Rent-to-own agreements in Ontario work by letting you save up for a down payment while renting a home. Why do many people get them?

Zillow reports that, as of February 2023, the median price of a standard home in Ontario is $611,845, indicating a rise of almost 2% from the previous year. When you factor in the $1,487 average cost of home insurance per year in 2022 (a 16% increase from 2021) you begin to see how rushing into homeownership can lead folks to be “house-poor”.

The Canadian government aims to double home-building in the next 10 years by making the rent-to-own housing program more accessible to the average Canadian. Considering getting into a rent-to-own agreement? Read on to learn more.

What Is Rent-to-Own in Ontario?

As the name suggests, rent-to-own (sometimes referred to as lease-to-own) is a type of agreement in which a tenant rents a property for a specific period of time, with the option to purchase it at the end of the rental term.

In a rent-to-own agreement, the tenant typically pays a higher monthly rent than they would for a traditional rental property. A portion of the rent is then credited toward the purchase price of the property if the tenant decides to buy it at the end of the rental period.

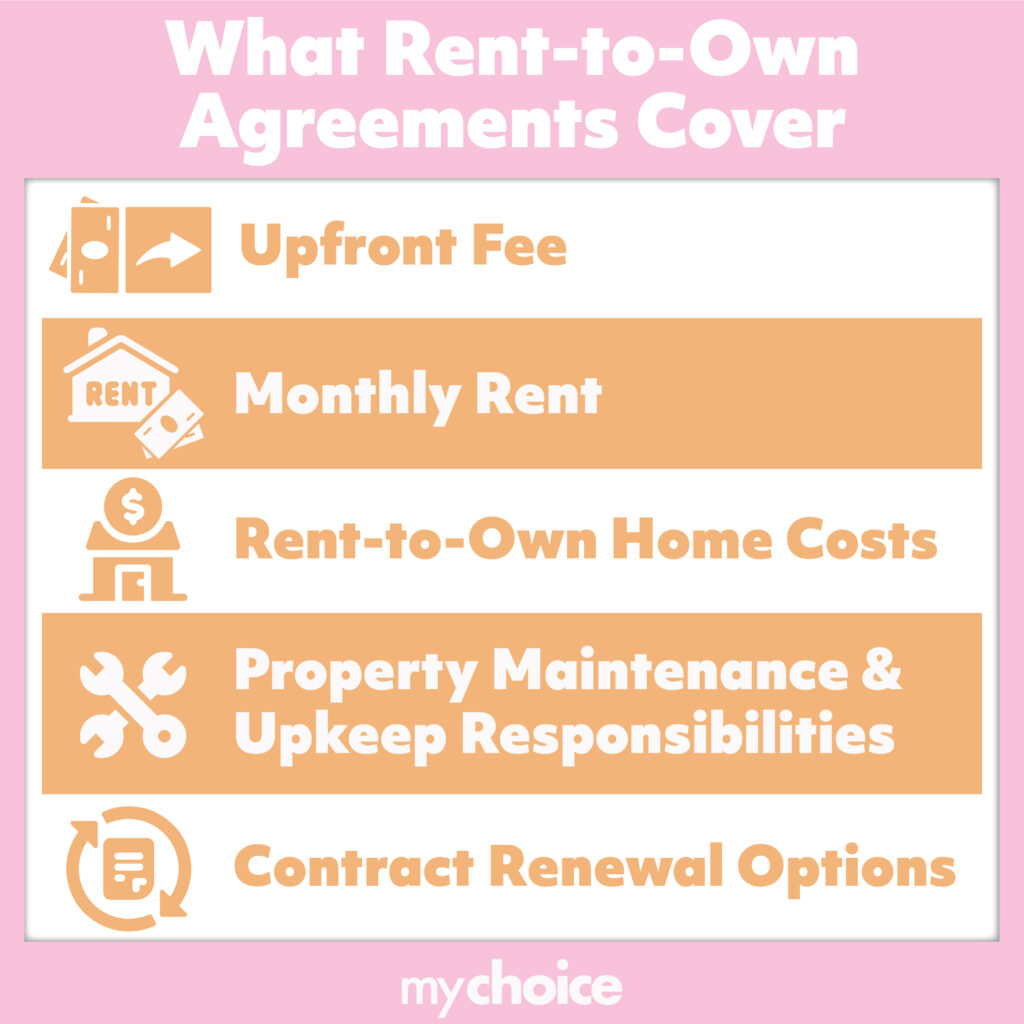

What Rent-to-Own Agreements Cover

A rent-to-own agreement covers essential details such as the upfront fee, monthly rent, the home’s eventual price, property upkeep responsibilities, and options for contract renewal. Let’s explore each detail further:

Upfront Fee

An upfront fee is typically a percentage of the purchase price of the property and serves as a down payment toward the eventual purchase of the property. The fee is non-refundable and payment is required at the beginning of the rent-to-own agreement. If you’ve already started saving up for a down payment, you may already have enough to cover this fee!

