While a life insurance policy provides unmatched peace of mind, it can become a financial burden for individuals who can’t afford the premiums. However, you can borrow from it instead of cancelling your policy altogether.

Infinite banking in life insurance has become popular with Canadian retirees and seniors, but it isn’t for everyone. Learn more about the infinite banking concept and whether it’s the right option.

How Infinite Banking in Life Insurance Works

As its title suggests, infinite banking allows policyholders to treat their life insurance like a “bank” and act as their own banker. American economist R. Nelson Nash developed the concept in the 1980s and published the IBC in the US in 2000.

With infinite banking, individuals can build value in a whole life insurance policy and borrow this amount through a private contract with the insurance company. Individuals repay the loan to the policy.

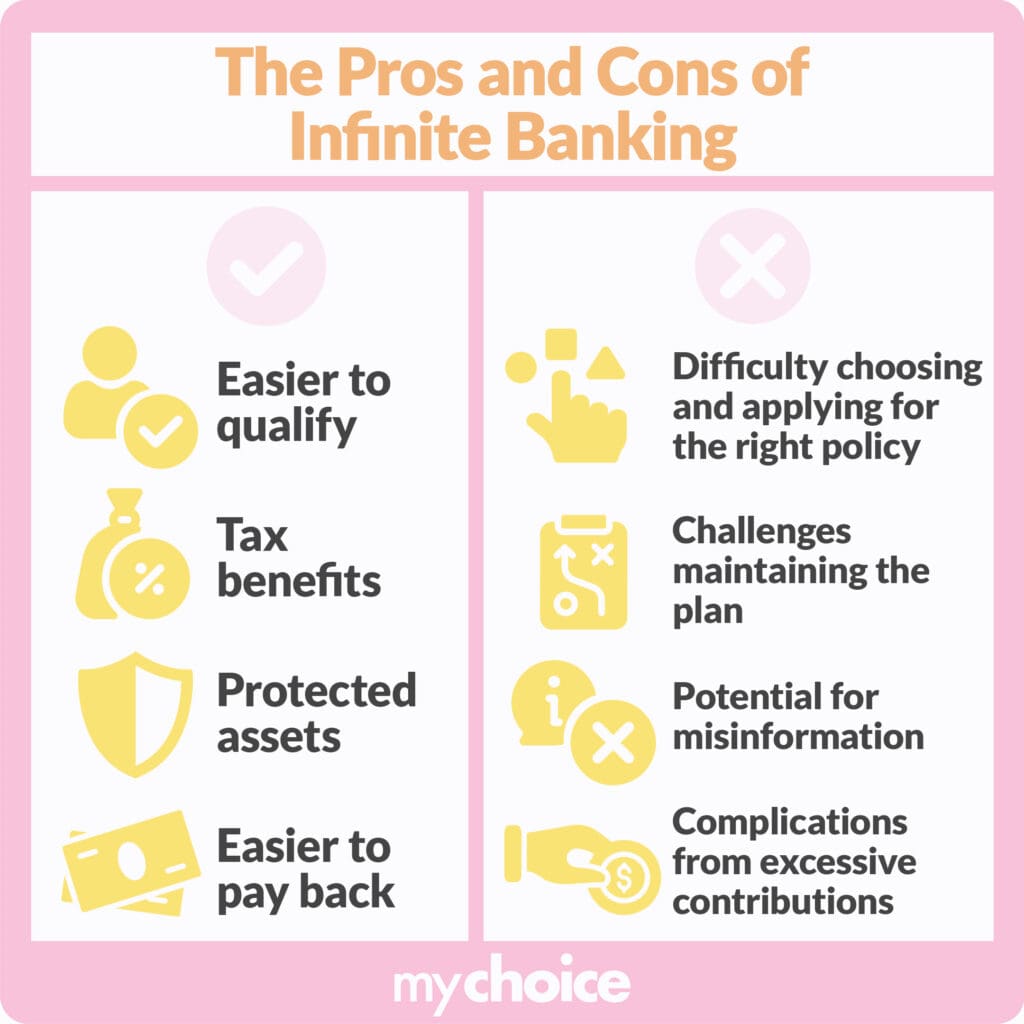

The Pros and Cons of Infinite Banking

While similar to a personal loan, infinite banking has its advantages:

Infinite banking is an excellent financial strategy for wealth-building, but it may only be appropriate for some people. Here are some of the disadvantages of consider:

What is the Best Whole Life Insurance Policy for Infinite Banking?

Determining the “best” whole life insurance policy for infinite banking is challenging, as your choice will depend on your financial circumstances, goals, and risk tolerance. Ultimately, you should base your decision on the following factors:

- Strong cash value growth potential

- Low expenses and administrative fees

- Flexibility with premium payments and loan options

- Favorable tax treatment

- Reputable insurance company

Tips for Managing an Infinite Banking Plan

The complexity of infinite banking requires careful management to provide worthwhile returns. Here are some tips for managing your infinite banking plan:

Alternatives to Infinite Banking

While infinite banking provides unique and tax-free benefits, it isn’t the only approach to financial planning. Here are alternative routes to consider:

Key Advice From MyChoice

- Before you try infinite banking, ask yourself the following questions: when do you need the funds? How easily can you access your funds? How much can you comfortably borrow, and when will you repay the funds?

- If considering alternatives to infinite banking, think about your financial goals and risk tolerance. Also, consider the costs associated with each option.

- You should understand the differences between infinite banking in Canada and the US. In the US, you can borrow money without paying taxes, whereas in Canada, you may have to pay taxes if you borrow more from the policy than you paid.