Many homeowners ask whether the cost of their home insurance matches their property’s value. After all, a property in a high-priced urban market might logically seem more expensive to insure than a simpler home in a smaller town. However, the relationship between your property’s value and insurance premium can be more nuanced than expected.

How exactly does your home’s value affect insurance premiums? What other factors do insurance companies consider when setting home insurance rates? Do you need to review your insurance policy when your home’s value changes? Read on to learn about the relationship between home value and insurance premiums.

Does Home Insurance Premium Scale with Home Value?

At first glance, it makes sense to assume that more valuable homes would command higher insurance premiums. After all, if you own an expensive house, you should expect to pay more to protect it.

In reality, insurance providers look at more than just the selling price of your property. Instead, they primarily consider what repairing or rebuilding your home would cost after a loss. High local construction prices and material costs can drive your premiums upward, regardless of your home’s market value.

On the other hand, if you have a more expensive property in an area where building costs are relatively cheaper, your premium might not be as high as you would expect. Insurers also consider factors such as the local crime rate, your home’s age and condition, your proximity to emergency services, and your claims history.

While there is some correlation between your property’s value and insurance rates, your home’s replacement cost and risk profile play a more significant role.

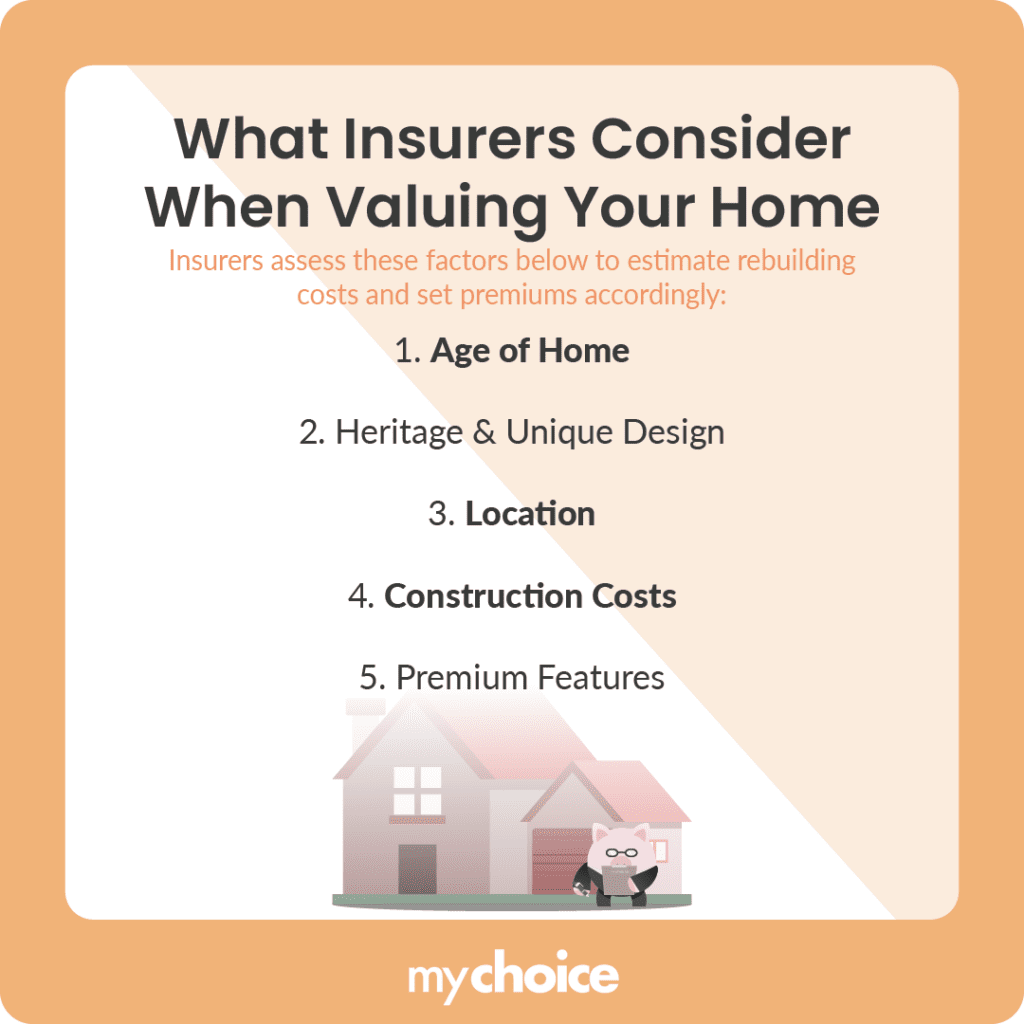

Key Home Value Drivers That Insurers Consider

When determining how your home’s value influences your premiums, insurers consider various factors to gauge how much it would cost them to rebuild or repair your home. These factors include:

Strategies to Keep Your Coverage Aligned with Your Home’s Worth

As your home’s value changes, it’s important to maintain coverage that adequately protects it. Here are some strategies you might consider following:

Should You Revisit Your Coverage When Your Home’s Value Changes?

Property values can change over time for various reasons. If your local real estate market experiences a significant upswing, your home’s appraised value might rise as well. Likewise, if local construction and material prices change, the cost to rebuild your home can also spike. When your home value changes drastically, you might risk becoming underinsured, especially if your policy has a coinsurance clause.

It’s a good idea to contact your insurance provider whenever your home value changes, whether from a changing market, home renovations, or other factors. Notifying them that your home’s worth has changed will allow you to review your home insurance policy to see if you’re underinsured or need additional coverage.

Key Advice from MyChoice

- Review your home insurance policy regularly to check whether you have enough coverage for your home’s value.

- Consider adding riders like wildfire or flood insurance if you live in a high-risk area.

- If you live in an older home, upgrading outdated systems like wiring or plumbing can reduce your insurance premiums.