If you want to optimize your insurance premiums, you should check regularly for better auto insurance rates in Ontario. Fortunately, checking for the best insurance rates is easy with MyChoice, taking only a few minutes of your time and saving you hours of work comparing different policies from various insurance providers.

Ensuring that you have the best insurance rate is something that every car owner should do. When should you check if you can get a lower insurance rate? What can you do to lower your premiums? Read on to learn about how insurance companies calculate your insurance rates and when you can expect to get lower premiums.

How Auto Insurance Rates are Set

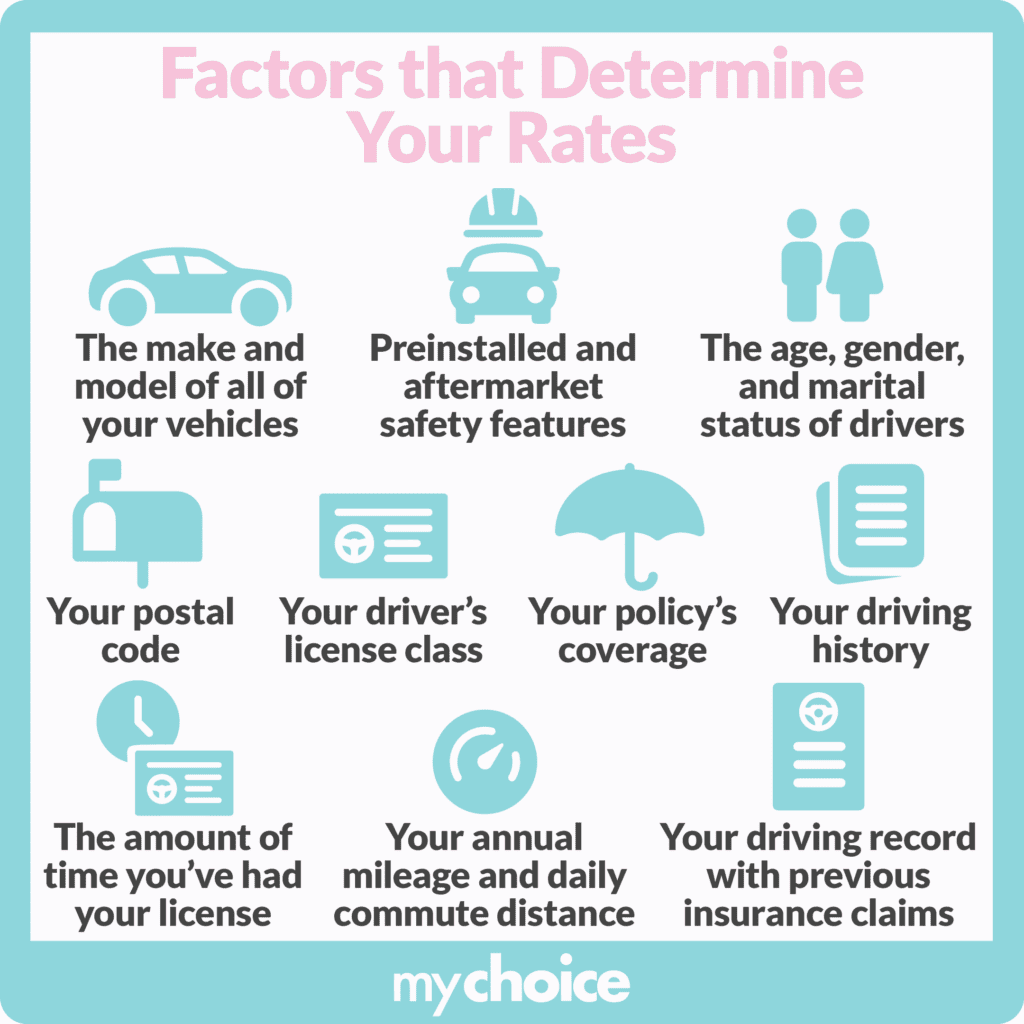

Auto insurance rates are determined by insurance companies based on several factors that relate to the risk level of your vehicle. If your car is more likely to get into an accident, suffer damage, or get stolen, you can expect insurance premiums to rise accordingly. Here are the factors that insurance providers consider when you take out an auto insurance policy:

- The make and model of all of your vehicles

- Preinstalled and aftermarket safety features

- The age, gender, and marital status of drivers included in your policy

- Your driving record, which includes any previous insurance claims, accidents, or traffic violations

- Your postal code

- The amount of time you’ve had your license

- Your driver’s license class

- Your annual mileage and daily commute distance

- Your policy’s coverage

- Your driving history

Different insurance companies can have vastly different rates for the same amount of coverage, so shop around for the best deal.

How Often Should I Check for Better Auto Insurance Rates?

Generally, it’s a good idea to check for better auto insurance rates once a year when your policy renewal date draws near, or when you’ve experienced a significant change in your household or lifestyle. Insurance companies review their rates every year and may raise or lower premiums according to the market conditions. Checking for a better rate yearly can be a hassle, but you may find a cheaper policy or one with better coverage for the same rate.

