Claiming home insurance is the worst thing that could ever happen. You love your home, and you don’t want anything to happen to your haven where your family resides – yet in 2023 alone, insured damage from severe weather in Canada exceeded $3.1 billion, making home insurance one of the top 5 most claimed insurance alongside health, auto, life, and property insurance.

Unfortunately, most insurers may drag their feet or request additional information. If you’re facing this right now, it’s understandable if you feel stuck or discouraged. Keep reading to understand why delays happen and what you can do about them can give you more control over the process, no matter which province you call home.

Understanding The Home Insurance Claims Process

To effectively navigate potential loss, understanding the process of claiming home insurance is fundamental. Below is a step-by-step guide for you to grasp the process of a home insurance claim.

Provincial Differences to Keep in Mind

Some provinces, like British Columbia and Alberta, face higher wildfire and flood risks, affecting coverage options and pricing. Each province has its own insurance regulator, such as the Financial Services Regulatory Authority of Ontario (FSRA) in Ontario or the Alberta Insurance Council (AIC) in Alberta, which can impact claim processing and dispute resolution. Some offer mediation or arbitration services – check with your provincial regulator for details.

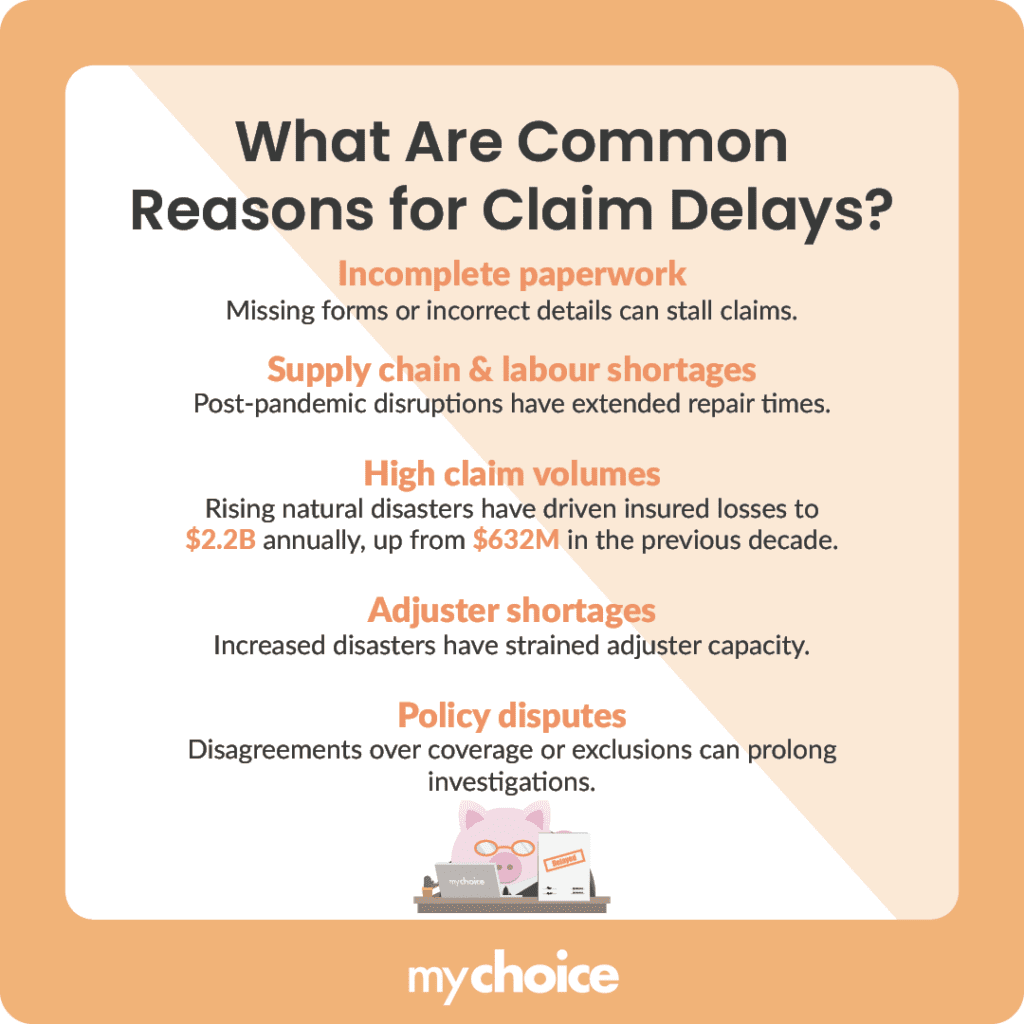

What Are Common Reasons for Claim Delays?

Navigating home insurance claims in Canada can be challenging, especially when faced with delays or requests for additional information. Below are a few reasons you might experience a slowdown:

Proactive Steps You Can Take During Delays

Despite your efforts, delays can happen, so it’s important to stay composed and take action. Keep records by tracking communication details and saving all correspondence. Provide evidence by submitting repair estimates, receipts, and photos to speed up the evaluation.

Follow up regularly with your claims representative to check progress and remind them of your pending claim. If needed, seek expert help from a contractor or home inspector, as their report can strengthen your case. Taking these steps can help move your claim forward.

Seeking Legal and Regulatory Support

You don’t have to navigate a delayed claim alone. If prolonged delays or disputes arise, you can try some of these tips:

Key Advice From MyChoice

- You have to organize documents and communications in one accessible place. Pro tip: An online drive allows flexible document access and helps minimize human error.

- Carefully review your insurance policy to understand coverage limits, deductibles, and exclusions before filing a claim. If anything is unclear, contact your insurer to clarify timelines, required documentation, and the claims process to avoid surprises.

- Regularly check in with your claims adjuster to ensure your file is being processed efficiently. Keeping open communication helps prevent unnecessary delays and allows you to address any missing information promptly.

- Familiarize yourself with consumer protection laws and provincial insurance regulations to understand what insurers are required to do. If you feel your claim is being delayed unfairly, reach out to regulatory bodies or consumer advocacy groups for guidance.

- If you believe your insurer is not treating you fairly, seek advice from a lawyer, insurance advocate, or financial expert. Professional guidance can help you navigate disputes, negotiate settlements, or take legal action if necessary.ificant capital expenditures or experienced a substantial increase in municipal taxes. These AGIs still need to be approved by the LTB; otherwise, the rent can only be increased by the guideline amount.