They’re often lumped in the same category, but there are important differences between insurance brokers and insurance agents. Brokers and agents both help you find the best insurance policy, but they do so in different ways. Depending on your needs, you might benefit from working with one over the other.

What are the differences between insurance brokers and insurance agents? Read on to learn more.

What Is an Insurance Agent?

An insurance agent is a person selling insurance policies for a specific company. They usually know all about that particular company’s insurance offerings and can answer all your questions about them. Agents can also give you insurance bundles, like a home and auto bundle, to help you save money.

Insurance agents are either independent contractors or salaried employees working for the company. They’re part of the staff, so they may be able to access special offers or discounts brokers can’t get.

Do you need an insurance agent to buy insurance? An agent isn’t required, but they can be a big help. They can close an insurance deal on their own, making policies faster and easier to get.

Types of Insurance Agents

There are two types of insurance agents you may find:

- Captive agents: Captive agents are the “traditional” insurance agents. They work for a single insurance company. Captive agents get various perks from their employer, like office space, referrals, and client leads. They only sell their employer’s insurance products in return for these benefits. They might not offer a lot of policies, but they’re extremely knowledgeable about the ones they sell.

- Independent agents: Independent agents work for multiple companies, usually as contractors. This means they can offer more insurance products than captive agents. They’re somewhat similar to brokers, but independent agents still represent the companies they work for. Contrast this with brokers who represent their customers’ best interests.

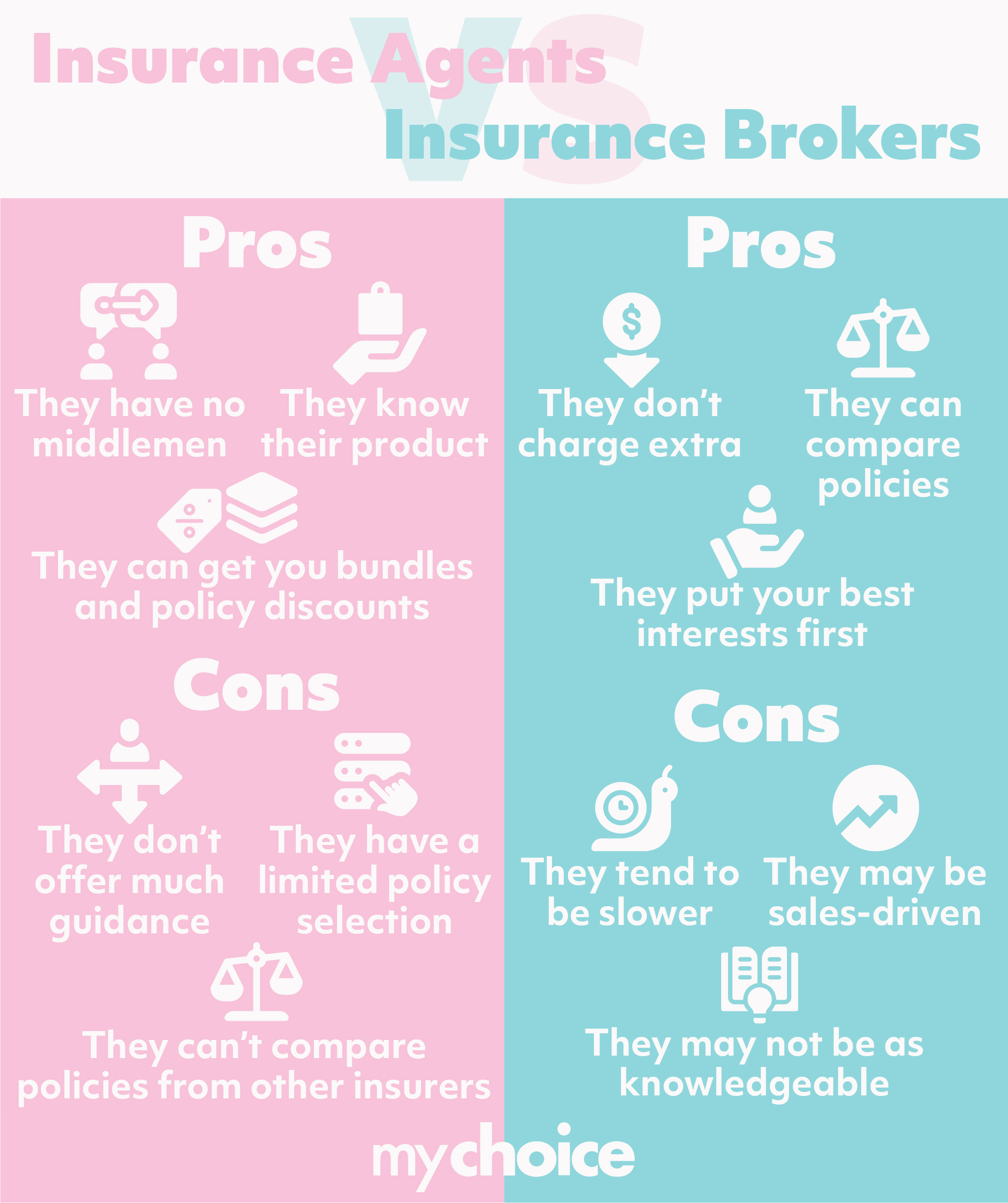

Pros and Cons of Insurance Agents

Choosing whether to work with agents or brokers means you need to know their pros and cons. Here are the benefits and advantages of working with insurance agents:

Pros

- Insurance agents have no middlemen: Working with an insurance agent means you’re dealing with the insurer directly. This means you can get quotes and finish your transaction faster.