If something significant changes in your lifestyle or household, you should check with your insurance provider if that equates to a better insurance premium. You could also shop around for better policies with other insurance providers. These lifestyle changes can include:

Where to Check for Better Insurance Rates

Checking for better insurance rates usually means contacting different insurance providers to compare rates between different policies. This can take a significant amount of time and effort if you’re doing it manually. Fortunately, we have a better solution.

By using MyChoice, you can shop around for the best auto insurance policy that fits your needs for the cheapest price. Just enter the details of your vehicle, postal code, desired coverage, and drivers you want to add to your policy, and we’ll take care of the hard work of searching for the optimal insurance provider and policy.

Tips to Lower Your Auto Insurance Rate

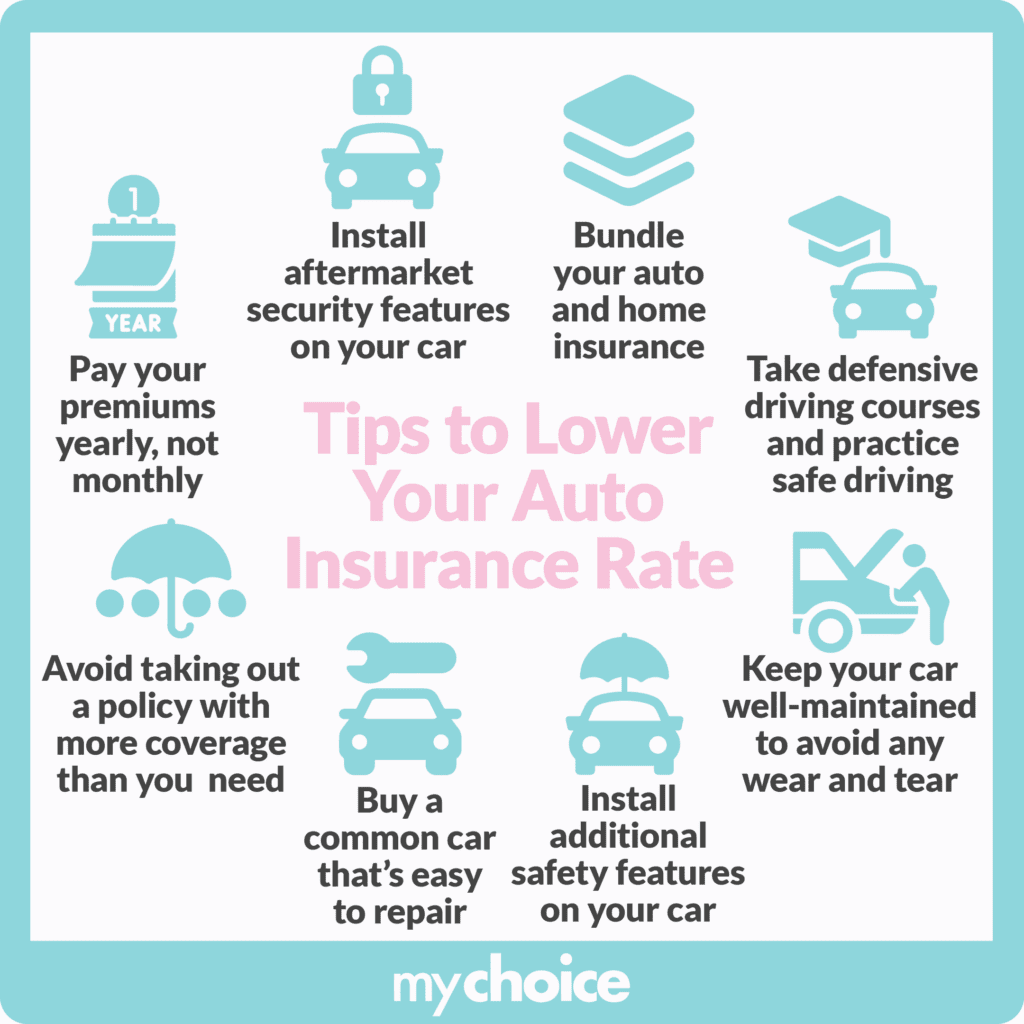

Besides big changes to your lifestyle, there are other things you can do to lower your insurance rates. Here are a few tips:

- Pay your insurance premiums yearly instead of monthly.

- Install aftermarket security features on your vehicle.

- Bundle your auto insurance with your home insurance to get a discounted rate for both policies.

- Take defensive driving courses and practice safe driving.

- Avoid taking out a policy with more coverage than you really need.

- Buy a common and affordable car that’s easy to repair.

- Install additional safety features on your vehicle such as winter tires.

- Keep your car well-maintained to avoid any wear and tear that would raise your premiums.

By applying these tips, you not only decrease the risk of accidents or damage to your vehicle but also encourage insurance companies to give you a lower premium as a result.

Key Advice from MyChoice

- If you haven’t gone through any huge lifestyle changes, check if you can get better insurance rates once a year before your policy renewal date.

- Check for better insurance rates once you’ve gone through a change in your lifestyle or household, such as moving homes or an improvement in your driving record.

- Use MyChoice to find the best deals on auto insurance policies across multiple insurance companies and coverage plans.