Retirees often rely on pension plans and Old Age Security (OAS) to sustain them as they age. However, there is another approach that might suit specific needs: an Insured Retirement Plan (IRP). This lesser-known option leverages the living benefits of certain types of life insurance policies to provide tax-advantaged retirement income.

How does an IRP work? What advantages does an IRP offer? Who benefits the most from an IRP? Read on to learn about the mechanics of a life insurance retirement plan and how you can start one today.

How an Insured Retirement Plan (IRP) Works

An insured retirement plan (aka LIRP in the US) is a strategy that uses a permanent life insurance policy to grow the policyholder’s money, with the goal of eventually tapping into the policy’s cash value for retirement income. This serves a dual purpose: giving your loved ones the security of a death benefit while allowing you to benefit from the policy while you’re still alive.

As you pay your premiums, the cash value grows tax-deferred. In whole life policies, the insurance company usually guarantees growth at a fixed rate. In universal or indexed universal life policies, growth is tied to a market index (like the S&P 500) or an interest rate, subject to certain caps and floors.

Once the cash value has accumulated enough funds, you can borrow against it or make withdrawals to supplement your retirement income. The structuring of loans vs. direct withdrawals matters significantly for tax treatment. Typically, loans against the cash value are not taxable but must be managed carefully to prevent your policy from lapsing.

With careful management, you can still maintain a meaningful death benefit that will pass on to beneficiaries tax-free, even if you borrow from the policy. This is especially beneficial for those who want to provide an inheritance or cover estate taxes.

Who Might Benefit Most from an IRP?

Not everyone will find the same benefits from an IRP, especially if you prioritize more straightforward retirement plans. However, certain groups of people may find that an IRP aligns well with their financial goals:

Little-Known Uses of IRPs

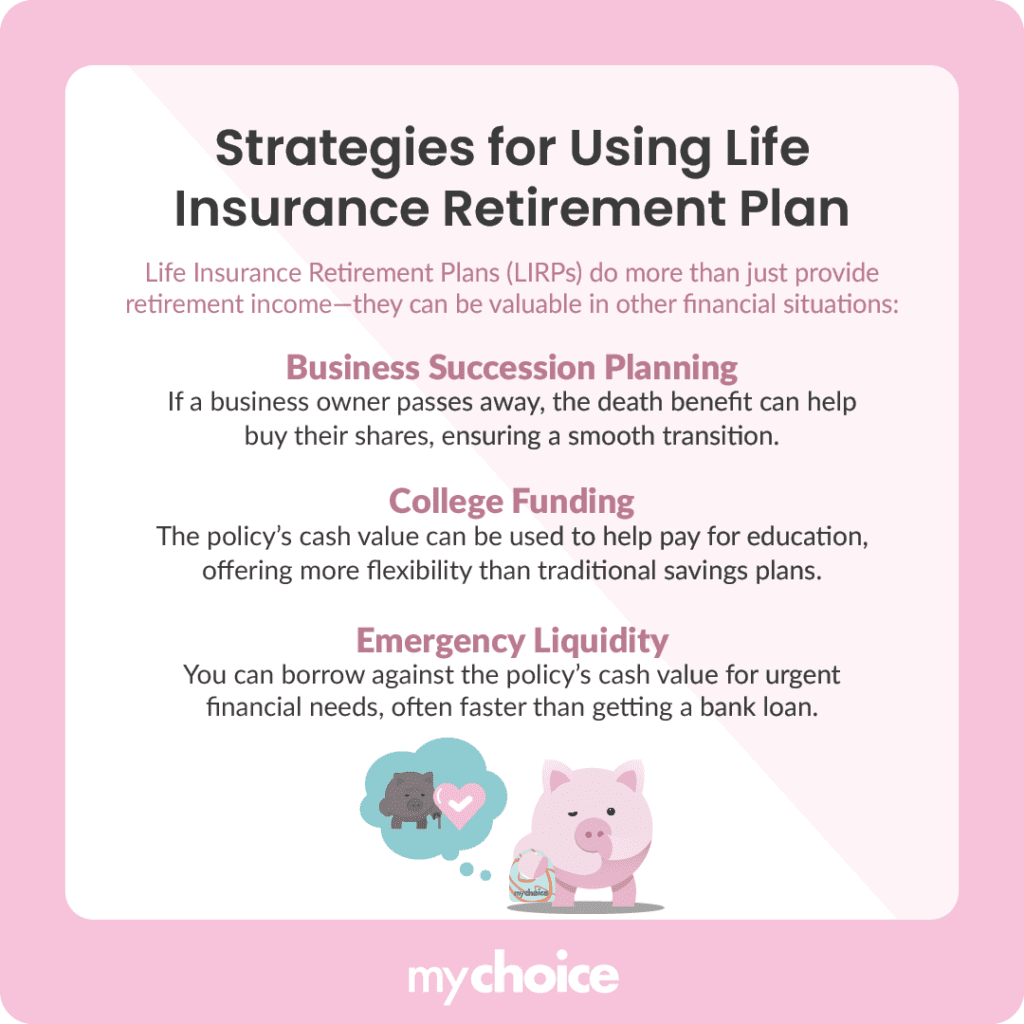

IRPs can be used for more than just supplementing retirement income. Here are some lesser-known but highly strategic applications of IRPs:

An IRP can offer incredible flexibility, but misuse or poor planning can lead to serious financial consequences. Over-borrowing from the policy might cause it to lapse, triggering taxes on the gains. The policy may become too expensive to sustain if you cannot meet the premium requirements.

How an IRP Can Fit Into Your Broader Estate Strategy

Other than serving as a retirement income supplement, a IRP can be a powerful component of estate planning. Because the death benefit is typically passed on to heirs tax-free, life insurance can help offset potential estate taxes, preserving more of your wealth.

The cash value inside a life insurance policy is considered a protected asset, meaning that creditors can’t take from it to satisfy debt without your consent. This can be a valuable layer of financial security, especially if you work in a field with high liability.

While the cash value doesn’t pass onto your beneficiaries when you die, you may be able to increase the death benefit relative to the cash value you’ve accumulated. This guarantees a larger sum for your heirs in the event of your passing.

How to Get Started Today

If you are interested in exploring whether an IRP fits into your retirement and estate strategies, here are some immediate steps you can take:

Key Advice from MyChoice

- When you’re going for a life insurance retirement plan, you can pay more than your monthly life insurance premium. The extra amount you pay will contribute to the accumulating cash value, and earn more interest as you hold the policy.

- Regularly review your life insurance policy to ensure it aligns with your expectations and needs, especially if you have variable or indexed universal life insurance.

- Prioritize investing in a standard retirement plan before considering investing in an IRP.