Life insurance provides a safety net to your loved ones when you pass away, helping them pay daily expenses and cover debts without financial strain. Many employers understand the importance of having this safety net and offer group life insurance as an employee benefit. However, your work-sponsored life insurance may not be enough for your family’s needs.

Should you get an individual policy for more coverage on top of your group insurance? Learn what the key features of workplace-sponsored life policies are and what to consider before spending on another policy.

What is Employer-Sponsored Group Life Insurance?

Employer-sponsored group life insurance is a type of life insurance policy that covers a group of employees in a workplace. This coverage is provided by the employer at little to no cost for employees, improving their living conditions and providing much-needed support that boosts their workplace satisfaction.

Here are some of the typical key features of group life insurance:

Reasons Why You May Want to Get Your Own Policy

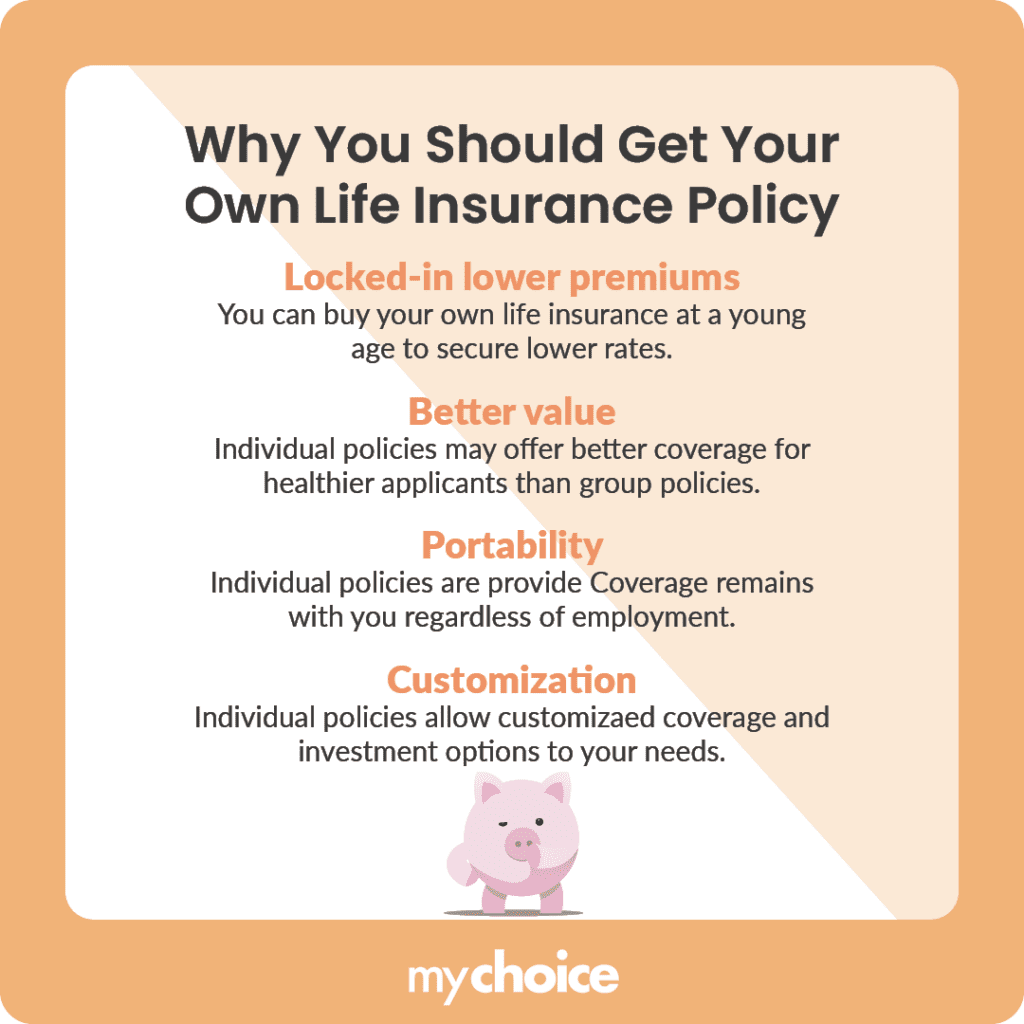

Group life insurance is a valuable workplace benefit, but there are several reasons why you may want to get an individual policy on top of it. Here’s a quick explanation of the most common ones:

What Factors Should You Consider While Getting Additional Coverage?

Not sure if you need additional coverage through an individual policy? Here are some considerations to take into account to ensure you make an informed decision:

Key Advice From MyChoice

- Evaluate your current and future financial responsibilities, which include living expenses, dependents, and debts like student loans and credit cards. Carefully calculating costs you need to pay off over time will help you determine how much coverage you’ll need to reduce your dependents’ financial burdens.

- Group life insurance policies can be customized for specific employee groups. For example, your employer can choose to offer different coverage amounts based on seniority or workplace roles. Employers should establish a process for regularly reviewing and updating group plans to keep them relevant to employee needs.

- If you need more coverage than your group policy provides but have health conditions that make it harder to qualify, consider getting simplified or guaranteed life insurance. Simplified life insurance has no medical exam, only a health-related questionnaire, while guaranteed life insurance provides coverage regardless of the applicant’s health status.