Most people use life insurance as a financial safety net for loved ones after passing away but don’t realize the benefits it can provide while alive. Using life insurance while alive in Canada can support your financial goals by providing access to cash, covering medical expenses, and playing a role in your retirement plan.

Learn how to use life insurance while alive and explore how it can improve your short-term and long-term financial well-being.

Can You Use Life Insurance While Alive in Canada?

Yes, you can claim life insurance benefits while still alive. How it benefits you ultimately depends on your financial goals and current situation. For instance, if you are a single person, you can use a life insurance policy for an emergency fund through its cash value component or dividends.

On the other hand, couples can use life insurance to enhance financial security through accelerated death benefits if one person becomes diagnosed with a terminal illness. Similarly, families can use a policy’s cash value for medical bills, home improvements, and education costs.

What Are the Living Benefits of Life Insurance?

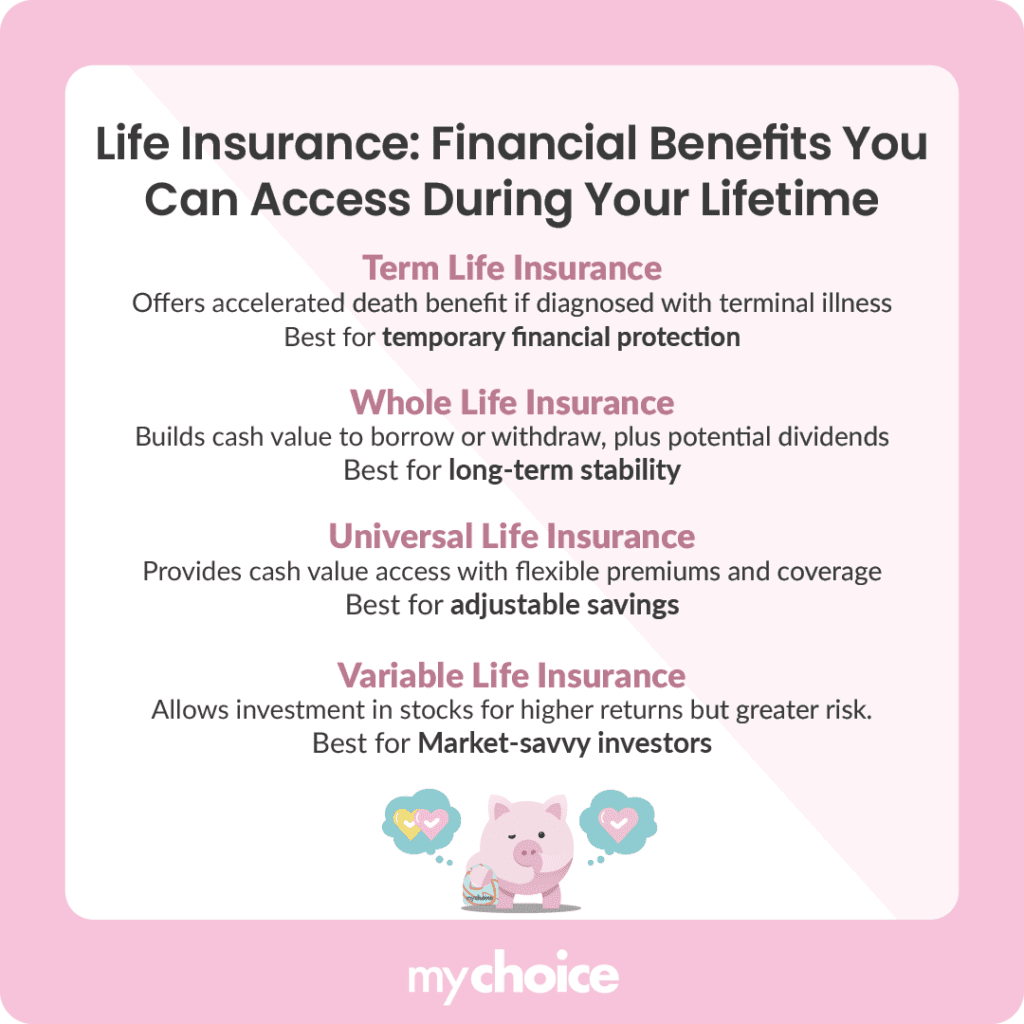

You can reap many benefits from life insurance, depending on your policy. Here’s how the benefits differ.

Life Insurance as an Investment Tool

If you have a whole, universal, or variable life insurance policy, you can use them as an investment tool. These policies build cash value over time, with whole life promising steady growth and universal life growing based on market performance. In addition, whole life insurance pays dividends, which you can reinvest into the policy.

With any permanent life insurance policy, the cash value grows tax-deferred, so you won’t have to pay taxes on the growth until you withdraw it.

Borrowing Against Your Policy

Borrowing against your life insurance policy can be a valuable financial tool since you can access cash without a credit check. Unlike traditional loans, you won’t be subject to an approval process to access your funds.

Additionally, your policy should have lower interest rates than credit or personal loans. Of course, the exact rate will be at your insurer’s discretion. Still, repayment schedules are often flexible, as policy loans don’t employ mandatory monthly payments.

Loans against the policy are also tax-free as long as the policy remains active and doesn’t lapse. Borrowing also won’t affect your credit score.

While it may seem that borrowing against your policy is simple and risk-free, doing so has its challenges. For example, while these loans are generally low-interest, they can compound if you don’t pay your loan back in time. Any outstanding loan balance will also come out of your death benefit.

There is also the potential for unforeseen costs, such as tax penalties, if your policy lapses during the loan period.

Still, borrowing against your policy can be a good idea, and even necessary, if:

- You face a sudden and unexpected expense and need quick access to funds.

- You’ve exhausted other low-cost borrowing options and can’t qualify for anything else.

- You have short-term funding needs that you can repay easily.

Avoid borrowing against your policy if:

- You’re planning for your financial future and are looking for something long-term.

- You already have long-term debt.

- You aren’t confident in your ability to repay the loan.

Life Insurance for Estate Planning and Wealth Transfer

Another lesser-known way to use life insurance while alive is for estate planning or wealth transfers. Through life insurance, you can leave behind a tax-free benefit to beneficiaries, helpful in transferring wealth to the next generation.

For instance, a high-net-worth individual might include life insurance in a more diversified investment strategy for their estate.

Life insurance also equalizes inheritances by ensuring heirs receive a fair share of your estate. For example, if you have one heir who will inherit something difficult to divide (a business or a piece of property), you can use life insurance to provide other heirs with a cash payout from the death benefit.

Key Advice From MyChoice

- Choose a permanent life insurance policy for long-term financial planning with living benefits.

- Consult a financial advisor to determine the most cost-effective option for your needs. They can help you choose the right policy based on your financial goals.

- Compare policy fees, premiums, and other costs against its potential financial gains. If you already have an existing policy, review it regularly to use it optimally.

- Borrow only what you can afford to repay. Regularly monitor the loan balance and ensure your policy doesn’t lapse.