The wildfire that devastated Jasper National Park this summer significantly impacted the local community, with the Insurance Bureau of Canada considering it the country’s second most expensive wildfire disaster for insurance payouts. While officials have since coordinated and begun re-entry, insurers are still busy going through claims and working with the local government to assess the damage.

What is the expected impact of the Jasper wildfires on the home insurance industry? Read on to learn more about the recent fires’ effects on local homeowners and how this may affect the affordability of coverage for Canadian consumers.

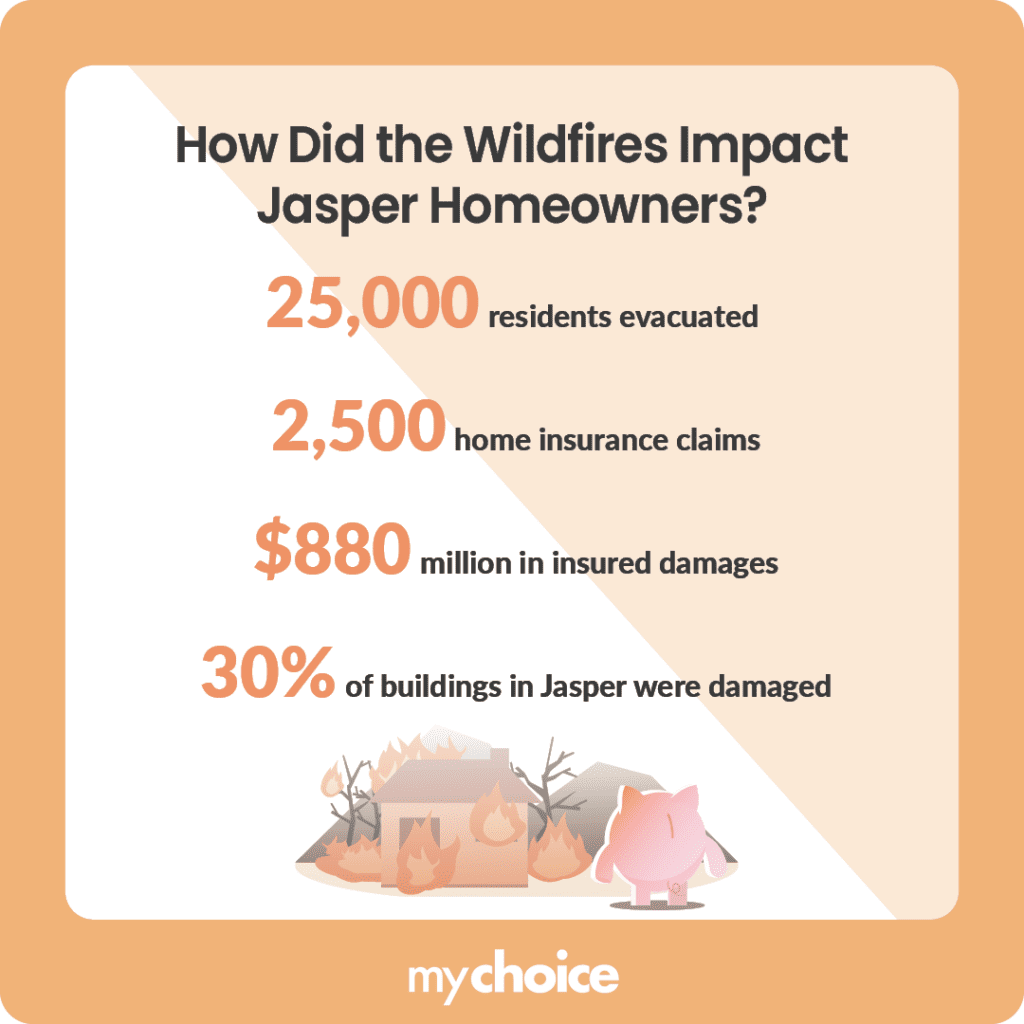

How Did the Wildfires Impact Jasper Homeowners?

This summer, The Jasper wildfires caused highway closures, the destruction of critical infrastructure, and the evacuation of residents and tourists. Local homeowners now face the challenge of assessing damage and rebuilding – here’s a closer look at the aftermath of the summer fires:

- Over 25,000 residents were forced to evacuate, causing families and individuals to be temporarily displaced. Clearing the debris is expected to take until December this year, with rebuilding taking several years more.

- Around 2,500 home insurance claims related to the wildfires have been made in Jasper so far.

- The IBC estimates insured damages to be $880 million, making it the costliest insurance event in Canada’s national park history to date.

- The Alberta government provided a one-time payment of every $1,250 per adult evacuee and $500 per child evacuee under 18 to help residents cover expenses.

- 358 out of Jasper’s 1,113 buildings were damaged by the wildfire. This represents approximately 30% of the town’s structures, and assessing the full extent of the damage is estimated to take six months.

Estimated Impact of the Jasper Wildfires on the Insurance Industry

The Jasper wildfires have raised significant concerns about implications for home insurance rates – not just locally, but for the rest of Canada. Here’s a breakdown of some of the most significant effects that the recent disaster is predicted to have on the home insurance industry:

Key Advice from MyChoice

- Given the increasing risk of wildfires, homeowners should take fireproofing measures to protect their homes. Consider strategies like keeping accessible fire extinguishers and using fire-resistant roofing to prevent a blaze from spreading and damaging your property.

- Fireproofing measures don’t just protect your home – they may also help you qualify for home insurance discounts. You can also get discounts by bundling your home insurance with other policies like life or auto insurance, so you can better manage insurance expenses.

- As extreme weather events and wildfires increase in frequency and impact, Canadian homeowners may struggle to find affordable home insurance, especially when insurance companies take severe financial losses. Compare rates from different providers using MyChoice to find the best deals for your desired coverage.