Monthly Rent

How much you will end up paying for rent will largely depend on the specific rent-to-own property as well as the terms of the contract. The market value of the home will heavily influence the actual rent payment.

In addition to rent, a typical rent-to-own agreement requires what’s known as rent credit. Essentially, it’s a portion of the rent payment that is considered a down payment toward the purchase of the property. If you choose to buy the property, the rent credit accumulated over the lease period can be applied toward the purchase.

Rent-to-Own Home Costs

Rent-to-own homes are priced no differently than non-rent-to-own homes. Market value, appraisal, as well as negotiation determine the purchase cost. The purchase price for a rent-to-own home is usually agreed upon and specified in the contract at the time of signing.

Most rent-to-own agreements determine the home’s purchase price at the start of the contract. Some of them allow the tenant to use the property’s market value at the end of their lease. This means you can negotiate the home’s purchase price closer to the purchase date. If the home’s market value drops during the lease, you can get a better deal on the house.

Although that option certainly exists, a common strategy when the cost of homes is on the rise is to set the purchase price early. This way, you are locking in a potentially lower price.

Property Maintenance and Upkeep Responsibilities

Typically, when you rent a property, your landlord is accountable for maintaining and repairing it. Nevertheless, the extent of their obligations may differ based on the terms of your agreement.

While you may be responsible for tasks like lawn mowing or snow clearing, you may not be liable for issues such as a damaged roof during your tenancy. Additionally, you may have to bear all the costs of repairs while being constrained from certain activities, such as making renovations or painting the walls of your room.

To ensure a successful rent-to-own agreement, it’s important to have a written contract that explicitly outlines property maintenance responsibilities. This includes maintenance tasks, such as:

- Repairing broken items

- Maintaining the lawn

- Performing routine maintenance

- Servicing house systems

Having a clear understanding of these responsibilities in the contract can prevent disagreements or misunderstandings throughout the lease term.

Contract Renewal Options

In certain rent-to-own agreements, one or both parties may have the option to renew the lease after the term’s expiration, delaying the final purchase date. You should ensure your rent-to-own property agreement includes provisions for contract renewal – this is crucial to avoid the possibility of losing your investment.

Having the option to renew your lease gives you more time to improve your credit score or secure loans. In turn, that improves your odds of buying the home. It is recommended that prospective buyers carefully review and negotiate the renewal terms and conditions of the agreement before entering into a rent-to-own transaction.

Does Ontario Require Insurance for a Rent-to-Own Home?

The short answer is no, Ontario does not require insurance for a rent-to-own home. However, it is a common practice for both landlords and tenants to have insurance coverage for their rent-to-own home.

Make sure to discuss insurance coverage with your landlord or tenant before move-in, and consult with an insurance professional to determine the appropriate coverage for your specific situation.

Insurance Coverage for Tenants

While not required by law, you can still obtain tenant insurance coverage for your personal belongings and liability. It offers tenants protection in case of damage or loss to their possessions, as well as any accidents that may occur on the rent-to-own property.

Note that once your lease is up and you have made the decision to purchase the home, you will need to switch from a tenant insurance policy to a home insurance policy.

Insurance Coverage for Landlords

As stated above, landlords are also not required by law to insure their rent-to-own home. Despite this, many landlords typically obtain home insurance coverage for the property itself – including the building structure and any fixtures – as well as liability coverage in case a tenant or visitor is injured on the property.

