On the surface, choosing to lend your car to a trusted friend or close relative may seem like a no-brainer to help someone out. But what happens if they crash your car? Who covers the damages, and how will this incident affect your insurance premiums?

Lending your car to someone comes with hidden risks that many drivers haven’t thought through. Read on to learn who can drive your car under your insurance policy in Ontario, how frequently lending your car affects your coverage, and if you should add someone to your policy if they drive your car often.

Who Can Drive My Car Under My Insurance in Ontario?

Technically speaking, anyone can drive your car as long as you have insurance. This is because auto insurance covers the car, not the person. So, whether it’s your sibling, friend, neighbour, or parent who plans on borrowing your car, they’ll be covered by your policy in the event of an accident.

Before lending your car out, make sure that the driver has a valid Canadian driver’s licence and access to important documents such as your title and registration and proof of insurance. You should also check if your vehicle is in good working condition and has enough gas in the tank for their trip.

What Happens if Someone Who Isn’t on Your Insurance Crashes Your Car?

If someone borrows your car and gets into an accident, your insurer will likely cover the damages. This is because insurance follows the car, not the person. However, your insurance company will first check in with you to make sure you gave the driver explicit permission to drive your vehicle.

Can Lending Your Car to a Friend Affect Your Insurance Rates in Ontario?

Lending your car to someone will not immediately affect your insurance rates. But, if they get into an accident and are determined at-fault, you can expect your rates to climb. This is because insurance companies are always trying to mitigate risks. If they discover their client often lends their vehicle to high-risk drivers, then they deem that client high-risk as well and could increase their rates accordingly.

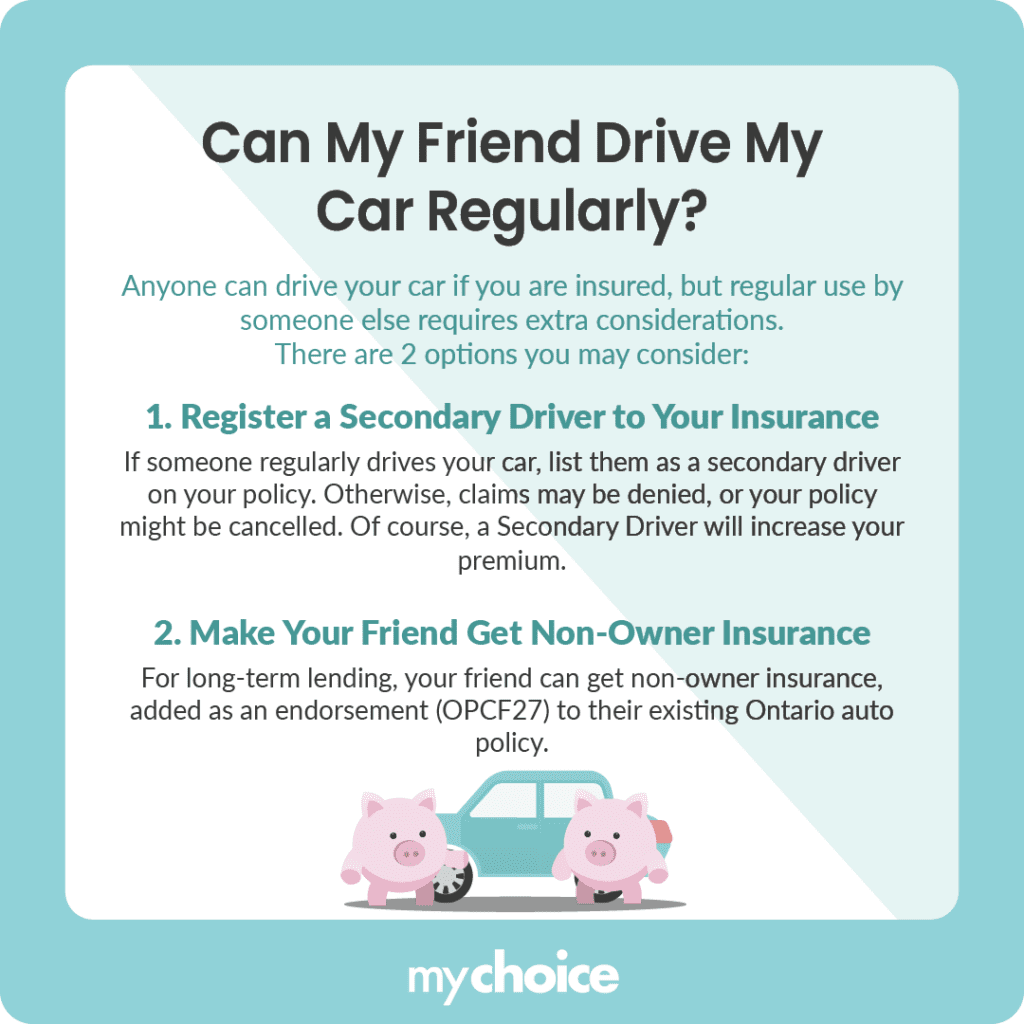

Can My Friend Drive My Car Regularly? What About Long-Term?

If you plan on regularly lending or renting your car out to a friend or family member, you should add them as a secondary driver on your insurance policy. A secondary driver (also known as an occasional driver) is someone who regularly uses your vehicle, but doesn’t use it as often as you — the primary driver. If your insurer finds out that another person is driving your vehicle without being listed as a secondary driver, your insurer may have grounds to deny any claims they make and even cancel your policy.

Bear in mind, however, that adding a secondary driver to your car insurance could likely increase your premiums, especially if you’re adding a young, new, or high-risk driver to your policy.

If you plan on lending your car out long-term but don’t want to cover for them in the event of an accident, you can encourage them to purchase non-owner coverage. This type of insurance protects someone who’s driving a vehicle they don’t own — such as a friend’s or a rental car. So, if your friend gets into a collision while using your car, their non-owner insurance should cover some of the damages.

Note that, in Ontario, non-owner insurance cannot be purchased as a standalone policy. Drivers must have an existing auto insurance policy and add non-owner insurance (formally known as OPCF27) as an endorsement.

Key Advice From My Choice

- Establish rules with anyone you lend your car to for their safety and your peace of mind, such as no eating or drinking in the vehicle. Make it clear that you’re lending the car only to them and they’re not allowed to lend it out in turn to someone else.

- Make sure your car is in good condition before lending it, and inform whoever’s borrowing it about how to take care of the car to avoid issues like vehicle breakdowns or worn tires.

- Always stay transparent with your insurance provider about significant changes that affect the risk and cost of covering you, such as lending your car frequently to family members or upgrading your vehicle. This will help you maintain a good working relationship with them and prevent future problems with making a claim.