Home fire insurance can be life changing if you ever find your home devastated by a fire, since it offers coverage to recoup your losses and rebuild your life without being potentially ruinous to your finances. But you may have questions, like “Does home insurance cover fire damage?” and other related queries.

Luckily, most home insurance plans already have this rolled into their comprehensive coverage – but you could purchase a little bit more, if needed.

Whichever you choose, there are a few caveats you need to be aware of when buying new coverage or extending your existing one.

Let’s dive in to learn more about home fire insurance.

What’s Covered by Home Fire Insurance

At this point, you may be wondering: “what does fire insurance cover?” That’s natural. Part of an insurance agreement is discerning which situations are covered by fire insurance, and which aren’t. Here are a few of the most common types of fires covered by most policies:

- Electrical fires caused by faulty wiring and general malfunctions

- Gas explosions and gas fires

- Fires caused by natural disasters like lightning strikes or wildfires*

- Fallen candles

- Fireworks accidents

- Kitchen-related fires

*This may come with specific limitations if you live in an area prone to wildfires. Insurers will likely charge higher fees or reduce the amount of coverage to offset the high risk of wildfire damage.

What Isn’t Covered by Home Fire Insurance

Not every fire is covered by insurance plans, even if you’ve paid for home fire specific policies. Generally speaking, preventable fires are usually the first to be disqualified from coverage. Specific examples may be fires due to a poorly maintained chimney, cigarettes left near flammable materials, and improper use of flammable liquids. The same logic applies to fires that were set on purpose, otherwise known as arson.

Home Fire Insurance Cost

Like all insurance policies, the cost of home fire insurance plans varies widely depending on a few factors. Here’s a quick and easy list of the main considerations that influence plan cost:

- Total cost to replace the property (usually the value of the home)

- Distance to fire departments and hydrants

- Location of the home and the hazards related to geographic region

- Fire security features like sprinklers, fire alarms, and smoke detectors

How Do I Make Claims on My Fire Insurance Coverage?

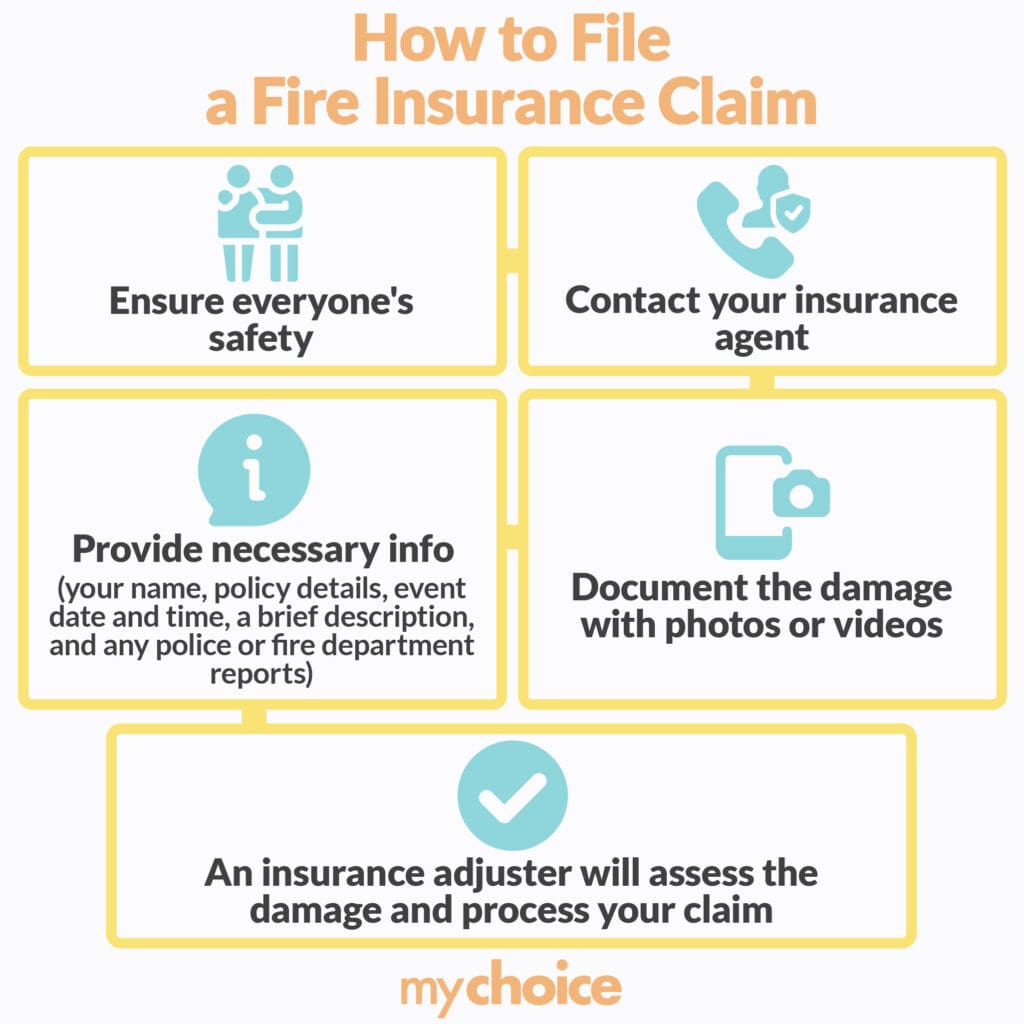

In the event that your home is subject to an actual fire, you’ll have to go through the claiming process to receive reimbursement or the actual cash value of your policy. Being proactive and immediately jumping into action after a fire can speed the claiming process along. Here’s how to make a claim on your home fire insurance, broken down into general steps:

Different Kinds of Home Fire Insurance Coverage

When to Consider Adding Home Fire Insurance to Your Comprehensive Plan

Since Home Fire Insurance is specialized in the sense that it covers a very very narrow scope of losses, it’s not a necessity for everyone. However, there are some cases when a little bit of extra coverage can make a significant difference in the long run. Here are a few example situations when a home fire plan can help:

Key Advice from MyChoice

No matter the size or type of coverage you purchase for your property, home fire insurance can help ease the burden. Here’s a bit of advice from us:

- Understand your coverage needs: When selecting home fire insurance, consider your specific needs and risks. If you live in an area prone to wildfires or have an older home, additional coverage like extended replacement cost or building codes coverage may be necessary. Evaluate the value of your possessions and unique features of your home to ensure your policy provides adequate protection for both your dwelling and personal property.

- Document everything: Regularly document the condition and contents of your home, including photographs and an inventory of valuable items. This practice will streamline the claims process if a fire occurs.

- Be proactive in the claims process: Document all damage thoroughly and cooperate with the adjuster to facilitate a fair assessment. Understanding the claims process and being proactive can expedite compensation, allowing you to focus on rebuilding and recovering with minimal financial strain.