Home insurance deductibles are an important aspect of your home insurance policy, determining how much you will pay out of pocket before your insurance coverage kicks in.

Do deductibles affect your insurance premiums? How much of a deductible should you choose? Read on to find out what you need to know about home insurance deductibles.

How Do Home Insurance Deductibles Work?

A home insurance deductible is the amount you agree to pay out of pocket when you file a claim. You need to pay the agreed-upon deductible before the insurance company pays out the rest of the damages. This could also be a straight deduction from the total insurance payout, depending on the agreement you have with your insurance company.

Here are a few real-life scenarios that show how an insurance deductible works:

- A storm passes through and causes damage to your home’s roof, resulting in a leak. After an assessment, the damages come out to $8,000, but you have a $1,000 deductible and choose to hire an independent contractor to repair your roof. Your insurance company will pay out $7,000 with the understanding that this will be enough to cover the repairs to your roof combined with the $1,000 you’re responsible for.

- A fire starts in your kitchen, resulting in $20,000 worth of property damages. Your home insurance policy features a $5,000 deductible and you choose to use your insurer’s preferred contractor or service provider. In this situation, you would pay $5,000 to the chosen contractor and your insurer will take care of the rest.

- A quick hailstorm rolls through and some hail breaks a few windows in your house. The cost to repair the damage is $800, but you have a $1,000 deductible. Since your deductible is higher than the repair cost, the insurance company w

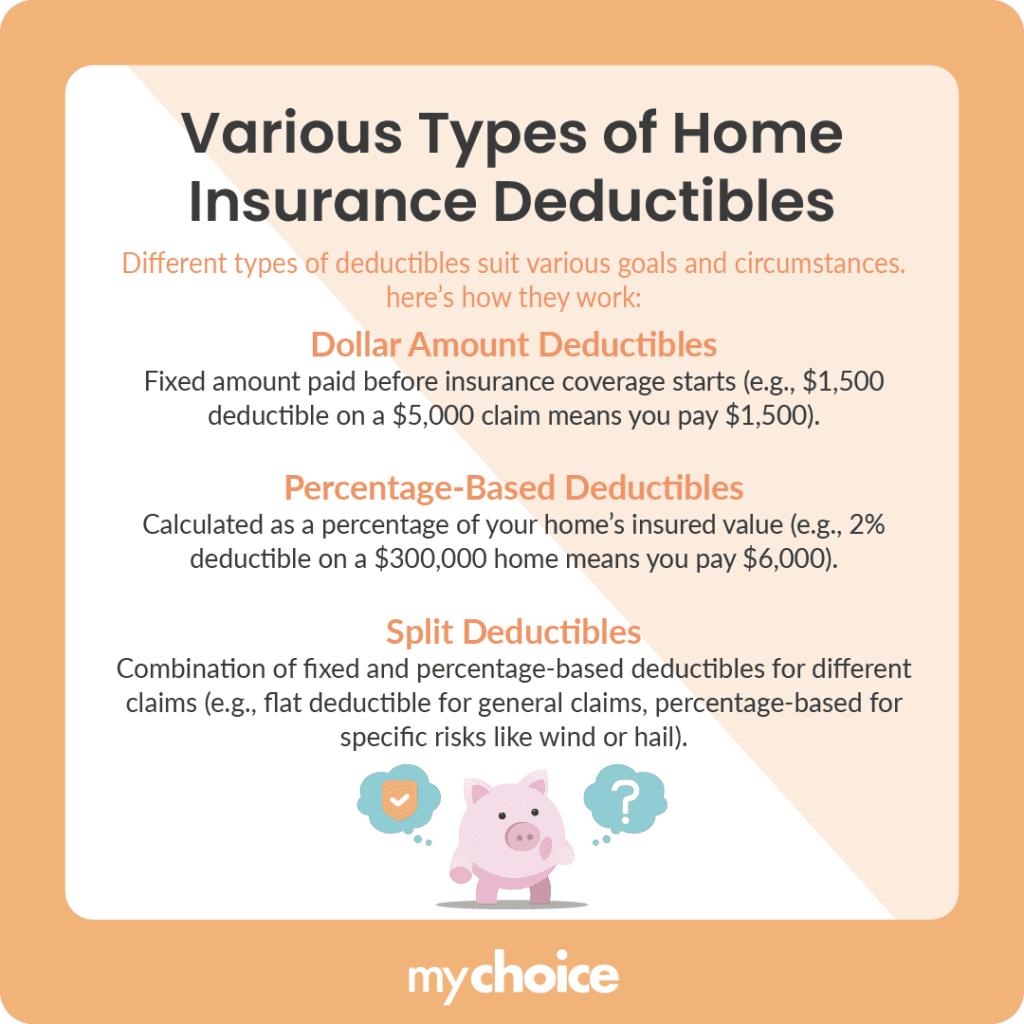

Different Types of Home Insurance Deductibles

Depending on your goals and personal circumstances, there are different types of deductibles that could suit your needs. Here are the types of deductibles and how each of them works:

Every type of deductible has its advantages and disadvantages. It’s important to choose a deductible type that corresponds with what you need and your budget. Here’s a comparison of the pros and cons of each type:

| Type of Deductible | Advantages | Disadvantages |

|---|---|---|

| Dollar Amount Deductibles | – Easy to understand – More predictable costs | – The deductible amount can’t be changed when claiming |

| Percentage-Based Deductibles | – Can result in lower deductibles depending on the claim value | – Unpredictable costs that can reach significantly high amounts for large claims. |

| Split Deductibles | – Flexibility in coverage – Tailored protection for specific perils | – Can be a bit complicated to understand whether a deductible is fixed or percentage-based when filing a claim. |

Deductibles vs. Premiums: Finding the Right Balance

Your choice of deductible significantly influences your insurance premiums. Generally speaking, a higher deductible typically results in lower premiums because you are assuming more risk yourself. Conversely, a lower deductible leads to higher premiums, as the insurer bears more risk and therefore charges more for coverage.

When considering how much to set as your deductible, consider your potential savings from choosing higher deductibles and calculate that against possible out-of-pocket expenses during claims. For example, if choosing a $2,000 deductible saves you $200 annually on premiums, consider whether saving that amount each year outweighs the risk of having to pay $2,000 out-of-pocket during a claim.

Your insurance premium cost can also be influenced by the type of deductible you choose. Typically, dollar amount deductibles lower your premiums the most, as your insurer doesn’t need to pay anything out if the damages are lower than your deductible amount, meaning less risk for the insurance company.

Choosing the Right Deductible for Your Needs

There are several factors that you need to consider when choosing the kind of deductible and amount that’s right for you:

To choose the right deductible amount and type, weigh the yearly savings on your premiums against the number of claims you might file and the amount of money you’re comfortable paying out-of-pocket for damages.

Key Advice from MyChoice

- Flat deductibles, percentage-based deductibles, and split deductibles all have different pros and cons.

- Choose a deductible amount that you’re personally comfortable with paying in case of a claim.

- Some insurers offer discounts on your premiums or deductibles if you choose to get repairs done by their preferred contractor or service provider.