Nobody wants to think about what’s going to happen to them after they pass – but it’s inevitable as we get a little bit older. Questions like, “will they be okay?” or “how are they going to cover my funeral expenses?” can crop up, especially when the average cost of funeral services can be anywhere from $2000 to $12,000, which can be prohibitively pricey out of pocket.

Luckily, there are some insurance policies that can be taken out at any time in your life that help cover these expenses – which helps bring a little bit of peace of mind to everyone involved. Final expenses insurance is one of the most common and helpful policies, in this case.

Final Expense Insurance for Funerals Explained

Final expense insurance, also known as funeral insurance, burial insurance, or guaranteed acceptance life insurance, is a type of whole life policy with a smaller death benefit. This policy is easier to get approved for than standard life insurance, and as a result, it’s especially popular among older adults who may not have other life insurance coverage. The primary goal is to cover funeral costs and other end-of-life expenses, easing the financial burden on loved ones.

Because final expense insurance is specific to covering final costs, most applicants won’t have to undergo extensive medical testing, a common requirement for many other insurance types. Instead, a basic health questionnaire is generally used. In rare cases, certain health conditions might disqualify applicants from coverage, but this is uncommon.

Some insurers even offer policies that don’t require any health questionnaires, known as “guaranteed issue” policies. These tend to have higher premiums but are open to anyone, regardless of health.

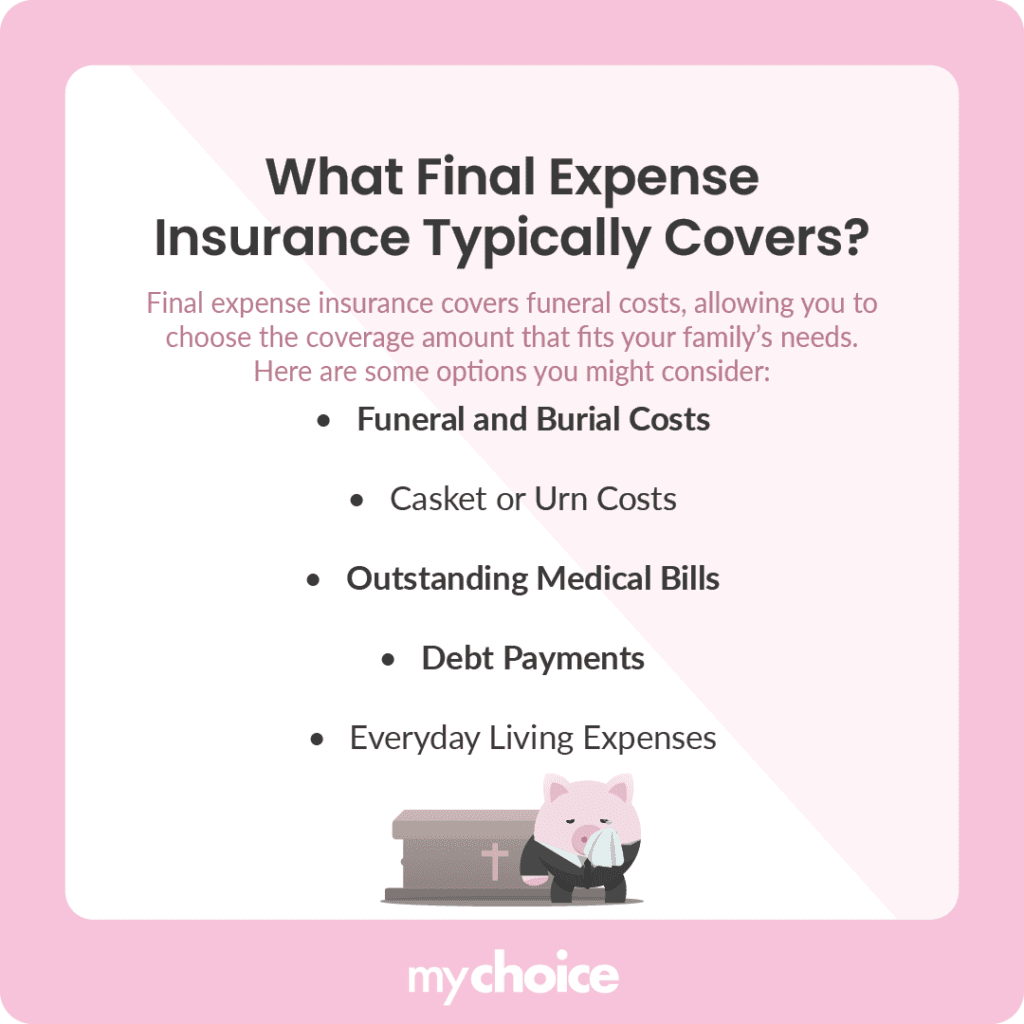

What Final Expense Insurance Covers

As we mentioned earlier, final expense insurance is primarily geared toward covering the costs associated with a funeral. However, you have the flexibility to select the coverage amount that best suits your family’s needs. When determining the coverage level, consider who will be left behind and how much financial support they might need.

For instance, if you’re the primary earner in the household, a larger policy might be beneficial to help your family transition financially. On the other hand, if you’re not the main source of income, a smaller policy that solely covers funeral expenses could be sufficient.

Here’s what final expense insurance typically covers:

- Funeral and Burial Costs: Includes funeral home and director fees, religious service fees, and arrangements for cremation or burial.

- Casket or Urn Costs: Covers the cost of the casket, urn, or other final resting arrangements.

- Death Certificates: Necessary documentation for handling estate matters and insurance claims.

- Obituaries and Flowers: Funeral essentials like floral arrangements and obituary notices.

- Outstanding Medical Bills: Immediate medical bills that might be left unpaid at the time of passing.

- Debt Payments: Any urgent debts, including credit card bills or short-term loans.

- Everyday Living Expenses: Groceries, utilities, or other essential goods to help family members during their transition.

How Much Does Final Expense Insurance Cost?

Final expense insurance generally costs between $50-$100 per month, but this can increase with age, health conditions, or higher coverage levels.

Older applicants, particularly those over 70 or with health issues, may face monthly premiums of $70-$120. While younger, healthier applicants can qualify for lower rates, it’s worth remembering that higher premiums typically provide more comprehensive coverage for loved ones.

How Much Coverage Should I Get?

Though funeral costs are often the primary concern, the focus should be on anticipated expenses, such as medical bills, debt, and funeral costs, that may burden surviving family members. Here are some considerations to make when deciding on the amount of coverage you need.

Do I Need Final Expense Insurance for a Funeral?

While final expense insurance is an affordable, accessible form of life insurance, it’s not necessarily essential for everyone. If you already have a whole life insurance policy, it likely includes a sufficient death benefit that can cover funeral expenses, among other costs. In this case, adding final expense insurance could be redundant.

That being said, there are specific situations where final expense insurance makes sense:

When choosing final expense insurance, consider both your current financial situation and your family’s future needs. It’s important to look at policies with flexible coverage amounts to ensure that your family is adequately protected without overpaying.

Comparing different providers and understanding the fine print, such as health requirements and exclusions, can help you make a choice that aligns with your needs.

Key Advice from MyChoice

- Evaluate your current situation and dependents when deciding on how much coverage you need

- Skip the final expense insurance if you have an existing whole life policy

- Plan out how the death benefit will be used ahead of time by meeting with your family