Pros of Rent-to-Own Agreements

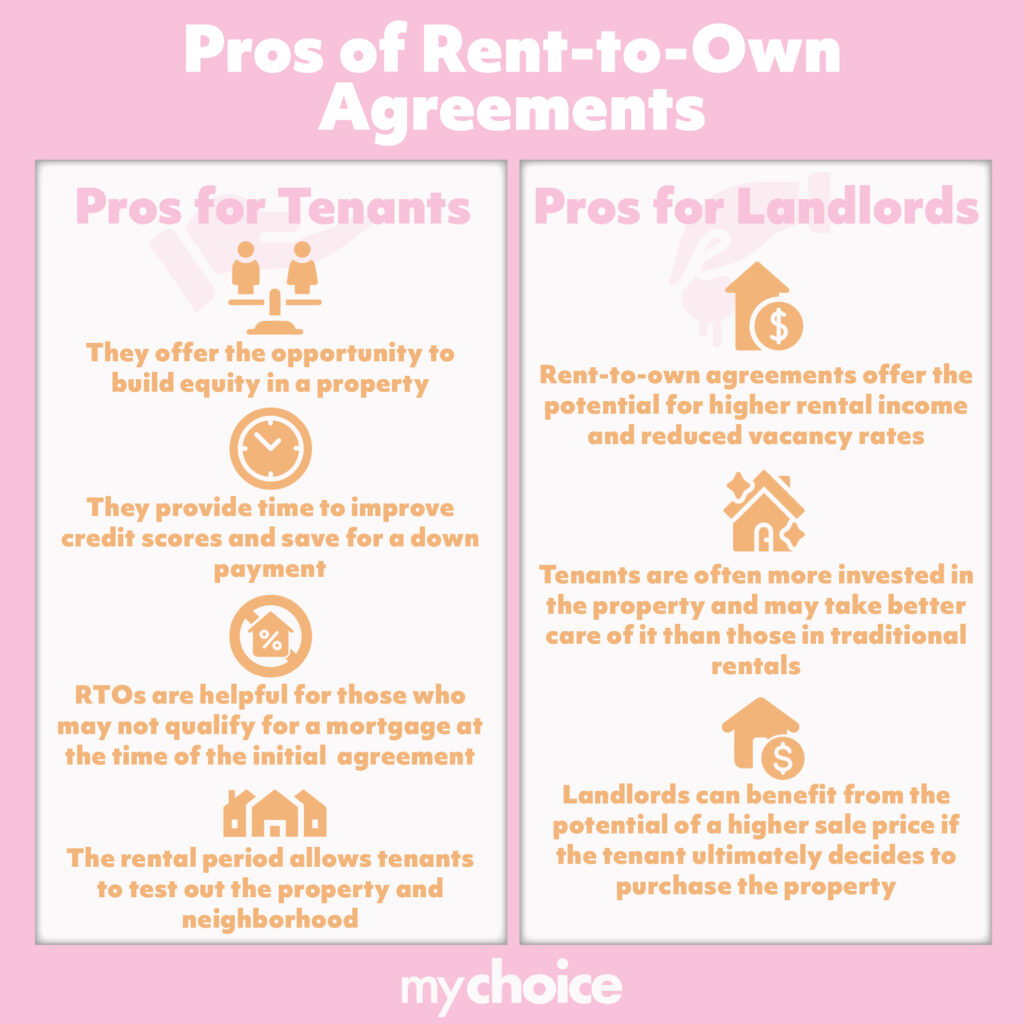

Rent-to-own agreements can be a win-win for both tenants and landlords if they are structured appropriately and both parties have a clear understanding of the terms and obligations of the agreement.

Pros for Tenants

- Rent-to-own agreements offer the opportunity to build equity in a property without the upfront costs of a traditional home purchase.

- They provide time to improve credit scores and save for a down payment.

- RTOs are helpful for those who may not qualify for a mortgage at the time of the initial lease agreement.

- The rental period allows tenants to test out the property and neighborhood before committing to a long-term purchase.

Pros for Landlords

- Rent-to-own agreements offer the potential for higher rental income and reduced vacancy rates.

- Tenants are often more invested in the property and may take better care of it than those in traditional rentals.

- Landlords can benefit from the potential of a higher sale price if the tenant ultimately decides to purchase the property.

Cons of Rent-to-Own Agreements

Rent-to-own agreements have some cons to consider, such as:

- Tent-to-own agreements often have higher monthly payments than a traditional rental agreement, which can make it difficult for tenants to keep up with payments.

- The property may be priced higher than its fair market value, which means the tenant could end up paying more than they would if they were to buy the property outright.

- The agreements are often structured in a way that benefits the landlord or seller, rather than the tenant. For example, if the tenant misses a payment or breaches the agreement, they may lose all the money they have invested in the property.

- Tenants may have limited control over the property while they are renting, which means they cannot make changes or improvements to the property without the landlord’s permission.

What Ontario Laws Cover Rent-to-Own Programs

In Ontario, the laws regarding rent-to-own agreements are governed by the Residential Tenancies Act (RTA) and the Consumer Protection Act (CPA). It is important for tenants to understand their rights and responsibilities under Ontario law when entering into a rent-to-own agreement.

The Residential Tenancies Act (RTA)

Under the RTA, rent-to-own agreements are considered to be leases and are subject to the same rules and regulations as traditional rental agreements. This means that landlords must provide tenants with a written agreement that outlines the terms of the rental arrangement, including the rent amount, payment due dates, and other important information.

The Consumer Protection Act (CPA)

Under the CPA, rent-to-own agreements are also subject to additional requirements to protect consumers. For example, landlords must provide tenants with a disclosure statement that outlines the total cost of ownership, including any fees or charges associated with the rent-to-own arrangement. Additionally, landlords must provide tenants with a copy of the agreement at least 21 days before the agreement is signed.

The Bottom Line: Is Rent-to-Own Worth It?

At the end of the day, whether or not rent-to-own is worth it depends on your individual situation and financial goals. For those who are in the market for a new home, it is definitely a great place to start. It could also be a fantastic in-between option for folks transitioning between renting and owning their first home. It’s important to consider all your options before entering into a rent-to-own agreement.

If you’re considering a rent-to-own agreement, consider getting tenant insurance from MyChoice to safeguard your belongings and future.