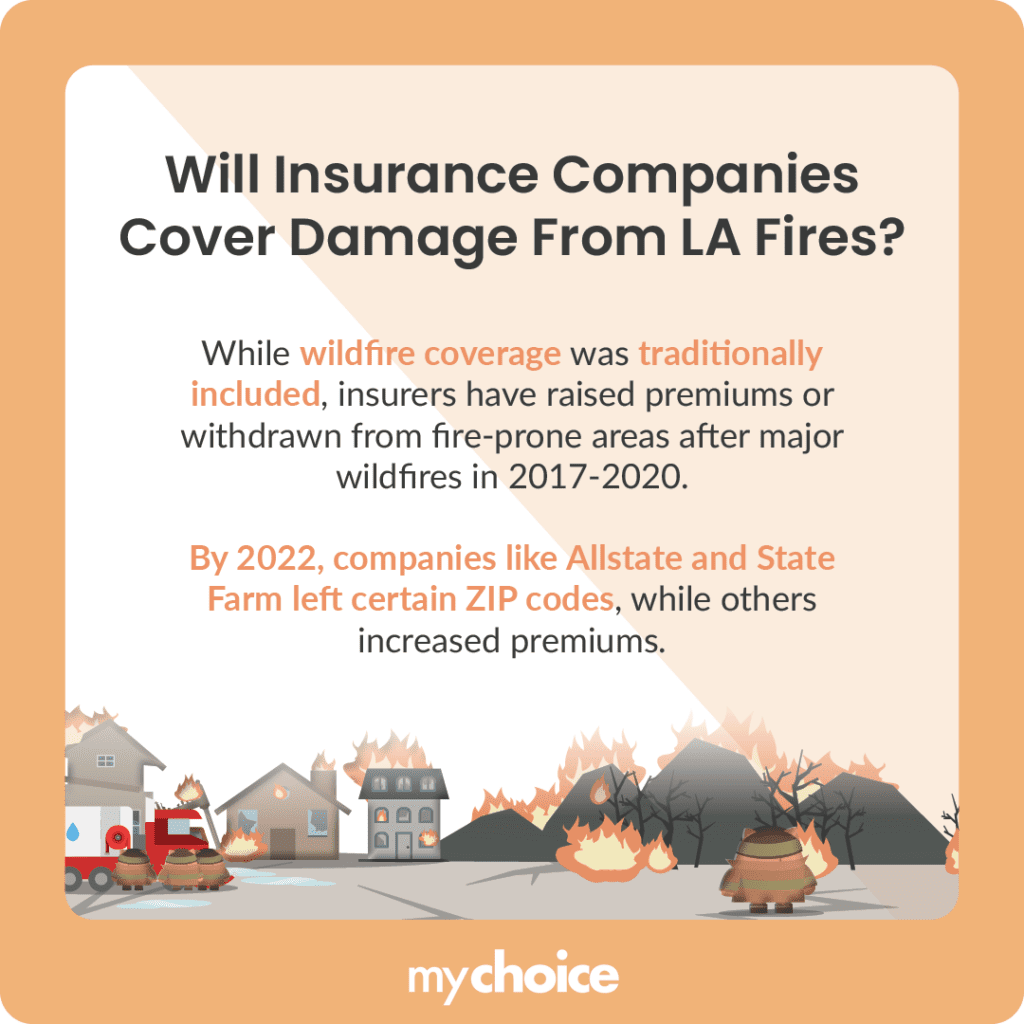

Will Insurance Companies Cover Damage From LA Fires?

One of the biggest concerns for homeowners and businesses facing property damage after the January 2025 wildfires is whether their insurance policies offer enough relief. Traditionally, standard homeowners’ insurance and commercial property insurance policies in California have included coverage for fire damage, including wildfires.

However, since a series of wildfires in 2017, 2018, and 2020, several carriers have raised premiums significantly or stopped offering certain types of property insurance in the most fire-prone regions.

In 2022, several high-profile companies such as Allstate, American National, Nationwide, and State Farm withdrew from specific California ZIP codes altogether, claiming the inability to reconcile risk exposure with regulatory constraints on premium adjustments. Other insurers, such as CSAA and the Auto Club of Southern California, increased premiums for home insurance significantly following the wildfires.

Whether insurance companies will cover damage from the LA fires depends on the specific policy features and the insurer’s existing strategy for wildfire risk in California. The good news is that the California Department of Insurance has historically been proactive in requiring insurers to process claims swiftly and fairly.

Who’s at Fault?

