Getting married is a significant milestone that often comes with a host of new responsibilities, including financial planning and securing your family’s future. Life insurance is a vital aspect of this necessary planning. Understanding your life insurance options can provide peace of mind, ensuring that your loved ones are protected financially in the event of an unexpected loss.

What’s the best life insurance plan for a married couple? Does having children affect your life insurance needs? Read on to learn more about life insurance options for married couples.

Couples have several life insurance options to consider. The two primary types are joint policies and separate policies.

Joint Life Insurance Policies for Couples

Joint life insurance covers two individuals under one policy. It pays out a death benefit upon the first death. Here’s a breakdown of its pros and cons:

| Pros | Cons |

|---|---|

| Simplifies management with one policy | Only pays out once |

| Potentially lower overall costs | Complicated if the marriage ends |

| Flexible underwriting | May not cover both spouses adequately |

Joint life insurance is particularly appealing for couples sharing significant financial obligations such as mortgages or childcare costs. By consolidating coverage into a single plan, individuals can save up to 40% on premiums compared to two separate policies.

When couples consider life insurance, they often encounter two primary types of joint policies: joint first-to-die and joint last-to-die. Each option serves different purposes and offers distinct benefits and drawbacks.

Separate Life Insurance Policies

Separate policies allow each partner to have their own coverage tailored to their individual needs. Here’s how they compare:

| Pros | Cons |

|---|---|

| Greater customization | Typically more expensive |

| Each spouse remains covered | Requires managing multiple policies |

| Higher coverage amounts possible | Underwriting might be more stringent |

Separate policies allow for individual assessments based on health and lifestyle factors, potentially leading to lower premiums for healthier individuals. This option also provides greater flexibility in adjusting coverage amounts as personal circumstances change over time.

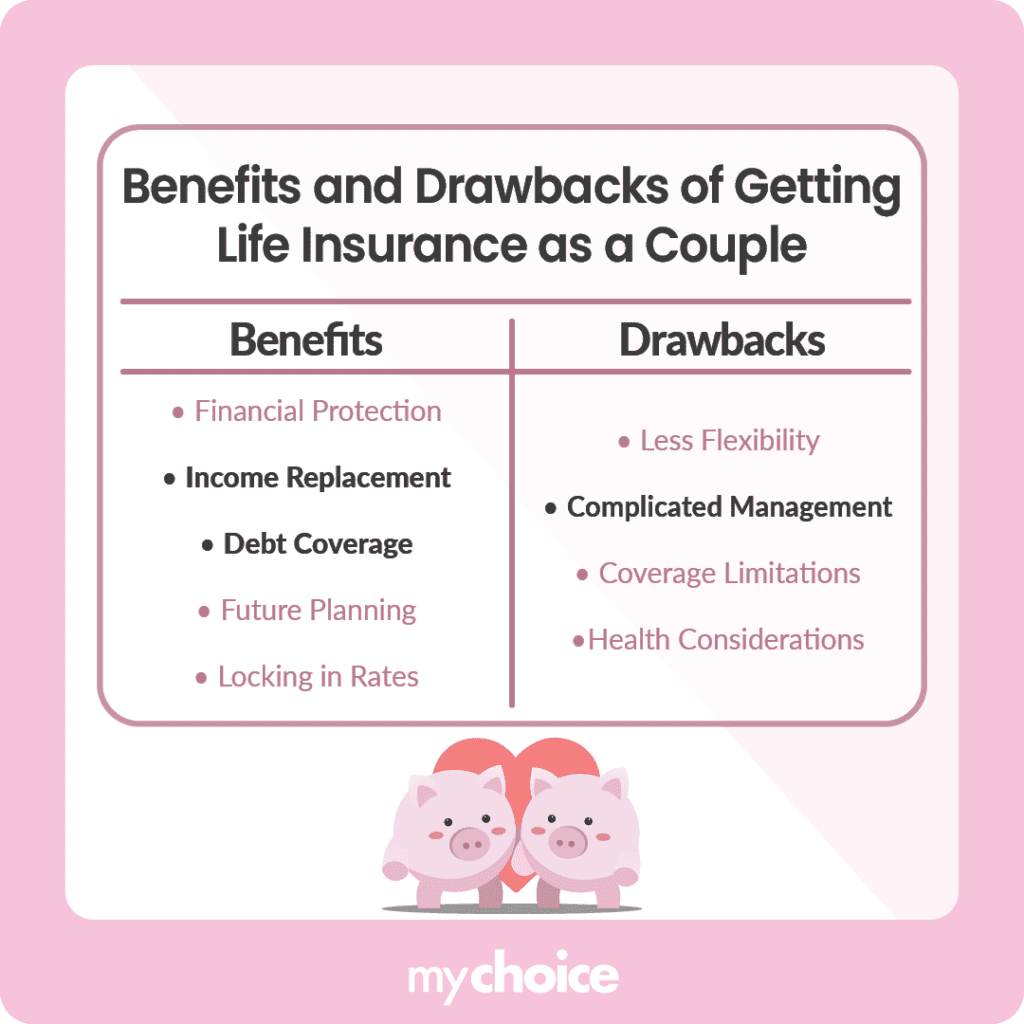

What are the Benefits and Drawbacks of Getting Life Insurance as a Couple?

When considering life insurance as a couple, you need to sit down with your partner to weigh the benefits against the drawbacks. It may be unpleasant to think about you or your spouse passing away, but it’s a necessary conversation to have to protect your loved ones in case of an unfortunate circumstance.

How Does Having a Kid Impact Our Life Insurance Options?

The arrival of children can significantly affect your life insurance needs. With children to support, couples often need higher coverage amounts to ensure their kids’ financial security in case of an untimely death. Parents should consider future expenses like education costs and childcare when determining coverage.

Parents may prefer term life insurance that lasts until children become financially independent or until significant debts (like mortgages) are paid off. Consider whether to take a term or whole life insurance policy depending on the age and number of your children.

How Much Life Insurance Coverage Does a Couple Need?

The amount of life insurance coverage you need as a couple is influenced by several factors that relate to your lifestyle and circumstances. When calculating the amount of coverage you need, consider the following:

If these factors are too much to consider when deciding how much coverage you need, you can use a life insurance coverage calculator to quickly determine the ideal coverage amount.

Key Advice from MyChoice

- Regularly evaluate your life insurance needs as you go through life changes. Having children, changing jobs, or moving addresses can change how much coverage you’ll need.

- Your health will significantly impact premiums. If one partner has health issues, it may be wise to explore individual policies rather than joint ones to avoid inflated costs.

- Some insurers offer discounts for couples who apply together or bundle policies. Take advantage of these opportunities to save on premiums while ensuring comprehensive coverage.