When you buy a newer car model, you get the latest features, cutting-edge technology, and that signature new-car feel. However, these perks usually come with the hidden cost of higher insurance premiums. A brand-new car typically commands higher insurance rates than older or used vehicles due to more expensive replacement parts, high replacement values, and unproven track records.

What factors affect the car insurance rates for newer car models? Do safety features reduce premiums? How does insurance for a new car compare to older cars? Read on to learn why new cars cost more to insure and how you can manage these costs.

Insuring a New vs Used Car

When insurance companies consider insuring a brand-new car versus an older or used car, the factors that affect premiums primarily focus on repair costs and the vehicle’s replacement value. After an accident, a new car might need proprietary parts, advanced electronics, and new materials, all of which can be more expensive and time-consuming to replace. On the other hand, used cars usually have lower-cost parts readily available, which can translate into less expensive claims.

Depreciation also plays a significant role, dictating the car’s replacement value if it’s totalled. A brand-new car has a significantly higher market value than an older model, which means that insurance companies will need to pay out a lot more if a new model gets completely wrecked.

Does the Year and Make of the Model Matter?

Insurance companies categorize vehicles based on risk. Your car’s year, make, and model are among the most significant factors in that calculation. A brand-new model might come with the latest safety features that reduce accident rates, such as automatic emergency braking or lane-keeping assist. These features can lower your accident risk, which may lower your premiums. However, these high-tech components can also increase repair costs when accidents occur, creating a push-and-pull effect on the final rate.

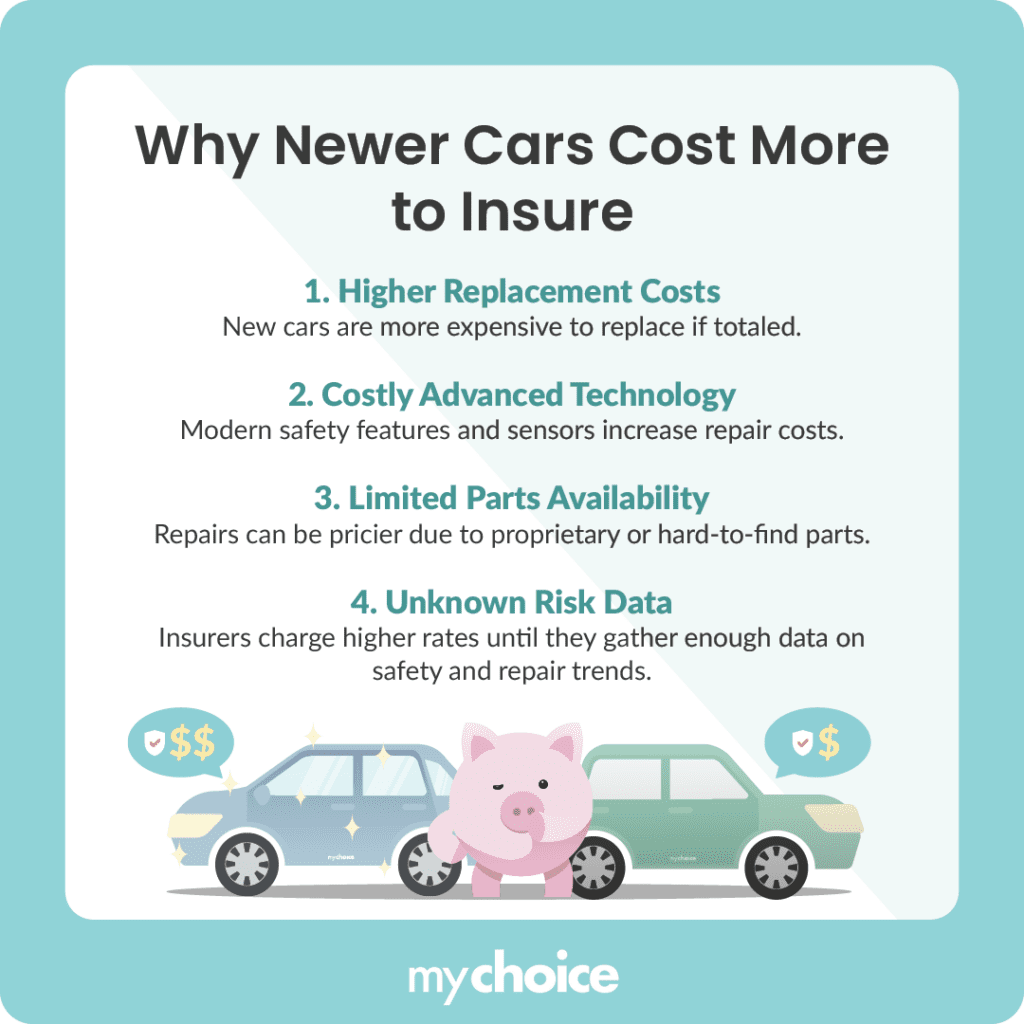

Reasons Why Newer Cars are More Expensive to Insure

Newer cars are typically more expensive to insure than older models. Here are some of the most common reasons that insurance companies have higher rates for newer vehicles:

Tips to Offset Higher Costs for New Cars

Buying a newer car can be very expensive, leading drivers to look for ways to reduce the mounting expenses. Here are some tips to save on your insurance premiums:

Key Advice from MyChoice

- Use MyChoice’s comparison tool to get quotes from multiple insurance providers for the best possible insurance rates.

- If you’re buying a newer car, consider one with built-in safety features. Some insurers offer lower premiums for cars with advanced anti-theft or collision detection systems.

- Review your car insurance policy regularly to see if the cost aligns with market rates and your driving record. Insurers will have better data after a new model has been on the road for a while, which can adjust premiums in your favour.