Home Insurance Rates Rise 5.28% in Canada in 2025

As we move into 2025, Canadian homeowners are once again faced with rising home insurance rates. Inflation in Canada has come down to 1.9% in January 2025, but the high number of claims – driven in large part by climate-related disasters – continue to put upward pressure on home insurance premiums. 2024 was the record year for weather-related losses in the country’s history, with a total of 8.5 billion in estimated insured damages.

In light of this trend, MyChoice, a leading insurtech company in Canada, conducted a comprehensive study examining home insurance inflation nationwide in 2025. By combining our internal data with the Shelter Consumer Price Index, we performed a province-by-province analysis – reviewing both recent changes and decade-long trends. Our team also looked at how much more, in dollar terms, Canadians have been paying for home insurance over the past 10 years.

Key Findings from the Study:

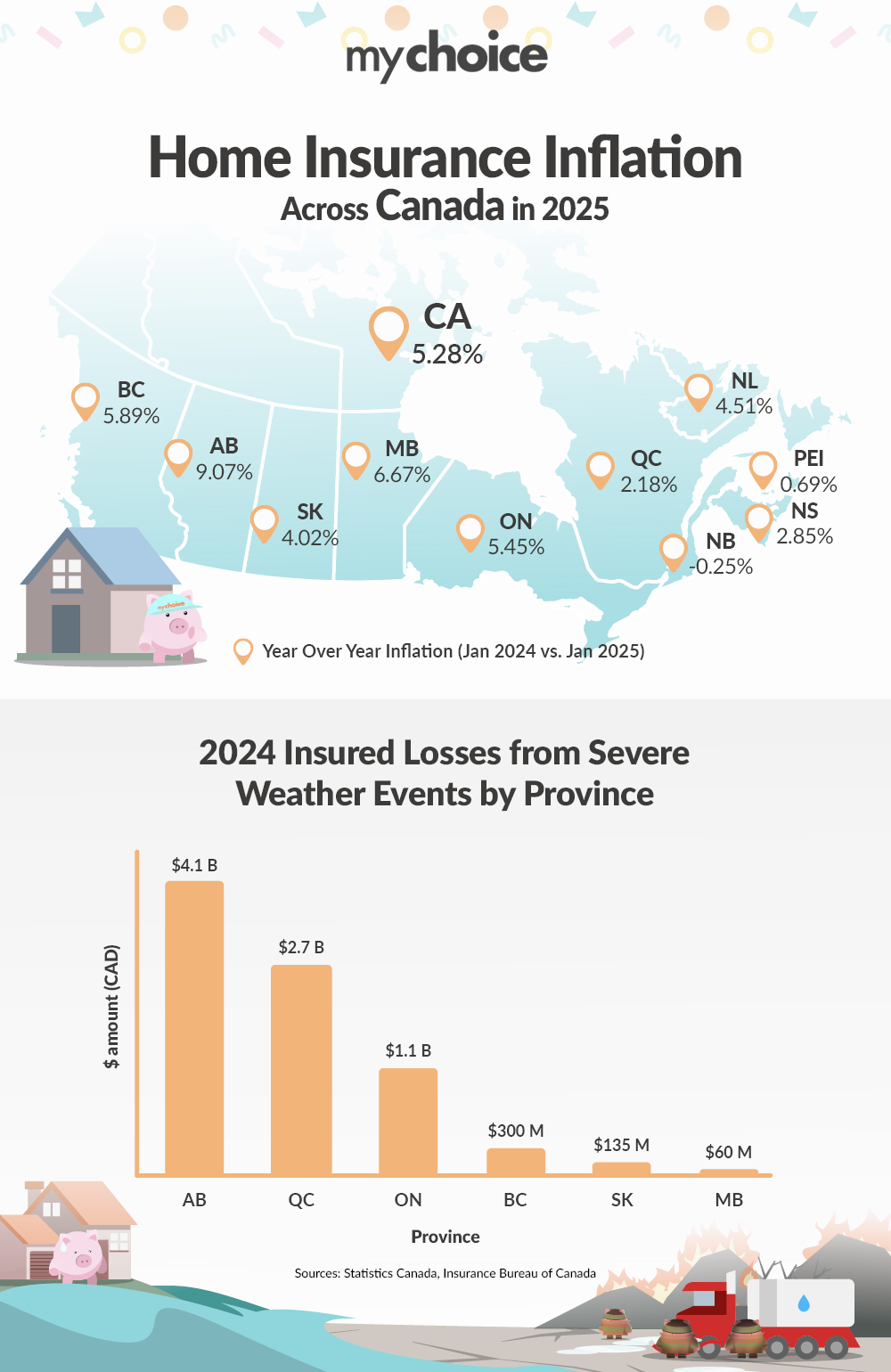

- Across Canada, home insurance has risen by 5.28% in 2025 – well above general inflation levels.