When natural disasters like these wildfires occur, insurance companies have to foot a massive bill, ultimately impacting their operational capacity. The January 2025 fires have brought renewed scrutiny to insurance companies and the complex web of factors that shape their underwriting decisions. Underwriting involves analyzing potential risks to set premiums, define coverage terms, or decide whether to provide insurance at all. In high-risk fire zones, insurers have found it impossible to set premiums that reflect the real danger of wildfire damage while keeping coverage affordable for homeowners and businesses.

Aren Mirzaiian, the CEO of MyChoice, offers his perspective on the situation: “A lot of the biggest insurance companies in the US and Canada are posting losses in their earnings reports or experiencing the worst underwriting performance in their 50+ year company histories. One of the biggest issues facing underwriting is the availability and ease of quoting and purchasing insurance online. Despite continuous efforts to simplify and optimize the work, online insurance application is still a process that can be unwieldy, riddled with human error, and prone to fraud. This can lead to many claims being denied. This conversation has quickly become a blame game between the carriers, brokers and homeowners. However, the reality is that in the last decade, climate change, inflation, and changing regulations have made underwriting even more challenging for insurers. The bottom line is – for insurance companies to stay solvent, they need to build back up their reserves. We need well-capitalized insurers who are ready and able to fulfill their contractual obligations to their policyholders when disaster strikes.”

Should Canadians be Worried About Their Situation Back Home?

Although Canada’s climate and wildfire patterns differ from California’s, there are some notable similarities. Wildfires have increased in frequency and severity throughout Canada, with many cities considered high-risk areas for wildfires. According to MyChoice’s internal study conducted in 2024, wildfire risks vary significantly across Canada. Many major cities in Alberta fall into high-to-medium risk categories, including Medicine Hat (8.6), Lethbridge (8.4), Grande Prairie (8.4), Fort McMurray (8.0), Edmonton (7.0), Calgary (6.2) and Red Deer (5.8). In contrast, most southern Ontario cities remain in lower-risk areas. However, some northern Ontario cities face moderate wildfire risks, such as: Kenora (5.4), Timmins (5.4), and Sault Ste. Marie (5.4).

For Canadian homeowners, the primary concern is whether the insurance industry will remain stable if wildfires become an annual crisis instead of a rare occurrence. 2024 was one of the most destructive years in terms of severe weather events, with total insured damages surpassing $8 billion. Consequently, insurance rates are expected to spike in 2025 due to the increasing frequency of these disasters.

Local insurance companies also face similar challenges with underwriting. As climate change intensifies, previously “low-risk” areas are now experiencing the kind of dryness and high winds that can spark rapid wildfires. This unpredictability poses big difficulties for insurance companies calculating premiums based on historical data.

Compared to California, the Canadian insurance market is more regulated when ensuring basic coverage availability. Provinces typically have programs to backstop major losses, and the federal government has historically played a more prominent role in providing disaster relief funds. However, if wildfire seasons intensify, insurers in Canada could potentially adopt the same cost-increasing or coverage-limiting strategies that their California counterparts have used. In early 2024, Aviva Canada announced that the company was planning to phase out Aviva Direct, its direct-to-consumer home and auto business, from Alberta as of January 2025.

Canadians who own properties in wooded or suburban forest areas should be especially vigilant about their coverage options and stay updated on changes in policy language and premiums. While Canada hasn’t yet reached the crisis levels seen in certain parts of California, current events suggest that wildfire preparedness will be vital to homeowners in the coming years.

How Can AI Help?

The insurance industry has increasingly turned to artificial intelligence (AI) to modernize and streamline its operations, especially in times of crisis. Wildfires like those in LA this January highlight the areas in which AI can be most beneficial: claims processing, risk modelling, and fraud detection. AI tools can greatly help insurance companies streamline the underwriting process, reducing human errors and giving more accurate insurance rates.

Large disasters can overwhelm insurance companies with tens of thousands of claims at once. This situation creates an opportunity for fraudulent claims to slip through. However, AI can cross-check reported claims against historical data, property records, and real-time imagery to flag outliers for further investigation.

Automating much of the screening process through AI means insurers are less likely to pay out fraudulent claims, thereby keeping premiums a bit more stable for honest policyholders.

Key Advice from MyChoice

- Consider taking steps to fireproof your home. Look into fire-resistant building materials, make sure that electrical systems are up-to-date, and keep a fire extinguisher handy in an easy-to-reach location.

- Research the incidences of wildfires in your area in recent years. Make sure to have an actionable plan to escape your neighbourhood in case of a fire. Practice fire drills with members of your household if needed.

- Homeowners in high-risk areas should review their insurance policies and purchase additional riders to ensure adequate coverage in case of a wildfire.