- Insurance agents know their product: Most insurance agents are highly knowledgeable about their company’s products. They can answer your questions and likely recommend the best policy to suit your needs.

- Insurance agents can get you bundles and policy discounts: You can save money by asking your agent to bundle multiple policies, like home and auto. Agents may also know extra discounts that brokers can’t access.

Cons

- Insurance agents can’t compare policies from other insurers: Insurance agents only focus on what their company offers. They can’t look at their competitors and check whether they offer the best value – meaning you’ll have to do that yourself.

- Insurance agents don’t offer much guidance: Insurance agents represent the insurer, so they can’t advise you on which policy to buy. They can give you all the details about the company’s offerings, but it’s up to you to make the final decision.

- Insurance agents have a limited policy selection: Insurance agents can only sell what their companies have. You might need to switch companies if you can’t find what you need from an insurance agent.

What Is an Insurance Broker?

An insurance broker is somebody who helps you get insurance but isn’t tied to any insurer. They’re independent insurance experts who can find you the best insurance deals. In fact, they’re required by law to act in their client’s best interests.

Insurance brokers work with you to identify what you need from a policy. They don’t have to sell policies from any particular company, so they can find an insurance policy that can satisfy your needs. This freedom to pick and choose policies from different companies gives brokers an edge over insurance agents.

Better yet, a broker’s services are free of charge for customers. Insurers pay them a commission if they manage to sell you an insurance policy.

Types of Insurance Brokers

There are two types of insurance brokers:

- Retail brokers: As an individual customer, you’ll mostly work with retail brokers. They sell policies covering common risks and hazards like auto and home insurance. Retail brokers usually get policies directly from insurers or a wholesale broker.

- Wholesale brokers: These brokers sell more specialized policies to insurance agents and retail brokers. As a customer, you likely won’t interact with many wholesale brokers.

Pros and Cons of Insurance Brokers

Thinking about working with an insurance broker? Here’s a list of pros and cons:

Pros

- Insurance brokers don’t charge extra: Insurance brokers get paid a commission by insurers. This means you don’t have to spend extra money to consult with a broker.

- Insurance brokers put your best interests first: Insurance brokers are required by law to focus on the client’s interest. This means you can ask them for recommendations and advice on which policy to take. You can also ask them about essential things to know about car insurance.

- Insurance brokers can compare policies: Unlike agents, insurance brokers can access the entire insurance market. They can compare offers from multiple companies to give you the cheapest insurance deals in Alberta and other Canadian provinces.

Cons

- Insurance brokers tend to be slower: Insurance brokers are essentially middlemen. They have to contact an insurer to purchase your policy, so it might take longer to get your policy.

- Insurance brokers may be sales-driven: Brokers work for a commission, and insurers often provide bonuses to brokers who reach sales targets. While brokers are required to focus on your interests, there may be some biases that you need to watch out for.

- Insurance brokers may not be as knowledgeable: Brokers have a good grasp of the wider insurance market, but they may not be experts in every company’s offerings. That said, a good broker is willing to do the legwork and research policies they recommend.

Differences Between Brokers and Agents

Some people think agents and brokers are essentially the same things, but they’re not. How are insurance brokers and insurance agents different? Here are three core differences between them:

Interests Represented

Insurance agents work for a certain insurer. That means they’re here to sell insurance policies and put the company first. They can help you find the best insurance policy but still have the insurer’s best interests at heart.

Meanwhile, insurance brokers focus on their client’s best interests. They’re legally obligated to give you the best insurance policy they can access. They receive commissions from insurance companies, but a good broker should put your interests first – they likely won’t recommend you an ill-fitting insurance policy.

Access to Insurance Policies

Insurance agents can only recommend policies from the company they work for. They might know a lot about what their companies offer, but the selection might be limited. You may need to switch insurers if an agent can’t help you find what you need.

Conversely, insurance brokers can search the entire market for a policy that’s right for you. But they usually don’t have the in-depth knowledge agents have, so they might not know about the policy’s finer details. That said, good brokers do the legwork and research policies before recommending one to you.

Policy Transaction Speed

Insurance agents can finish a policy transaction by themselves because they work directly for the insurer. This means you can close on the policy faster.

Insurance brokers don’t work for any insurance company, so they can’t finish a transaction by themselves. They need to contact the insurance company to finalize your sale, meaning your insurance process might take longer.

What to Ask When Shopping for Insurance

Agents and brokers are here to answer your questions about insurance to the best of their ability. But, first, you need to know what to ask. Here are example questions you can ask insurance agents and brokers:

Questions to Ask Insurance Agents

- Can you explain the claims process to me?

- How long does an insurance claim usually take?

- Will I work with the same agent to manage my policy?

- Can you alter insurance coverage to meet my needs?

Questions to Ask Insurance Brokers

- How much experience do you have in the insurance industry?

- How do you select the best policies for me?

- Which insurers do you recommend?

- Can you help me find the best insurance company for my needs?

Need more information from your insurance broker? Read our article on questions to ask your insurance broker.

Insurance Agent vs Broker: Which One Should You Choose?

Whether you choose an agent or broker, you should choose the one that best fits your needs. If you’re already set on using a certain insurer, an agent might suit your needs better. Conversely, a broker is better when you don’t know which company to buy insurance from.