Climate Change is Responsible for a 379% Increase in Average Annual Insurable Damages in the Last Decade in Canada

In light of the devastating impact of the Milton hurricane in Florida, which by some estimates will cause anywhere in between $60-100 billion in insured damages, many Canadians are left wondering how the recent spike in natural disasters will impact the situation at home. This past summer in Canada will go down as one of the most challenging periods for homeowners and insurers alike. The Insurance Bureau of Canada recently reported a record-breaking 228,000 insurance claims – representing a staggering 406% increase compared to the previous 20-year average.

In light of these growing threats our team conducted a thorough analysis of how insurance payments from natural disasters changed over the last 40 years across Canada. Using data from the Canadian Disaster Database, we compared the 10-year average of disaster-related annual insurance payments against the prior 30-year average, adjusted for inflation. Our team also analyzed the Shelter Consumer Price Index data from the past 10 years to determine the home insurance inflation across Canada and compared it to current rates from the MyChoice quote database.

Below are the key findings from the study:

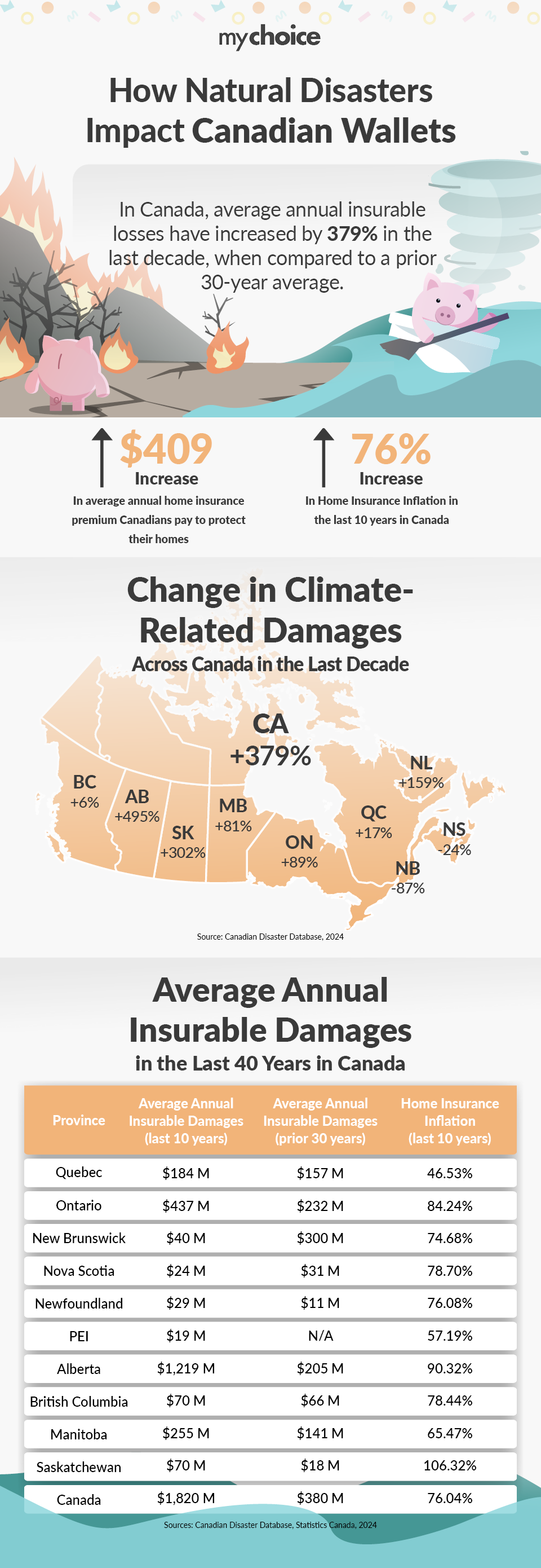

- In Canada, the annual average insurance payouts in the last decade increased by a whopping 379%, when compared to the prior 30-year average.

- Provinces like Alberta and Saskatchewan experienced catastrophic increases of 495% and 302% in average annual insurance payouts, respectively, while Ontario had an 89% increase in the last decade.

- Some provinces didn’t have an increase in climate-related insurance payouts but still experienced home insurance inflation, absorbing the overall risk of increased climate-related damages across the country.

- It looks like climate-related disasters have cost an average Canadian around $400/year in increased home insurance premiums in the last 10 years.

- Home Insurance premiums have increased by 76% across Canada in the last decade, with Saskatchewan and Alberta having the highest increases at 106% and 90%, respectively.

The below infographic showcases the change in average annual insurance payouts across Canada in the last 40 years.

As these events become more frequent and destructive, insurers are left with no choice but to raise premiums to keep pace with the growing risk, or in some cases, to consider ceasing operations in certain areas. The big US insurance companies like Farmers, Progressive and AAA have already announced that they will be limiting their exposure in the home insurance market in the state of Florida. This leaves many Canadian homeowners wondering if insurance companies will follow suit in Canada. Earlier this year, Aviva Canada announced that the company is planning to phase out Aviva Direct, its direct-to-consumer home and auto business, from Alberta in early January 2025.

MyChoice COO, Matt Roberts, offers a commentary regarding the current insurance landscape: “As climate change continues to reshape the Canadian insurance landscape, it’s more important than ever to regularly reassess your home insurance coverage. In the face of rising premiums and increased claims, finding the right balance between affordability and adequate protection is crucial. At MyChoice, we essentially offer you tools and resources to navigate the changing market and ensure that you’re not overpaying for coverage while staying protected from the growing risks of climate change.”

In these uncertain times, knowledge is power. Don’t wait until the next disaster strikes – review your coverage, compare your options, and make informed decisions to protect your home and your family.

| Province | Change in Average Annual Insurance Payouts | Average Annual Home Insurance Premium (2014) | Average Annual Home Insurance Premium (2024) | Home Insurance Inflation (2014-2024) |

|---|---|---|---|---|

| Quebec | 17.05% | $618 | $905 | 46.53% |

| Ontario | 88.94% | $627 | $1,155 | 84.24% |

| New Brunswick | -86.62% | $412 | $719 | 74.68% |

| Nova Scotia | -23.98% | $407 | $728 | 78.70% |

| Newfoundland | 158.92% | $408 | $718 | 76.08% |

| PEI | n/a | $455 | $715 | 57.19% |

| Alberta | 494.96% | $696 | $1,324 | 90.32% |

| British Columbia | 6.25% | $701 | $1,250 | 78.44% |

| Manitoba | 80.86% | $574 | $949 | 65.47% |

| Saskatchewan | 302.13% | $491 | $1,012 | 106.32% |

| Canada | 379.28% | $539 | $948 | 76.04% |