Receiving a rejection for home insurance can feel like a major setback. Unfortunately, many homeowners can face home insurance denials for various reasons. However, getting your home insurance application denied doesn’t mean that your home is uninsurable. You can often take steps to lower the risk factor of your home, giving you a better chance of acceptance when you reapply.

According to the Canadian Association of Financial Institutions in Insurance, 80% of Canadian homeowners are either uninsured or underinsured, highlighting just how important it is for our team at MyChoice to address this issue and provide the necessary guidance for homeowners.

Why does rejection happen for home insurance? How can you minimize the chances of a rejection? Does a rejection affect future applications? Read on to learn what you can do if you get rejected for home insurance.

Common Reasons for Rejection

Home insurance providers use specific criteria to assess the risks associated with insuring a property. If your home fails to meet one or more of these factors, you’re more likely to get rejected when applying for a policy. Here are some common grounds that insurers might use to reject your home insurance application:

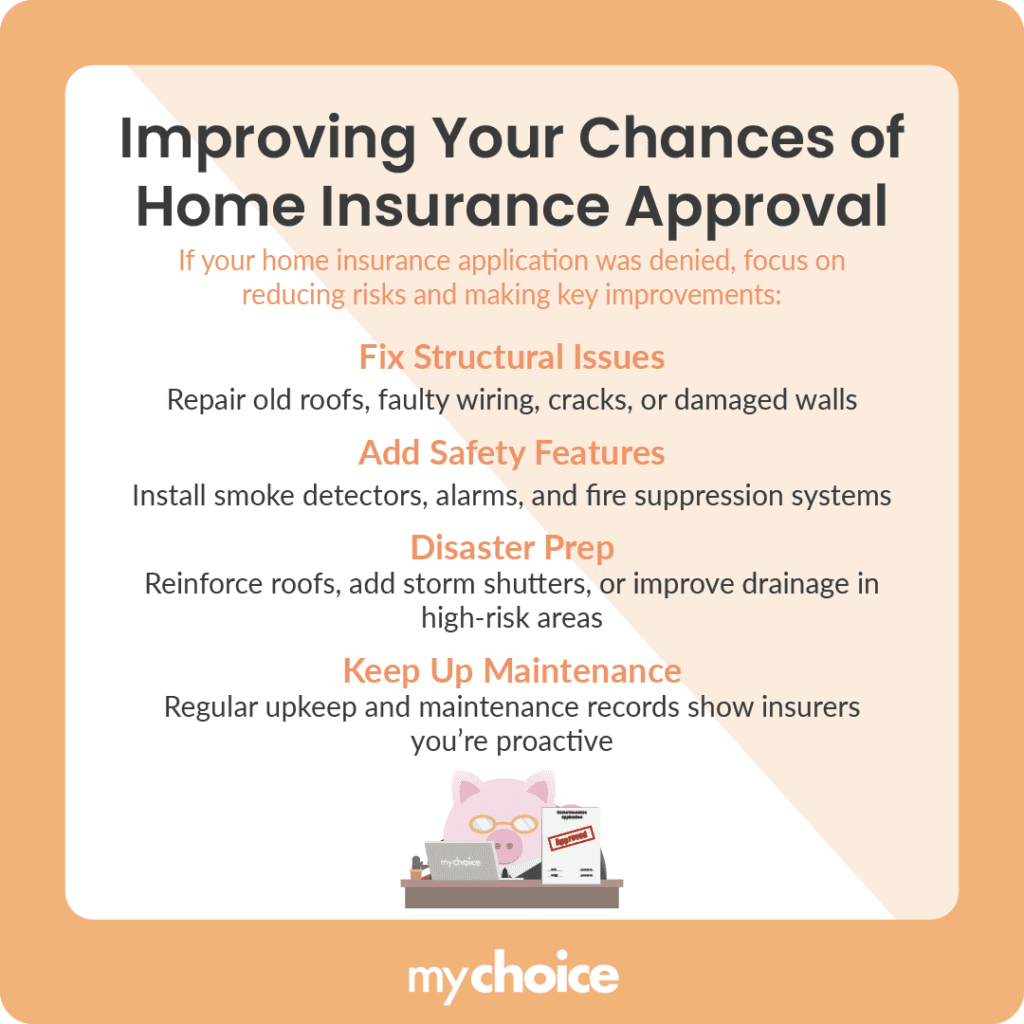

Fix What You Can: Risk Mitigation and Home Improvements

Once you understand why you might have been rejected for home insurance, the next step is to focus on risk mitigation and improvements that can enhance your property’s safety and appeal to insurers. Here are some steps you can take to improve your chances of getting your home insurance application accepted:

Mind Your Claim-Filing Strategy Going Forward

When your home insurance application gets rejected, this could be due to an extensive or problematic claims history. If you or your home has had multiple claims in the past, this factor might have contributed heavily to a rejection. Here are some strategies to manage your claim history effectively moving forward:

Key Advice From MyChoice

- Consider additional riders to protect against fires, thefts, and other hazards during renovation or construction.

- Review your policy limits, especially for personal liability and medical payments coverage. If you’re hiring a contractor, ensure they have coverage in case their workers are injured on the job.

- Understand what renovations can influence homeowners’ insurance. While additions like pools and saunas can increase your home’s value, they also increase liabilities and hazards.