Age is one of the foremost factors that impact life insurance rates, but it is only one piece of the entire puzzle. Your health, lifestyle, job, and even gender can all affect your life insurance rates, and it’s absolutely essential that you understand how everything plays together when committing to an insurance plan.

Let’s dive in further to learn about life insurance, age, and how everything comes together.

Life Insurance Rates Explained

By definition, life insurance is meant to provide your beneficiaries with a payout called a death benefit in the event that you pass away. This is in exchange for a life insurance premium, which really is just a fancy way of saying a monthly, quarterly, bi-yearly, or yearly payment made toward your insurers to maintain that coverage.

That said, this is the most basic form of life insurance and there are many different types to suit most situations. Some policies have a “living benefit” that allows beneficiaries to withdraw from the payout while the insured individual is still living, for example.

Regardless of type, insurance rates are determined by actuarial tables. Within these tables are the relevant information about life expectancy and mortality rates based on age – making it the main factor for determining how much a person will pay on their premiums.

How Age Impacts Your Insurance Premium

It’s not a secret that younger folks tend to pay lower premiums on their life insurance – and the reasoning is plain as day. Younger individuals in their twenties and early thirties are usually in the physical primes of their lives without having to do too much to maintain a basic level of good health, and that means insurance companies have less to worry about when it’s time to make claims on the policy.

In short, younger people are less likely to have life-threatening conditions or develop new ones that complicate their quality of life, and therefore they’re less of a risk to insurance companies. As a result, they’ll need to pay less to offset the potential risk of insuring them.

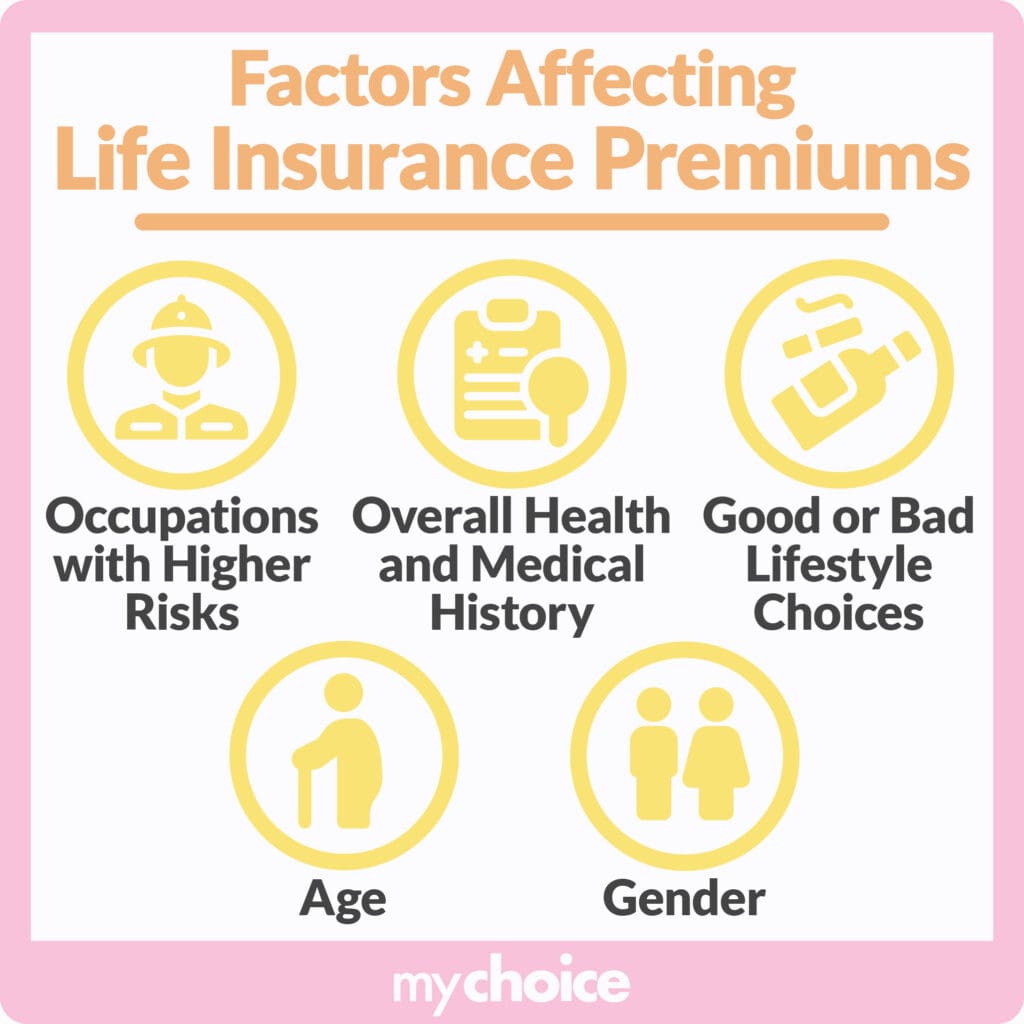

Other Factors That Influence Life Insurance Rates

As we mentioned earlier, age isn’t the end-all-be-all when it comes to determining insurance rates, and there are loads of factors that influence your monthly payments. Let’s dive in.

Key Advice From MyChoice

- Younger is better when purchasing life insurance, so shop around now rather than later.

- Consider the type of insurance plan you’ll need for your beneficiaries. Term life is good for a while, but permanent insurance may be more aligned with your values.

- Be smart with your financial decisions and shop around and compare before committing to any one insurer.