- Alberta leads the country with a 9.07% year-over-year increase in home insurance rates in 2025. The province also recorded a staggering $4.1 billion in weather-related damages in 2024 – the highest in Canada.

- Other provinces with notably high YoY inflation include Manitoba (6.67%), British Columbia (5.89%), and Ontario (5.45%).

- Homeowners in Alberta are now paying an average of $660 more for home insurance in 2025 than they did in 2015. In British Columbia, that figure stands at roughly $592, followed by $551 in Saskatchewan and $519 in Ontario.

- Over the past decade, annual home insurance costs for the average Canadian have risen by $421.

Climate Change Impact

The undeniable influence of climate change on the frequency and severity of natural disasters in Canada serves as a critical backdrop for the projected increases in home insurance rates. As mentioned, 2024 was a record year for weather-related losses in the country’s history (8.5 billion in total). The Jasper Wildfires (1.1 billion) and the Ontario flash floods (990 million) in July were among the biggest climate-related disasters in 2024.

A parallel development illustrating the global reach of climate challenges is the January 2025 wildfires in Los Angeles. Several large U.S. insurers have either withdrawn or limited new policies in high-risk California regions, citing heavy underwriting losses and regulatory hurdles. The situation escalated further when California’s FAIR Plan – the state-run insurer of last resort – announced it needed an additional $1 billion to cover wildfire claims in the state. Under a recent decision by state regulators, California’s private insurers must shoulder half of these costs and can pass the remainder on to policyholders via a one-time fee.

These moves highlight how governments can step in to sustain insurance markets when natural disasters become more frequent and severe. According to MyChoice CEO, Aren Mirzaian, the lesson isn’t lost on Canadian carriers: “Each year, the insurance industry grapples with the growing challenge of covering losses from wildfires, floods, and other climate-related events, necessitating a recalibration of rates to keep pace with this escalating risk. We’re witnessing carriers grappling with huge losses – some reporting the worst underwriting results in decades. As the climate becomes more unpredictable, Canada isn’t immune. We’ve already seen some insurers limit operations in high-risk zones, such as Aviva Canada pulling back direct-to-consumer home and auto in parts of Alberta. We need well-capitalized insurers and proactive government support. Otherwise, we’ll continue to see coverage become less affordable or less available in regions prone to disasters.”

Government Response & Consumer Impact

Fortunately, federal and provincial governments in Canada are ramping up efforts to reduce wildfire risks and the resulting financial fallout for homeowners. One of the most significant initiatives is the WildFireSat Program, backed by a $72 million federal commitment to launch a seven-satellite constellation by 2029. These satellites will provide daily thermal imaging of active forest fires, helping authorities allocate resources more strategically and identify high-risk blazes early. In Alberta, provincial officials are also calling on municipalities to strengthen wildfire defences by clearing flammable debris and establishing fireguards several hundred metres wide.

On the household level, it’s more important than ever to assess whether your home insurance can handle increasingly unpredictable weather events. If you live in wildfire-prone areas, consider securing comprehensive fire coverage, which should include protection for fire damage, additional living expenses, emergency evacuation, and replacement cost coverage to ensure you can rebuild to a similar size and quality if disaster strikes. If you live in flood-prone areas, review your flood protection. Most standard policies don’t cover sewer backup or overland water damage, so you may need to add these coverages separately. Review your policy to make sure you’re covered and take small proactive steps – like installing a sump pump, which can significantly mitigate flood damage when disaster strikes.

Raw data:

| Province/Territory | Average Annual Home Insurance Premium (2015) | Average Annual Home Insurance Premium (2025) | Home Insurance Inflation (2015-2025) |

|---|---|---|---|

| Quebec | $597 | $918 | 53.75% |

| Ontario | $657 | $1,176 | 79.05% |

| New Brunswick | $443 | $741 | 67.39% |

| Nova Scotia | $411 | $744 | 81.11% |

| Newfoundland | $412 | $731 | 77.26% |

| PEI | $466 | $726 | 55.87% |

| Alberta | $736 | $1,396 | 89.70% |

| British Columbia | $692 | $1,284 | 85.48% |

| Manitoba | $583 | $982 | 68.40% |

| Saskatchewan | $494 | $1,045 | 111.33% |

| Canada | $549 | $974 | 76.94% |